The way to become a Chartered Accountant is one of the most prestigious and challenging courses in India. Many students ask about the how to become CA after 12th, primarily those from the commerce stream. In order to become CA after 12th, first, you need to clear the CA foundation then the Intermediate, next complete 3 years of articleship and lastly clear the final level of ca. Being at every level calls for tremendous labor and hard work but makes the dream possible with proper planning. The complete process, along with eligibility criteria, syllabus, and after 12th opportunities for CA in the career have been covered by this article.

Who is CA?

CA or Chartered Accountant is a practicing professional in finance-related matters, proficient in accounting, auditing, taxation, and financial management. CAs ensure proper reporting of finances to stakeholders, regulatory compliance, and strategic planned financial management. This nature of a CA role then becomes very important to maintain financial integrity and guide businesses and people in financial decisions.

Role of a CA

A CA is a role much more important than just mere calculations. CA assists businesses to make intelligent financial decisions and gets them back on the right track. CAs verify the accuracy of records of finance as well as whether they conform to the laws of the land. CAs also aid in taxes by assisting people and organizations to prepare their returns and prepare finances accordingly. The advice about investments, budgeting, and cutting costs proves useful for growing the business as well as wisely managing money.

CAs are necessary for internal controls and risk management to ensure the compliance of the organization with the financial regulations. They also give guidelines for mergers, acquisitions, and other financial transactions, which makes their knowledge relevant to the running of any financial management or decision-making.

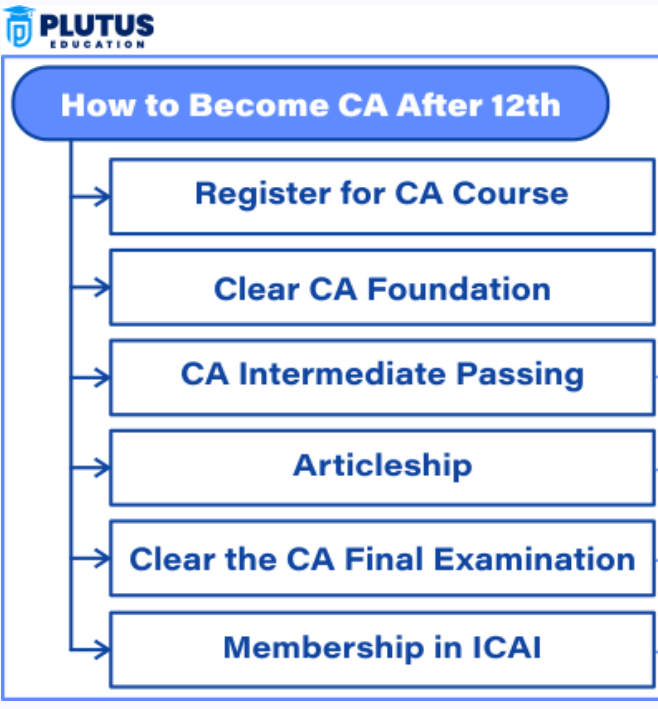

How to Become CA After 12th?

Here’s how to become a CA after 12th commerce or any other stream in steps: This requires completion of three levels of exams along with undergoing training.

- Register for CA course: For the first move, log into the Institute of Chartered Accountants of India website and sign up for the CA course. Filing of an online application form for the CA Foundation Course; scanning of and uploading relevant documents such as certificate showing completion of 12th, and proof of identity and payment for registration and prescribed examination fee. Information about the study material will be shared along with the list of examinations after registration.

- Clear CA Foundation: Prepare well to clear the CA Foundation exam. Read and attempt the prescribed syllabus by focusing on key subjects such as accounting, law, and economics. The number of questions in each and previous year’s papers can help you get a feel for the exam. The most important things are time management and revision. Keep up to date with the guidelines given by ICAI and the nature of examinations.

- CA Intermediate Passing: After one passes the foundation exam, this candidate is qualified to sit in the CA intermediate exam. There should be a thorough knowledge of the syllabus and theoretical content of equal importance.

- Articleship: After the intermediate CA, an articleship of 2 years has to be compulsorily performed in a firm. Articleship gives professional training and practical hands-on experience on accountancy, auditing, and taxation. Under such training, you acquire the skills of being a professional with real-time financial scenarios and regulatory compliance.

- Clear the CA Final Examination: To clear the CA final exam, one requires detailed study and practice. The candidate can also go through the previous year’s question papers and mock test. The format needs to be practised for it also. Proper schedule to master all your weak areas, practising constantly.

- Membership in ICAI: Join ICAI after getting through the CA Finals exam through the prescribed Membership Application Form with all supporting documents and fees. You will receive membership approval after verification. Upon getting this approval, you would be granted the status of a Chartered Accountant and entitled to hold a license using the designation of a CA.

Eligibility to Become CA Course After 12th

There are two main routes for admission in CA: the Foundation Route ( After the 12th) and the Direct Entry Route (After Graduation). The two paths take care of students with diverse academic backgrounds and qualifications. ICAI has announced the eligibility requirements for the May 2025 CA exams. Here is a more detailed explanation of each route.

CA Foundation Eligibility

It is the best course for students passing Class 12. To appear through this route, one needs to pass Class 12 and complete the four-month study period after admission to the CA course. Only after completing this period, a candidate can sit in the Foundation examination.

As per the ICAI exams May 2025 requirement, Students are first registered with the Board of Studies, from which the whole journey commences. Thus, the process helps the student obtain all necessary study materials and aid in studying for the advanced level effectively. It is through this entry process that the students move on to CA programs to make an appropriate groundwork for the next level.

CA Exam 2025

A student desirous of becoming a Chartered Accountant has to first register himself with the Institute at the CA Foundation level. The registration form is available on the ICAI website and is available throughout the year.

CA exams are conducted thrice a year in January, May and September. For an exam session, the student needs to have registered at least eight months before the 1st day of the examination month.

ICAI has announced the date for the September 2025 exams:

| Course Levels | Dates |

| FOUNDATION | 16th, 18th, 20th & 22nd September 2025 |

| INTERMEDIATE | Group -I: 4th, 7th & 9th September 2025 |

| Group -II: 11th, 13th & 15th September 2025 | |

| FINAL | Group-I: 3rd, 6th & 8th September 2025 |

| Group-II: 10th, 12th & 14th May 2025 |

CA Exam Pattern

The Chartered Accountancy (CA) course follows a pattern of CA exams structured at every level so that the students learn theory as well as practice. This is the structure of exams at every level.

| Exam Level | Details |

| CA Foundation | Four papers, consisting of both objective and subjective questions. |

| CA Intermediate | Eight papers were conducted in a written format. |

| CA Final | Eight papers, combining practical and theoretical components. |

CA Exam Passing Criteria

The passing criteria in exams for the CA (Chartered Accountancy) Foundation, Intermediate, and Final exams are as follows:

| CA Course Levels | Passing Marks |

| CA Foundation 2025 | 50% aggregate |

| 40 per cent in each subject | |

| CA Intermediate 2025 | 50% aggregate |

| 40 per cent in each subject | |

| CA Final 2025 | 50% aggregate |

| 40 per cent in each subject |

CA Career Scope: Job Profiles and Salary

Qualified CA has the vast option for employment. Generally, they are appointed to look after the accounting, taxation, and financial accounts of companies and corporations with different levels of salary but can do a lot more than that. One can work on the following job profiles after the completion of the CA course:

| CA Job Profiles | Description | Average Salary |

| Chartered Accountants | CAs provide financial advice, audit financial statements, and prepare tax returns for individuals and businesses. | ₹10 LPA |

| Financial Controllers | Oversee financial activities, including financial reporting, budgeting, and ensuring compliance with regulations. | ₹15 LPA |

| Tax Accountants | Specialize in preparing and analyzing tax documents, ensuring compliance with tax laws while maximizing tax efficiency. | ₹8 LPA |

| Chief Financial Officers | Manage financial actions, including planning, reporting, forecasting, investments, risk management, and financial strategies to achieve company goals. | ₹6 LPA |

| Auditors | Review financial records for accuracy, ensure compliance with laws, and provide assessments of an organization’s financial health and performance. | ₹7 LPA |

Become CA After 12th FAQs

1. CA Course After 12th Commerce

You can become a CA after 12th commerce by getting registered for the CA Foundation course, passing the required exams, and completing articleship training.

2. CA Course Details after 12th

The CA course consists of three levels: Foundation, Intermediate, and Final, along with practical articleship training.

3. How to become Chartered Accountant after 12th in India?

After clearing CA Foundation, Intermediate, and Final from ICAI, the candidate can become a Chartered Accountant after 12th in India.

4. What are the criteria for admission in the CA course after 12th?

Any candidate who has completed Class 12th from any recognized board is eligible to apply for the CA Foundation course.

5. What are the job prospects of Chartered Accountants?

CAs work as auditors, tax consultant, financial analysts, CFO’s, or starting their own practice among others.