The company is one of the most well-structured and regulated forms of business organization that can be stretched and scaled like never before. The company is an artificial legal person created by law and endowed with rights and responsibilities similar to those of a natural person. Incorporated under the Companies Act 2013, a company is separate from its members and exists independently of them. There is immense flexibility, limited liability, and everlasting succession in the company formation, and it builds a powerful engine for economic development and innovation-whether a public limited company listed on a stock exchange or a privately held startup. The discussion in this article will be on the meaning of a company, the distinct features identifying it, and the types of companies recognized within the confines of India.

What is Company?

One of the significant things to understand before studying features and types is that a company is something more than a business. It is legally recognized as an entity that works and operates independently of its owners. In the eyes of the law, it is treated as a “person” capable of owning property, entering contracts, and suing or being sued.

Legal Definition under Companies Act, 2013

The definition of a company under Section 2(20) of the Companies Act, 2013 is a company formed under this act or any prior company legislation. Upon registration under the law, the company becomes a separate legal entity having rights and liabilities quite distinct from the rights and liabilities of its shareholders.

The Separate Legal Personality of Company

On registration, the company itself can hold property, bank accounts, and contracts; sue, and be sued. The legal personality of the company is distinct from that of the members, hence shielding them from personal liability for the company’s business.

Role of Shareholders and Directors

The organization raises capital by issuing shares to shareholders. The shareholders elect a Board of Directors to manage the affairs of the company. A dividing line is drawn between ownership and management, hence establishing a professionally governed company.

Corporate Structure and Governance

The memorandum of association (MOA) and articles of association (AOA) are two basic documents defining a company’s structure; they define a company’s goals, rules, and scope of operations. They are mandatory for compliance with statutory reporting, auditing, and meetings as per the Act.

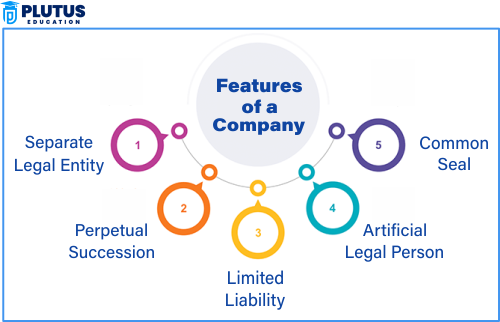

Features of a Company

What makes a company different from a partnership or sole proprietorship? The answer is in its features. These characteristics define and benefit the company with continuance, limited risk, and easy management.

Separate Legal Entity

Therefore, a company is independent of its members. It can own assets, enter into contracts, and conduct business in its own name. This separation shields shareholders from being personally responsible for the company’s debts or actions.

Limited Liability

Limited liability is one of the best benefits of having a company. The liability of residence is limited to the amount not paid on their shares, so when the company goes into bankruptcy, personal assets remain safe.

Perpetual Succession

Companies continue to exist regardless of changes in membership. Death, insolvency, or retirement of shareholders or directors does not dissolve the company. It exists until it is legally wound up.

Transferability of Shares

The free transferability of shares makes it very easy for investors to buy or sell their holdings in a public company. Such liquidity encourages more investor participation. Private companies, however, may place restrictions on share transfers.

Artificial Legal Person

Although a company cannot perform physical acts, it enjoys the rights of a natural person—like entering contracts or owning property. It functions through human representatives like directors or employees.

Common Seal (Optional)

Traditionally, companies used a common seal as an official signature for documents. Although it is now optional under the Companies Act of 2013, many companies still use it for formal or legal agreements.

Capacity to Sue and Be Sued

A company can take legal action or be sued in its name. This allows it to enforce rights and fulfill obligations under the law, reinforcing its standing as an independent legal entity.

Distinct Ownership and Management

While shareholders are the owners, they do not manage daily operations. This responsibility lies with the Board of Directors, ensuring expertise and professionalism in decision-making.

Kinds of Companies: Types Based on Liability, Ownership & Purpose

Companies are classified under various categories based on how liability is assigned, who owns the company, and why the company is formed. This classification is crucial for entrepreneurs, investors, and regulators, impacting governance, taxation, and compliance requirements.

Companies Based on Liability

Liability refers to the financial responsibility members, or shareholders hold if the company faces losses or debts. Based on this, companies can be divided into the following types:

Company Limited by Shares

The most common type is where liability is limited to the unpaid value of shares a member holds. For example, if you own 100 shares worth ₹10 each and have paid ₹800, your maximum liability is ₹200.

Company Limited by Guarantee

Typically formed for non-profit purposes, these companies do not issue shares. Instead, members agree to contribute a fixed amount to cover liabilities in the event of winding up. These are common in social, cultural, and educational institutions.

Unlimited Company

There is no limit to member liability here. If the company cannot pay its debts, members may be required to use personal assets. Such companies are rare and usually found in niche financial or investment sectors.

Companies Based on Ownership

Ownership refers to who controls the company—whether a single person, a private group, or the general public. This classification influences control, fundraising methods, and transparency requirements.

Private Limited Company (Pvt. Ltd.)

A private company restricts share transfers and limits membership to 200 (excluding employees). It cannot raise funds from the public. It offers privacy and flexible operations, which is ideal for family businesses or closely held enterprises.

Public Limited Company (Ltd.)

These companies can invite the public to buy shares and are usually listed on stock exchanges. They require a minimum of 7 members but have no upper limit. Suitable for large-scale businesses, public companies enjoy easier access to capital but must comply with stringent disclosure norms.

One Person Company (OPC)

Introduced by the Companies Act 2013, OPCs allow a single person to own and run a company. They combine the benefits of sole proprietorship with the legal protection of a company. They’re a popular choice for freelancers and individual entrepreneurs.

Companies Based on Purpose

While most companies are profit-driven, some are created for social welfare or to serve government interests. Companies can also be categorized by their core objectives.

Non-Profit Organizations (Section 8 Companies)

These companies operate for charitable, religious, cultural, or educational purposes. They reinvest their income into their mission instead of distributing profits. They are granted special tax benefits and enjoy relaxed regulatory norms.

Government Companies

The central or state government holds at least 51% of the share capital in these companies. Examples include ONGC, SAIL, and BHEL. They are formed to operate in strategic sectors and maintain public welfare while functioning commercially.

Features of a Company FAQs

1. What are the key features of a company?

Key features include separate legal identity, limited liability, perpetual succession, share transferability, and distinct ownership and management.

2. What is the definition of a company under the Companies Act 2013?

A company is an artificial legal person created by incorporation under the Companies Act of 2013, with the ability to contract, own property, and be sued or sued in its name.

3. What are the advantages of a company structure?

Advantages include limited liability, business continuity, ease of capital generation, and professional management.

4. What is the difference between private and public companies?

A private company restricts share transfer and cannot issue shares to the public, while a public company can list on stock exchanges and has more members and transparency requirements.

5. How does perpetual succession benefit a company?

Perpetual succession ensures the company’s continued existence regardless of changes in its membership, supporting long-term growth and stability.