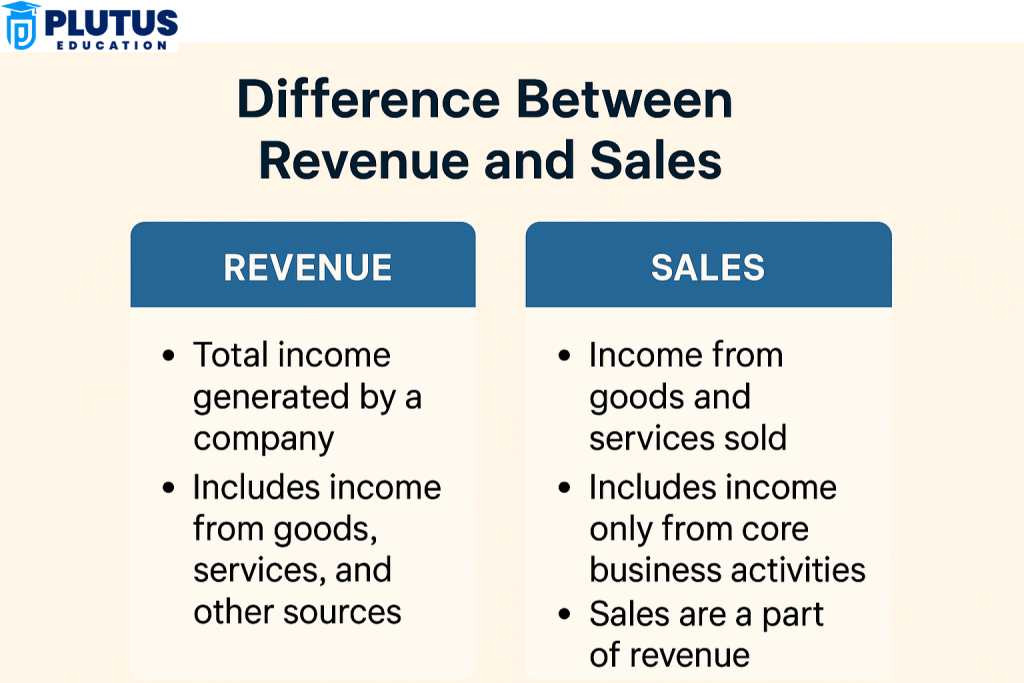

Many people use the words revenue and sales as if they mean the same thing. However, there is a big difference between revenue and sales, especially in business and accounting. Revenue represents the total income a company earns. Sales mean the money a company gets from selling its goods or services. So, all sales are revenue, but not all revenue comes from sales. For example, if a company sells 100 mobile phones, the money it gets from that sale is called sales. But if the company also earns money from rent, interest, or investment, all this money adds up to its total revenue. That is the main difference between revenue and sales — revenue is the big picture, and sales are one part of that picture.

What is Revenue?

Revenue means the total income a company earns from all its activities. This includes sales of goods or services, interest earned, rent received, and income from investments. It is the first line in the income statement, so people also call it the “top line.”

Businesses earn revenue not just by selling things. Sometimes, they earn by providing services or leasing assets. A company can have many sources of revenue. That is why it is essential to understand where the money is coming from.

For example, a telecom company earns money from mobile recharges (sales) and also earns revenue from advertisements shown on its app. A hotel earns money by booking rooms (sales) and can also earn by renting out halls or offering transport services (other revenue).

Revenue shows the size of the business. When a company’s revenue grows, it usually means the company is doing well. But sometimes high revenue does not mean high profit. Expenses also matter.

In accounting, companies report revenue before subtracting any costs or expenses. That is why it is called gross revenue. If a company gives discounts or has returns, those are subtracted to find net revenue.

Revenue tells how much money is coming into the company. It helps investors and owners check the performance of the business. Higher revenue usually shows more customer demand or vigorous business activity.

Types of Revenue

Businesses can earn different types of revenue. The most common is operating revenue. This comes from the company’s primary business activity. For example, for a bakery, selling cakes and bread gives operating revenue.

Non-operating revenue is the money earned from activities not related to the main business. For example, a company might earn interest from savings, rent from extra space, or income from selling old machines. This money is not regular but is still counted as revenue.

Recurring revenue is money that comes again and again, like subscription fees, monthly rent, or annual service charges. It makes the business more stable.

One-time revenue is money that comes from a single event. For example, a company selling an old car or property gets this kind of revenue. It does not repeat and may not be there next year.

Understanding types of revenue helps in planning and analysis. Regular revenue gives stability. One-time revenue may provide a temporary boost but not long-term security.

What is Sales?

Sales are the total money a company gets by selling its goods or services during a specific time. It is also called turnover. This is a part of revenue and often the most significant part, especially for product-based businesses.

For example, when a clothing store sells shirts, pants, and jackets, all that money adds up to its sales. It does not include money earned from other sources like rent or investments. So sales are the income from just the main selling activity of the business.

Sales are significant in judging how well a company’s product is doing. If the sales are high, it means customers like the product and are buying more. If sales go down, it may show a problem in demand, marketing, or competition.

Sales figures help in planning stock, production, and marketing. Companies track daily, weekly, and monthly sales to make better decisions.

Businesses also divide sales into gross and net sales. Gross sales are the total money received before any deductions. If customers return goods or get discounts, those are removed to find net sales.

Sales are usually the primary driver of revenue. However, some companies, like software firms or educational platforms, may have subscription income, too. So, knowing what part of the revenue is from sales is useful for deep analysis.

Types of Sales

There are several kinds of sales. Understanding these helps in knowing how a business earns.

- Product sales are common in retail or manufacturing. When you buy a phone or a pair of shoes, that is a product sale.

- Service sales happen in industries like telecom, education, or banking. For example, when someone pays for a mobile plan or coaching class, it counts as service sales.

- Online sales are done through websites or apps. This is growing fast in India. Companies like Amazon, Flipkart, and Zomato earn most of their sales online.

- Offline sales happen in physical shops. Grocery stores and local garment shops are good examples. Some businesses do both online and offline sales.

- B2B sales (Business-to-Business) happen when one company sells to another. For example, a factory selling raw materials to another factory is a B2B sale.

- B2C sales (Business-to-Consumer) happen when a company sells directly to the customer. For example, a bakery selling bread to a family is a B2C sale.

Each sales type needs different strategies. Online sales need a strong digital presence. B2B sales need negotiation skills. Service sales depend on good delivery and trust.

Key Difference Between Revenue and Sales

Now, let’s clearly understand the difference between revenue and sales through real-world comparison. Although sales are part of revenue, the two are not always the same. Let’s see how.

Meaning and Scope

Revenue is the total income a company earns from all sources. It includes sales, interest, rent, royalties, and other earnings. It gives the complete picture of money inflow.

Sales are the income a company gets only from selling its main goods or services. It does not include money earned from non-operational activities.

So, revenue is broader in meaning. It gives more detail about how the company earns money. Sales focus only on business from core operations.

Usage in Financial Statements

In accounting, revenue appears at the top of the income statement. It includes sales and other income.

Sales appear under revenue or as the first part of revenue, depending on the business type. In retail or product-based companies, sales often make up most of the revenue.

When people say “top-line growth,” they usually mean growth in revenue. However, if a company earns a lot from interest or one-time events, top-line growth may not mean higher sales.

Examples

Suppose a school earns ₹50 lakh from student fees and ₹5 lakh from renting out its auditorium. Total revenue is ₹55 lakh. Sales (student fees) are ₹50 lakh.

Now take an IT company that sells software for ₹1 crore and also earns ₹20 lakh from technical support services. Sales are ₹1 crore. Revenue is ₹1.2 crore.

These examples show that sales are part of revenue. But revenue can include other money, too.

| Aspect | Revenue | Sales |

| Definition | Total income from all sources | Income from selling goods or services |

| Scope | Broad; includes sales, interest, rent, etc. | Narrow; includes only product/service sales |

| Location in Accounts | First line of income statement | A part of revenue line |

| Examples | Sales + interest + rent + royalties | Only product or service sold income |

| Includes Returns/Discounts? | Yes, net revenue adjusts for returns | Yes, net sales remove returns and discounts |

| Used For | Financial analysis and business valuation | Sales forecasting and demand tracking |

Importance of Understanding the Difference

Knowing the difference between revenue and sales helps in better financial planning, analysis, and reporting. Students, accountants, and business owners all need this clarity.

When companies want to track growth, they must check both sales and total revenue. If revenue increases but sales remain the same, then the extra money is coming from other sources. This is useful but not always reliable for future growth.

For budgeting and forecasting, sales trends are more dependable. Marketing and production teams often rely on sales numbers. Investors also prefer to study how much of the revenue comes from core business, not from non-regular activities.

Also, understanding this difference helps avoid confusion in communication. Many times, people use revenue and sales as the same word. But if they mean different things, the analysis can go wrong.

Difference Between Revenue and Sales FAQs

1. What is the main difference between revenue and sales?

The main difference between revenue and sales is that revenue includes all income earned by the business, while sales include only money earned by selling goods or services. Sales are a part of revenue, but revenue can also include rent, interest, or one-time income.

2. Can revenue be higher than sales?

Yes, revenue is often higher than sales because it includes other income sources like interest, rent, and investments. For example, if a company earns money from selling products and also from renting out office space, the total revenue will be more than just the sales.

3. Do sales and revenue appear in the same place in the income statement?

Sales usually appear first under the revenue section of the income statement. Revenue comes at the top and may include multiple parts: product sales, service income, interest, and more. So, yes, they appear together but have separate entries in some cases.

4. Why is revenue also called the top line?

Revenue is called the “top line” because it is the first number on a company’s income statement. It shows the total income before any costs or expenses are removed. It reflects the scale of business operations and income-generating capacity.

5. What if a company has high revenue but low sales?

If a company has high revenue but low sales, it means it is earning more money from other sources like interest, royalties, or one-time deals. This is not a bad sign, but investors and owners must understand whether this revenue can continue or not in future periods.

6. Is sales the same as turnover?

Yes, in many countries, including India, the word “sales” is often used as another word for “turnover.” Both mean the income from selling goods and services. However, turnover may sometimes also refer to the total business activity in accounting.