F&O (Futures and Options) are derivative financial products employed for hedging, speculation, and trading in equity markets. F&O Trading Income Tax is the tax imposed on income from trading in Futures and Options (F&O) in India. Because F&O trading is viewed as a business activity and not an investment, its taxability differs from other asset classes, such as stocks or mutual funds. The tax on F&O trading in India is assessed under the heading ‘Business and Profession’; thus, traders must keep proper accounts and report profits accurately in their income tax returns (ITR).

What is F&O?

Futures and options (F&O) are derivative contracts applied in share trading. They gain value from an underlying asset like shares, indices, commodities, or foreign exchange. Traders employ F&O to hedge, speculate, and identify arbitrage opportunities.

- Futures Contracts: These are contracts to purchase or sell an asset at a set price at some point in the future.

- Options Contracts: These provide investors with the right, but not the obligation, to purchase or sell an asset at a predetermined price before a specified expiration date.

Tax Treatment on F&O Trading Income

The income tax on F&O trading in India is governed by business taxation principles, i.e., profits and losses on F&O trading are considered non-speculative business income.

In F&O trading, all dealings are business activity from the tax perspective. The Income Tax Act considers any gain or loss made from F&O trading as business income from the income tax point of view. Still, the legislation does not mandate that all share dealings be treated similarly. You have the flexibility to classify your share dealings according to their nature rather than applying a single principle of taxation.

For example, you will have to report F&O trading income tax under the head business income, while you can report long-term or short-term capital gains on other shares separately under capital gains. To claim them as capital gains, keep your investments in shares as investments and not stock-in-trade in your accounts. This classification allows you to manage tax liabilities better and comply with income tax rules.

Tax Slabs Applicable for F&O Traders

The new tax slab for F&O traders under the new tax regime for AY 2024-25 decides the rate of income tax applicable based on taxable income. If you opt for the new tax regime, your F&O trading income will be taxed as per the following slabs of income and rates:

| Taxable Income (INR) | Slab Rate |

| Up to 3,00,000 | NIL |

| 3,00,001 to 6,00,000 | 5% |

| 6,00,001 to 9,00,000 | 10% |

| 9,00,001 to 12,00,000 | 15% |

| 12,00,001 to 15,00,000 | 20% |

| More than 15,00,000 | 30% |

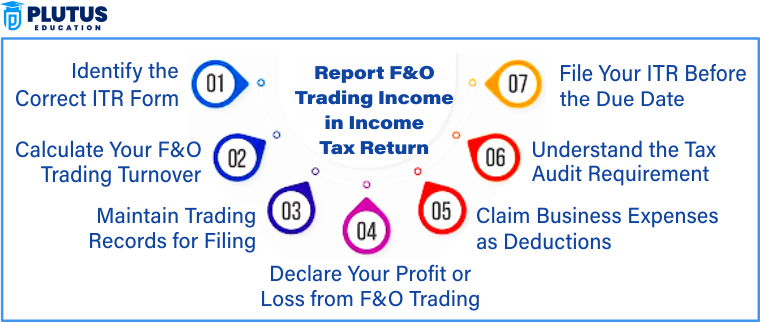

How to Report F&O Trading Income in Income Tax Return?

F&O trading income comes under business income in India. Report it accurately when filing your income tax return (ITR) to save from penalties. Tax treatment for F&O trading income tax helps you take deductions, offset losses, and select appropriate ITR forms per trading turnover. Continue the step-by-step procedures below for seamlessly lodging your F&O trading income tax return.

Step 1: Determine the Right ITR Form

As F&O income is business income, you must file ITR-3 if you receive income from a profession or business. If turnover is less than ₹2 crore and you want presumptive taxation, you can file ITR-4. However, presumptive taxation is not always advantageous for traders because it takes a fixed profit percentage. Traders, in general, must file ITR-3 to calculate the correct tax.

Step 2: Calculate Your F&O Trading Turnover

A new method of calculating turnover in F&O trading against any standard stock execution. It comprises the net total of all profits and losses from F&O trades. Follow these steps:

- Sum up the absolute values for all the profits and all the losses incurred for the financial year.

- Assuming you made a profit of ₹15,000 in one trade and made a loss of ₹8,000 in another, your total turnover would be ₹23,000 (₹15,000 + ₹8,000).

- The filers should report turnover for tax audit consideration and select taxable mode over non-mode.

Step 3: Maintain Trading Records for Filing

When filing returns on F&O trades maintaining respective records is top priority. These guiude while checking out income tax and makes filing effortless. The following`s records should be retained:

- Contract notes from brokers

- How to read a profit and loss statement.

- Trading account reports from ledger

- What do you need to apply What you’ll specific all types of other deposits, as bank statements deposit statement showing the particular withdrawal and deposits deposit statement bank statements showing deposits

- Proof of Expenses for Deductions

Step 4: Declare Your Profit or Loss from F&O Trading

Your F&O profit or loss must be reported under profit and gains from business or profession in the ITR form.

- If you sold it for a profit, increase your total taxable income.

- If you make a loss, you can offset it against other income (other than salary) or carry it forward for eight years.

- Through example, pending income(₹6 lakh) + Pending F&O losses(₹1.5 lakh) = ₹4.5 Lakh taxable income after adjustment.

- This can ease your tax burden, as losses can offset business income, capital gains or rental income.

Step 5: Claim Business Expenses as Deductions

As F&O trading is a business activity, you can make deductions on expenses directly required for your trading. These expenses, when deducted, minimize the taxes you have to pay by lowering your taxable income. These expenses include:

- Brokerage fees and trading charges

- Internet and telephone bills

- Trading software subscriptions

- Advisory or consultancy fees

- Office rent or salaries of employees (if any)

Step 6: Understand the Tax Audit Requirement

If your turnover in F&O is more than ₹10 crore or shows very low profits, you might be asked to undergo a tax audit. But under the presumptive taxation system, if your turnover is less than ₹2 crore, you can be exempted from an audit if you show at least 6% of turnover as profit. If you show less profit, you might be asked for an audit by a chartered accountant (CA).

Step 7: File Your ITR Before the Due Date

The due date for filing F&O trading income tax return is as follows in case you are liable for tax audit:

- No tax audit – File ITR before 31st July of the assessment year.

- If tax audit is applicable – ITR must be filed on or before 31st October of the relevant assessment year.

You to avoid penalties and losses can be carried for tax advantages if you File time.

Tax Audit Applicability Based on F&O Trading Turnover

A tax audit is required for F&O traders if turnover exceeds a certain limit. Not doing a tax audit when it is due can result in penalties under section 271B, up to Rs. 1,50,000 or 0.5% of turnover.

- Turnover up to ₹1 crore: No tax audit unless the profits are less than 6% of the turnover. Traders need to show profits accurately to escape investigation.

- Turnover between ₹1 crore and ₹10 crore: A tax audit is required for F&O traders if turnover exceeds a certain limit. Not doing a tax audit when it is due can result in penalties under section 271B, up to Rs. 1,50,000 or 0.5% of turnover.

- Turnover up to ₹1 crore: No tax audit unless the profits are less than 6% of the turnover. Traders need to show profits accurately to escape investigation.

Tax Obligations for Other Investment Types

Besides F&O taxation of its revenue, you can even do intra-day trading, short-term trading, or long-term investment. The Indian income tax for F&O trading classifies each of them differently.

- Intra-day Trading: It’s a standalone business and constitutes a speculative business. You must determine income or loss from intra-day trading distinctively from F&O trading income tax.

- Short-term Trading: If you frequently trade equity shares, the profit can be either business income or capital gains based on the number of trades and the frequency. You must select a classification and stick to it for each year of experience.

- Long-Term Investments: Gains from equity shares held for a longer period or with a lesser trade volume would qualify as capital gains. Long-term investors generally pay a lower tax rate than frequent traders.

F&O Trading Income Tax FAQs

1. Is income from F&O trading taxable in India?

Yes, income from F&O trading is fully taxable in India. It is treated as business income under the head “Profits and Gains of Business or Profession.”

2. How is F&O trading income calculated for tax purposes?

Income from F&O trading is calculated as:

- Profit/Loss = (Sell price – Buy price) – brokerage and other charges

This is treated as non-speculative business income and must be reported accordingly.

3. Do I need to maintain books of accounts for F&O trading?

Yes, if your F&O turnover exceeds ₹10 crore or if your income exceeds ₹2.5 lakh and you are not opting for presumptive taxation, you must maintain books of accounts as per Section 44AA of the Income Tax Act.

4. Is audit mandatory for F&O traders?

Audit under Section 44AB is mandatory if:

- Your turnover exceeds ₹10 crore, or

- Your declared income is less than 6% of turnover and your total income exceeds the basic exemption limit.

5. What is the turnover calculation for F&O trading?

Turnover in F&O is calculated as the sum of absolute profits and losses from all trades during the financial year. It does not include the total contract value.