The factors affecting the capital structure are essential to businesses that need to achieve both financial stability and growth. Capital structure refers to the proportion of debt and equity that a business employs in financing operations or long-term goals. Deciding on the appropriate capital structure is necessary since it affects a firm’s risk, profitability, and overall financial well-being. This article, therefore, endeavors to discuss what capital structure is, what factors affect the composition of capital structure, and what importance it holds for business.

What is Capital Structure?

Capital structure is the combination of debt and equity used by a firm for financing their operations, expansion, and investment. Capital Structure, therefore, is a manifestation of how a company can balance its financial resources to meet short-term and long-term obligations while trying to minimize risks and maximizing returns.

Key Features of Capital Structure

- Debt and Equity Components: It consists of Debt, which includes loans, bonds, and all types of borrowed money, and then Equity, which includes funds received by issuing shares and retained earnings.

- Long-Term Focus: Capital structure primarily focuses on long-term financial resources rather than short-term liabilities.

- Optimization Goal: It is based on finding the best combination of debt and equity for cost-minimization of capital as well as maximization of value for the firm.

Types of Capital Structure

- Equity-Heavy Capital Structure: Companies relying more on equity and less on debt. Suitable for businesses with high-risk tolerance.

- Debt-Heavy Capital Structure: Companies with a high proportion of debt, often chosen for lower financing costs but with higher financial risks.

- Balanced Capital Structure: A mix of equity and debt to balance risk and cost efficiency.

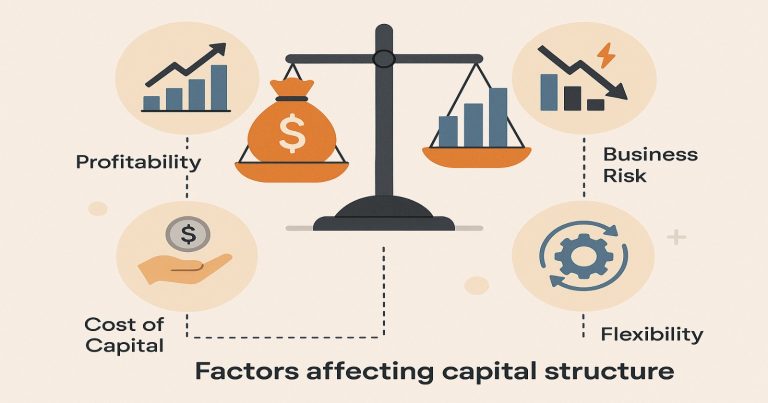

Factors Affecting the Capital Structure

Several factors affect the capital structure decisions of a company. These factors determine how much debt and equity should be used and in what proportion.

Nature of the Business

- Stability of Income: Utilities companies enjoying constant inflows have the advantage of accepting more debt because cash flows would be stable.

- Maturity of stage: Startup firms should opt for equity-based because of low creditworthiness. At maturity, debt is preferred to avoid taxes.

- Asset Structure: Companies with tangible assets can use such assets as collateral for loans, thereby influencing the capacity to gain debt financing.

Cost of Capital

- Cost of Debt: The interest rate on loans and bonds plays a crucial role. Companies prefer debt if borrowing costs are low compared to equity returns.

- Cost of Equity: Raising funds through equity is often more expensive than debt because shareholders expect higher returns.

- Weighted Average Cost of Capital (WACC): Companies aim to minimize WACC by balancing debt and equity effectively.

Risk & Financial Leverage

- Debt Risk: Higher amounts of debt result in financial leverage and risk bankruptcy at times of economy deceleration.

- Equity Risk: Excessive equity dilutes ownership and control, affecting shareholder value.

- Risk Tolerance: High-risk tolerance may allow the firms to take more debt to amass potential returns.

Tax Considerations

- Tax Benefits of Debt: Interest on debt is tax-deductible, reducing the company’s overall tax burden and making debt financing more attractive.

- Equity and Dividend Taxes: Dividends paid to shareholders are not tax-deductible, which makes equity financing less tax-efficient than debt.

Control & Ownership

- Retaining Control: The issue of equity shares can lead to a diffusion of ownership and control. Companies with an intention to retain control prefer debt over equity.

- Decision-Making Impact: Debt financing does not have ownership dilution. Management remains in control.

Market Conditions

- Economic Environment: During favorable market conditions, companies might issue equity to avoid debt. In uncertain times, companies often rely on internal funds or loans.

- Investor Sentiment: Strong investor confidence in the company can make equity financing more accessible and attractive.

Legal & Regulatory Requirements

- Debt Covenants: Lenders can restrict the usage of borrowed funds, which consequently affects a company’s usage of debt.

- Compliance Costs: Equities may accrue more compliance and disclosure costs, particularly for listed firms.

- Industry Regulations: Some industries have specific rules that dictate acceptable debt levels.

Availability of Financing

- Access to Capital Markets: Large companies with established reputations can raise funds easily through Debentures or public equity offerings.

- Creditworthiness: A company’s credit rating directly impacts its ability to secure loans at favorable interest rates.

Flexibility

- Repayment Terms: Debt typically comes with a set repayment schedule, which restricts one’s flexibility about money. Equity has no repayment obligation, providing more flexibility.

- Adaptability to Changes: Companies, whose cash flows are uncertain, may prefer equity, because it is more adaptable compared to the fixed payment schedules of debt.

Importance of Capital Structure

For every business, it is important to understand and manage the capital structure. In reality, a well-designed capital structure supports growth, minimizes risks, and ensures financial stability.

- Cost of Financing: A balanced capital structure helps minimize the cost of capital by using the right mix of debt and equity. Lower financing costs mean higher profitability.

- Risk Management: Companies balance debt and equity to provide balance to risk in the process. High debt increases the chance of default, while excessive equity reduces control and their returns for shareholders.

- Funding Business Growth: The capital structure determines a company’s ability to raise funds for expansion, acquisitions, and other growth opportunities.

- It enhances investor confidence: A stable and optimized capital structure, indicating proper management of funds, reduces the perceived risks.

- Long-term financial health: An optimal capital structure enables a company to fulfill its obligations and sustain growth in the long term, even in times of economic challenges.

Conclusion

The factors influencing the capital structure play a crucial role in determining the financial strategy of a company. Businesses have to consider various factors, such as the cost of capital, risk tolerance, market conditions, and tax implications, when deciding their capital structure. A balanced approach ensures financial stability, minimises risks, and supports long-term growth. Careful analysis of these factors allows companies to create an optimal mix of debt and equity to align with their goals and market conditions.

Factors Affecting the Capital Structure FAQs

What is capital structure?

Capital structure is the composition of debt and equity, which a firm employs to raise finance for its operations and to sustain growth.

What are the key determinants of capital structure choice?

Business nature, cost of capital, risks, tax benefits, market conditions, and control preferences represent some of the main factors.

What influence does tax have on the capital structure choice?

Interest expenses on debt are allowed for tax purposes, whereas dividends on equity are not deductible.

Why is the optimal capital structure important?

An optimal capital structure reduces funding costs, manages risk, and enables profitable business growth.

How do market conditions impact capital structure?

If market situations are favorable, businesses like to go for equity financing. Businesses, during unfavorable times, usually rely on internal sources or loans.