A deep understanding of national and private income is vital to students, economists, and policymakers. Both incomes are critical indicators to measure a country’s economic performance, but their analytical nature varies. From national income, the monetary value of all goods and services is final and produced by the residents of a country, with foreign income included. However, private income focuses on the earnings of individuals and private businesses, productive and unproductive, from pensions to remittances. A good understanding of their differences inherently aids in contemplating wealth distribution, policy-making, or a micro-macro monetary and financial consideration.

What is National Income?

National income used in macroeconomics measures the whole income of a nation’s residents earned for engaging in economic activity, regardless of its location, either in or from within the borders of their native country. It amounts to wages, rents, interest, and profits obtained more or less through some productive effort and thus is an essential indicator of the country’s economic performance.

Definition and Components of National Income

The national income can be expressed as the net domestic product at factor cost plus net factor income from abroad. It comprises incomes solely derived from producing goods and services and excludes all transfer payments such as pensions or remittances.

The main components are:

- Salaries and wages of employees

- Profits of private and public enterprises

- Rent and interest on property and investments

- Net income from abroad (like remittances sent by residents working abroad)

National Income Formula

There are three major methods to calculate national income. Each method gives the same result under proper accounting and theoretical conditions:

1. Income Method

This method sums up all factor incomes earned by the factors of production (land, labor, capital, and enterprise) within a country.

Formula:

National Income (NI) = Rent + Wages + Interest + Profit + Mixed-Income

Components:

- Rent – Income from land.

- Wages – Income from labor (salaries & wages).

- Interest – Income from capital investments.

- Profit – Income of entrepreneurs.

- Mixed Income – Income that cannot be attributed solely to any single factor (common in unorganized sectors).

2. Expenditure Method

This method calculates national income by summing up all final expenditures made in an economy.

Formula:

NI = C + I + G + (X – M)

Where:

- C = Private Final Consumption Expenditure

- I = Gross Domestic Capital Formation (Investment)

- G = Government Final Consumption Expenditure

- X = Exports of Goods and Services

- M = Imports of Goods and Services

Note: (X – M) is the Net Exports.

3. Output (Product) Method

This method sums the value of all final goods and services produced in an economy.

Formula:

NI = Gross Value of Output – Value of Intermediate Consumption – Depreciation – Net Indirect Taxes

Steps:

- Calculate the Gross Value Added (GVA) at factor cost.

- Subtract depreciation (to get net) and net indirect taxes (taxes – subsidies) to get national income.

Major Characteristics of National Income

National income concerns an economy’s production and productivity more than anything else. It provides an overall account of a nation’s relative efficiency in utilising its resources and labour. Another important distinguishing feature is that it consists entirely of income earned through productive endeavours; thus, it becomes the best-adopted yardstick for national economic planning and comparisons across time and space.

What is Private Income?

Income is based upon specific definitions and includes all the earned and unearned income that accrues to the private individuals and businesses in any economy during a specified period-that is, income received as a regular or standard revenue flow or considered otherwise disposable by an individual or household.

Definition and Calculation of Private Income

Private income is calculated as follows:

Private income = National Income – Income From The Government Sector + Transfer Payments

It includes all of the following:

- Salaries, business profits, and investment income

- Gifts, pensions, scholarships, and remittances from abroad

- Interest and dividend income from personal savings or investments

Features of Private Income

Transfer payments, which are defined as income whose transfer was not paid for with the direct provision of goods or services, are among the most significant incomes included. Unlike national income, it excludes public sector income, concentrating instead on wealth accumulation in households and the private sector. Thus, private income is a microeconomic measure of the standard of living and potential for private consumption.

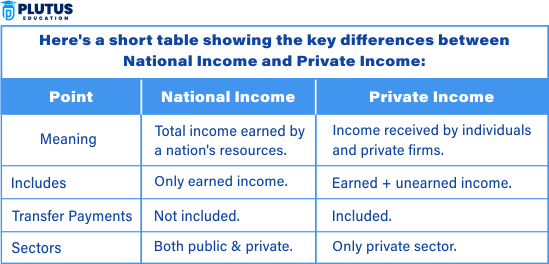

Differences Between National Income and Private Income

Though they are closely interlinked, the two incomes differ in purpose, substance, and methodology. National income gives an aggregate view of the economy’s output, while private income zooms into the earnings of, and therefore the welfare of, private individuals and private firms.

Scope and Coverage

National income covers all the earnings of the economy, public sector, the private sector, and foreign payments to measure the country’s total output, from which income from productive activities is derived. Private income, however, is limited somehow by its context, excluding, on the other hand, an income derived from the government and accounting for unearned income.

Treatment of Transfer Payments

Transfer payments are not counted as part of national income since they are regarded as free benefits paid to different sections of the population. However, transfer payments are a necessary component of private income, as they enhance the purchasing power of individual households, meaning they do not contribute to production. This one distinction significantly alters the quantitative value of both aggregates.

National Income in Macroeconomic Planning

National income becomes the input for the government planners to frame fiscal and monetary management policies, gross domestic product evaluation, resource allocation, and inflation management. It shows the overall health and output of the economy, which allows the government to compare its progress from one year to the next or with that of other nations.

Private Income in the Welfare and Tax Policy

Private income deals more with the individual financially. It assists the government in designing welfare schemes, determining tax slabs, and analyzing income distributions in society. It also provides insight into disposable income and household consumption trends, which drive consumption-based policy creation.

National Income vs Private Income

| Aspect | National Income | Private Income |

| Scope | Includes income from all sectors—public, private, and international contributions. | Covers only income earned by private individuals and businesses. |

| Transfer Payments | Excluded, as they are not tied to productive activities. | Included, as they contribute to disposable income. |

| Public Sector Income | Includes government earnings such as taxes, fees, and public enterprise profits. | Excludes income from the government sector. |

| Components | Wages, profits, rents, interest, and net income from abroad. | Wages, profits, rents, interest, and transfer payments (e.g., pensions, remittances). |

| Calculation Formula | NI = NDP at Factor Cost + Net Factor Income from Abroad | PI = NI − Income from Government Sector + Transfer Payments |

| Purpose | Assesses total productivity and economic output. | Evaluates individual and business earnings. |

| Policy Relevance | Used for national budgeting, fiscal policies, and growth assessment. | Useful for taxation, welfare distribution, and understanding private consumption. |

.

To sum it up, national income versus private income delineates two distinct views of our economy. National income defines a country’s aggregate productive forces and the economy’s contributions at a broader scale. It is the basis of policymaking at the government level, conducting an international comparison, and assessing economic growth. On the other hand, private income pertains to personal and corporate earnings, one of which is non-productive. Thus, it is a much more realistic measure for understanding household welfare, disposable income, and private consumption trends. These two concepts complement each other in broadening our understanding of the state and movement of a nation’s economy so that better planning and forecasting mechanisms can be implemented and proper and equitable distribution of resources can occur.

National Income vs Private Income FAQs

1. What is the national income, and how is it calculated?

A term denoting the summation of the monetary value of all final goods and services produced by residents of a country, national income is calculated by Net Domestic Product at Factor Cost + net Factor Income from Abroad.

2. What extras does private income include that the national one does not?

Private income factors in transfer payments-pensions, social remittances, and other social benefits, whereas the national ones do not since these are not earned by engaging in production.

3. Why are transfer payments excluded from national income?

Transfer payments are excluded from national income because they are not linked to any productive activity and contribute nothing to GDP or national output.

4. How are national and private incomes related to policy-making?

National income governs decisions on macroeconomic policies such as budget making and inflation control, while private income matters for welfare policies, tax structure, and income distribution strategy.

5. Which better indicates individual welfare-national income or private income?

While national income indicates the country’s overall productivity, private income stands closer to the heart of individual welfare since it is the cash the individual has in hand for free disposal and consumption.