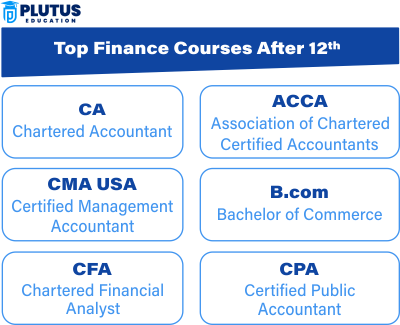

After completing 12th grade, finance students can pursue courses like B.Com, BBA in Finance, CA, CS, CFA, ACCA, and CMA. These courses provide a foundation in financial concepts and can lead to careers in accounting, investment, and financial planning. Choosing the right career path after completing 12th grade is essential. Many students from commerce backgrounds want to enter the finance field. Finance courses after 12th help students gain skills and knowledge about money, banking, accounting, and investments. These compare students for finance, accounting, banking, investment, and business management jobs. They also build a strong foundation for advanced studies, like an MBA or CFA. Students can choose between degree courses, diploma programs, and short-term certifications based on their career goals and interests. The options range from finance degree courses after 12th to a diploma in finance and even short-term finance courses. Let’s explore all the details step by step.

Best Finance Courses After 12th in India

Many Indian students want to build a career in finance. They can start by choosing the best finance courses in India. These courses help them learn about finance, accounting, economics, and investment strategies. These skills are in high demand in both the public and private sectors.

B.Com Finance

A Bachelor of Commerce (B.Com) in Finance is an undergraduate degree program that is three years in duration and deals with the financial principles of banking, economics, and accounting. It lays an excellent foundation in the core business concepts and prepares students for advanced finance careers or further qualifications. Offered by top institutions such as the University of Delhi and Mumbai University, B.Com in Finance suits those who aspire to join entry-level banking, accounting, or financial services. Although Plutus Education does not directly offer B.Com degrees, it supports such academic goals through its supplementary courses and mentorship programs in finance.

BBA in Finance

BBA in Finance is a three-year undergraduate professional degree with the elements of management education, specialising in finance management, investment analysis and risk control. Colleges like Christ University and NMIMS are among those that have this degree to capitalise on very good ties to the industry, as well as opportunities for internships. It is designed for individuals who want to pursue a career in corporate finance, investment banking, or financial consulting. For example, Plutus Education does not offer full BBA programs; however, students can benefit from specialised finance certification courses.

Diploma in Finance and Accounting

A diploma in Finance and Accounting is generally a one-year program to develop the core competencies in accounting systems, taxation, auditing, and financial management. It aims to provide hands-on, practical, job-oriented training that institutes like NIFM and Tally Academy can share. It is a short-term diploma program that suits people looking to upgrade skills quickly and get into the field in junior finance positions. Indeed, this diploma is not available at Plutus Education. Still, the platform offers something similar: short-duration finance courses that improve students’ practical abilities to get them job-ready.

Chartered Accountancy (CA)

Chartered Accountancy (CA) is arguably one of India’s best and most stringent professional qualifications, taking around 4.5 to 5 years to complete. The Institute of Chartered Accountants of India (ICAI) offers and plans the course. It is structured at three levels—Foundation, Intermediate, and Final—and practical training under the CA program. Such a professional may be hired in prestigious positions with firms that hire auditing, taxation, or corporate finance professionals. Full coaching for all levels of CA as offered by Plutus Education, including expert faculty, mock tests and mentorship.

Company Secretary (CS)

CS or Company Secretary is a specialised professional program offered by the Institute of Company Secretaries of India (ICSI). This qualification typically takes about three to four years to complete. It specializes in corporate law, governance, and compliance, training a person to handle a company’s legal responsibilities. CS professionals are essential for ensuring regulatory adherence in a corporate environment. Plutus Education focuses mostly on finance while also providing support for CS aspirants through expert sessions and learning materials that incorporate relevant legal and corporate law perspectives.

Chartered Financial Analyst (CFA)

CFA is a Chartered Financial Analyst, an internationally acknowledged credential provided by the CFA Institute (USA). The program spans 2-3 years and then branches into three rigorous levels, specialising in investment management, financial analysis, ethics, and management of portfolios. The CFA program is the gold standard in finance and counts among the most popular and respected qualifications for asset management and equity research. Plutus Education also conducts dedicated CFA coaching for all three levels. This coaching comes packaged with industry-standard study materials, mock exams, and expert mentoring.

Association of Chartered Certified Accountants (ACCA)

The ACCA (Association of Chartered Certified Accountants) is a qualification in professional accountancy that can be obtained almost all over the world and is offered by ACCA Global (UK), which usually takes 2 to 3 years to finish. The course covers taxation, audit, management accounting, and ethics courses, among others. More than 180 countries have recognised it. An ACCA-qualified professional is recognised in almost all multinational and global financial firms. Plutus Education is a reputable resource for ACCA coaching in India, offering end-to-end support through live classes, study materials, and exam strategies under global standards.

Cost and Management Accounting (CMA)

Cost and Management Accounting (CMA) is one of the most sought-after courses in India for an individual looking to specialise in cost management, budgeting, and providing strategic financial advice. This is done under the Institute of Cost Accountants of India (ICMAI), and its duration varies between 3 and 4 years. A CMA is crucial in making decisions concerning the manufacturing and service industries. Plutus Education does not exclusively have CMA-associated programs on offer. Still, it also provides students with related finance programs and preparatory support in line with the curriculum of professional courses such as CMA.

Top Finance Courses After 12th

Students can enrol in various top finance courses after the 2nd. These include full-time degrees, diplomas, and certifications. Below is a table showing popular courses:

| Course Name | Type | Duration | Offered By |

| B.Com in Finance | Degree | 3 Years | Delhi University, Mumbai University |

| BBA in Finance | Degree | 3 Years | Christ University, NMIMS |

| Finance and Accounting Diploma | Diploma | 1 Year | NIFM, Tally Academy |

| Chartered Accountancy (CA) | Professional | 4.5–5 Years | ICAI (Institute of Chartered Accountants of India) |

| Company Secretary (CS) | Professional | 3–4 Years | ICSI (Institute of Company Secretaries of India) |

| Chartered Financial Analyst (CFA) | Professional | 2–3 Years (Level I–III) | CFA Institute (USA) |

| Association of Chartered Certified Accountants (ACCA) | Professional | 2–3 Years | ACCA Global (UK) |

| Cost and Management Accounting (CMA) | Professional | 3–4 Years | ICMAI (Institute of Cost Accountants of India) |

These finance degree courses after 12th give deep knowledge about money management, banking, stock markets, and more. Students interested in accounting can choose accounting and finance courses after the 12th to get both skills together.

Career Options in Finance After Completing 12th

A career in finance can lead to good salaries and growth. There are many career options in finance after 12th for students who complete finance-related courses. These jobs are available in banks, companies, government offices, and financial institutions.

Popular Career Paths in Finance

Finance is a vast field. Here are some job roles that students can get after completing commerce finance courses:

- Financial Analyst—This job requires strong numerical skills. A financial analyst studies market trends and company reports and makes investment plans. Students can begin this path by taking a financial analyst course after the 12th grade.

- Investment Banker—Investment bankers help companies raise funds and manage mergers, acquisitions, and IPOs. Students can learn this by taking investment banking courses after the 12th grade.

- Accountant – Accountants keep financial records and help manage taxes. Students taking accounting and finance courses after the 12th can work in this field.

- Bank Officer —banks hire finance graduates for jobs like loan officer, relationship manager, or back-office executive. These jobs suit those who complete banking and finance courses after the 12th. grade

- Insurance Advisor or Actuary – These jobs are great for those interested in insurance and risk. Students can take professional finance courses to enter this area.

Finance also has options in stock markets, real estate finance, credit rating, taxation, and budgeting. Some students even open their finance-related businesses using the skills learned from private finance courses.

Short Term Finance Courses After 12th in India

Yes, you can do short term finance courses after 12th. These courses help students get early exposure to the world of finance, accounting, banking, taxation, and investment. Whether you’re from a commerce background or not, these practical and job-ready courses can help you build a career path or add skills for freelancing or internships.

Short term finance courses after 12th are available both online and offline. Some take just 1–3 months to complete. Many of these courses do not require any prior knowledge of finance or maths, making them ideal for beginners. Let’s explore the best short term finance courses you can do after 12th.

Top Short Term Finance Courses After 12th

After passing class 12th, especially with commerce or arts stream, students can join short finance certification programs to learn practical skills like accounting, budgeting, taxation, and investing. These courses are great for skill-building, freelancing, and job opportunities.

1. Certificate in Financial Accounting (Tally + GST)

This is one of the most popular finance courses after 12th. It teaches students basic accounting, bookkeeping, GST filing, and how to use software like Tally.

What You’ll Learn:

- Basic Accounting Principles

- Tally ERP 9 or Tally Prime

- GST Billing and Returns

- Income Tax Basics

Duration:

1 to 3 months

Ideal For:

12th pass commerce students, B.Com students, job seekers

Job Roles:

- Junior Accountant

- Tax Assistant

- Accounts Executive

Institutes:

- NIIT

- ICA Edu Skills

- Local commerce training centres

2. Certificate in Banking and Finance

This course gives a good foundation in how banks and financial institutions work. You learn about savings, credit, insurance, mutual funds, and basic banking rules.

What You’ll Learn:

- Banking operations

- Financial markets

- Introduction to loans and credit

- KYC, AML, and compliance

Duration:

2 to 4 months

Ideal For:

Students planning to enter the banking sector

Job Roles:

- Bank Front Desk Executive

- Loan Assistant

- KYC Verification Officer

Institutes:

- NISM (National Institute of Securities Markets)

- BFSI Sector Skill Council courses

- Mahendra’s / Career Power

3. NSE Certified Capital Market Professional (NCCMP)

Offered by the National Stock Exchange (NSE), this short term course introduces students to the stock market, investment, and trading.

What You’ll Learn:

- Stock market basics

- Trading and investing

- Technical analysis

- Fundamental analysis

Duration:

1 to 3 months

Ideal For:

Students interested in stock market, investing, and trading

Job Roles:

- Stock Market Analyst

- Equity Dealer

- Trading Assistant

Institute:

- NSE Academy (Online or in partner centres)

4. Certificate in Financial Modelling

Financial modelling is about analyzing real-world financial scenarios in Excel. It’s used in investment banking, equity research, and corporate finance.

What You’ll Learn:

- Excel for finance

- Business valuation

- Ratio analysis

- Forecasting techniques

Duration:

2 to 3 months

Ideal For:

12th pass with good computer knowledge

Job Roles:

- Financial Analyst (Junior)

- MIS Executive

- Research Assistant

Institutes:

- EduPristine

- IMS Proschool

- Internshala Trainings (Online)

5. Certificate in Investment and Personal Finance

This is a beginner-friendly short course that helps students understand how to save, invest, and manage personal money.

What You’ll Learn:

- Budgeting

- Saving vs Investing

- Mutual Funds and SIPs

- Managing credit and loans

Duration:

1 to 2 months

Ideal For:

Any 12th pass student who wants to learn personal money skills

Job Roles:

While not job-focused, it helps in freelancing or internships in financial planning

Institutes:

- Coursera / Udemy (Online)

- The Knowledge Academy

- BSE Institute Ltd

Why Choose Short Term Finance Courses After 12th?

Short term finance courses after 12th can open up new job opportunities and give clarity on future career paths. Here are some key benefits:

- Job-Ready Skills: Practical skills like Tally, GST, Excel, and stock trading are in demand.

- Quick Certification: Most courses are 1–3 months long and affordable.

- Internship Opportunities: Some courses offer live projects or internships.

- Foundation for Higher Studies: They help build a strong base before B.Com, BBA, or CA.

- Freelancing / Side Income: Students can do part-time jobs or freelancing in taxation or accounting.

Quick Comparison Table

| Course Name | Duration | Job Role | Skill Level |

| Financial Accounting (Tally+GST) | 1–3 months | Accountant | Beginner |

| Banking & Finance | 2–4 months | Bank Assistant | Beginner |

| Stock Market (NCCMP) | 1–3 months | Trader/Analyst | Beginner |

| Financial Modelling | 2–3 months | Analyst | Intermediate |

| Personal Finance | 1–2 months | NA / Freelance | Beginner |

Finance Courses After 12th FAQS

1. What are the best finance courses in India?

The best finance courses in India include B.Com in Finance, BBA in Finance, a diploma after 12th, and an investment banking or financial analysis certification.

2. What is the eligibility for the finance course after the 12th?

Students must complete 10+2 with a minimum of 50% marks. A commerce background is preferred, but not always required.

3. Can I pursue online finance courses after the 12th?

Yes, platforms like Plutus Education, Coursera, Udemy, and edX offer many affordable and flexible online finance courses after the 12th.

4. What is the average finance course fee in India?

Fees range from ₹30,000 per year for degree programs to ₹5,000 for short certifications. Government finance courses usually cost less.

5. Are there any professional finance courses available after the 12th?

Students can take professional finance courses, such as CFA (after graduation), CIMA, or investment banking certifications, from reputed institutes.