A public limited company is a kind of business entity that sells equity to the public through an exchange. In other words, it is a form of a company whose shares can be traded in the general market and can be owned by anyone. Features of public limited company separate from other forms of business and defining these characteristics is essential in the eyes of business enthusiasts or investors. The advantages are that public limited companies can raise funds from the public. Disadvantages include the regulations and scrutiny of the shareholder.

What is Public Limited Company?

A public limited company (PLC) is a company whose shares are freely traded on the stock exchange. The ability for the general public to buy shares and become owners has thus made it a public limited company. A PLC has to adhere to the rules and regulations strictly to ensure transparency, accountability, and fair treatment for all shareholders. Raising capital by offering shares to the public seems to be the most common feature.

The main reason a public limited company is preferable is its capacity to raise a large amount in sales of shares. This leads to large-scale operations that are meant to expand. Public limited companies essentially belong to big businesses, usually multinational companies needing a substantial amount of money for quite a number of reasons like business expansion.

An example of a Public Limited Company (PLC) in India is Tata Consultancy Services. TCS is the largest IT services and consulting company in India, and its shares are traded on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). TCS is registered under the Public Limited Companies Act and is thus subject to approval from other regulatory authorities. TCS has to render, for instance, quarterly financial performance, annual reports, and share sale controls, along with any of its subsidiaries. This kind of structure can help the company to capitalize upon major projects and consequently many success stories.

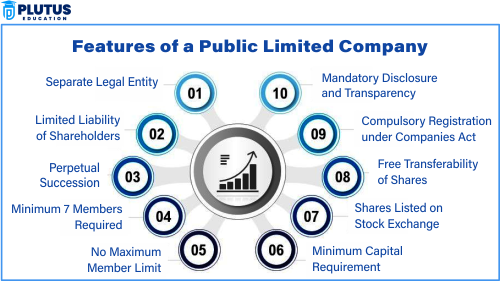

Features of Public Limited Company

The features of public limited company are what make this type of organization unique in the corporate world. These features also influence its structure, management, and financial operations. Some of the key features of a public limited company include:

- Ownership through Shares: The ownership of a public limited company is divided into shares. Shareholders can buy and sell shares in the company, giving them ownership rights in proportion to their shareholding.

- Limited Liability: Shareholders in a public limited company have limited liability. This means that if the company goes bankrupt or faces financial issues, the shareholder’s assets are not at risk. They are only liable to the extent of their investment in the company.

- Raising Capital: One of the outstanding features of public limited companies is the ability to raise much capital by issuing shares to the public. Such capital may be used for business expansions, acquisitions, research and development, and other corporate purposes.

- Shareholding Structure: In public limited companies, ownership is widely diffused. Owners can be as varied as individual investors to institutional investors such as banks, pension funds, and mutual funds. Shares of the company are traded on public stock exchanges, which, for example, include the BSE and NSE.

- Regulatory: Public limited companies are subject to considerable regulation by government authorities and stock exchange rules. Such companies must keep in line with standards of corporate governance, offer financial information, and give annual reports to the public.

- Public Disclosure: Transparency is one of the main characteristics of public limited companies. They must disclose their financial information, operations, and plans to the shareholders and the public. This is available to the interested party by quarterly earnings reports, annual general meetings, or public filings.

- Perpetual Succession: The company’s existence is not affected by changes in ownerships or management. Even if shareholders buy or sell their shares, the company continues to exist and function as a separate legal entity.

- Profit Distribution: Public limited companies can distribute their profits to shareholders in the form of dividends. The amount of dividends is determined by the company’s profitability and the decisions of its Board of Directors.

- Management: In a public limited company, management is separate from ownership. The shareholders elect a board of directors to oversee the company’s affairs. The directors appoint executives to manage the operation on a day-to-day basis.

- Taxation: Like other corporations, public limited companies are liable to pay corporate tax; however, the rates and requirements for taxation may differ according to the country the company is in.

Types of Public Limited Companies

There are various public limited companies based on their organizational structure, objectives, and mode of operation. The main types, however, are:

Listed Public Limited Company

A listed public limited company has shares listed on a recognized stock exchange. Any member of the public can buy and sell shares easily through any stock exchange such as the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Examples of listed public limited companies include Apple, Amazon, and Google-the conglomerates of the world.

- Advantages: Easier for raising capital through offers of sale to the public. Liquidity for shareholders. Increase in visibility and credibility.

- Disadvantages: Maintenance of high regulatory compliance. Susceptible to ebbs and flows of market needs. Pressure to meet quarterly financial goals.

Unlisted Public Limited Company

An unlisted public limited company has the public shares not listed on the stock exchange but still would like to purchase by the public. The entities might be willing in the future to go public or remain privately owned for other reasons.

- Advantages: Fewer regulations than those faced by the listed company. Owners might make decisions without interference from shareholders.

- Disadvantages: Limited access to capital markets. Less liquidity available for shareholders. Potential challenges in raising funds for expansion.

Public Limited Company FAQs

1. What is a Public Limited Company (PLC)?

A Public Limited Company is a business entity that offers its shares to the general public through a stock exchange. It has limited liability, a separate legal identity, and must follow strict regulatory and disclosure requirements.

2. What are the key features of a Public Limited Company?

Key features include limited liability, transferability of shares, minimum of 7 shareholders, and the ability to raise capital from the public. It is governed by the Companies Act and must include “Ltd.” or “PLC” in its name.

3. What are the advantages of a Public Limited Company?

PLCs can raise large capital through public investment and enjoy increased credibility and market visibility. They also benefit from limited liability protection for shareholders.

4. What are the disadvantages of a Public Limited Company?

PLCs face high regulatory compliance, risk of hostile takeovers, and loss of control due to public shareholding. They also require full financial disclosure, which may affect competitive advantage.

5. Can anyone buy shares in a Public Limited Company?

Yes, shares of a PLC are freely tradable on the stock exchange and can be bought by any member of the public. However, prices fluctuate based on market demand and company performance.