A JV is one of the best opportunities for any commercial purpose, wherein two or more corporations come together. Joint ventures are more like mergers because each partner retains its separate identity; other ways exist to distinguish them. The partners share their profits, risks, and resources. Based on various considerations, they can work together in the same or different countries or operate for short or long periods. Joint ventures have gained immense popularity in many sectors such as technology, infrastructure, and international trade. In this dynamic and fast-changing world of global markets, joint ventures have become instrumental in cutting operational costs, minimizing associated risks, and penetrating new markets. This article discusses the meaning, functions, importance, types, and examples of joint ventures, targeting students, entrepreneurs, and business professionals to provide a rounded understanding of the strategic tool.

What is a Joint Venture?

Before discussing the more practical aspects of joint ventures, a joint venture should have a clear definition. A joint venture is more than just a partnership; it is a formal relationship in which the objectives are clearly defined and mutual benefits accrue to both parties.

In Business, the Meaning of Joint Venture

Strategically, joint ventures represent a temporary partnership where two or more business entities agree to come together for the agreed purpose of a specific project, activity, or market entry. Each party contributes resources in the form of money, technology, labor, or expertise, thereby sharing profits, losses, and sometimes total control of the joint venture.

How Joint Ventures Differ from Other Business Models?

Joint ventures offer merger-like advantages while retaining dual legality. This makes them flexible and less risky alternatives for expanding into new markets or testing ideas, as they require less commitment than mergers or acquisitions.

Characteristics of Joint Ventures

Generally, they share ownership, have a limited duration, and are usually intended for specified purposes. They operate based on a formal contract detailing contributions, control, responsibilities, and revenue-sharing arrangements among the partners.

Short-Term and Long-Term Nature of JVs

Most joint ventures are created for project-based, temporary reasons, with some growing into long-term partnerships. The time frame is dictated by the nature of the project and the ongoing interests of both parties.

Example of a Joint Venture in India

Tata Motors’ acquisition of Jaguar Land Rover is one of the best examples of how India meets British automotive heritage in joint ventures. These ventures helped Tata grow globally while availing itself of the advantages of advanced European technology and brand equity.

Key Functions of a Joint Venture in Business Expansion

Joint ventures contribute strategically to speeding up and helping firms grow, innovate, and penetrate new markets. Each partner has something valuable to contribute.

Resource Sharing and Operational Efficiency

Joint ventures allow partners to pool their financial and non-financial resources, including capital, technology, human talent, and infrastructure. This collective strength reduces costs, increases efficiency, and improves productivity.

Expanding into New Markets

Many companies use joint ventures to enter unfamiliar markets, especially international regions. Local partners bring regulatory insights, customer knowledge, and distribution channels, helping foreign entities avoid costly errors.

Risk Mitigation and Shared Responsibility

Since capital and responsibility are shared, joint ventures spread the risk among partners. This is especially useful for high-stakes or uncertain projects where failure could be costly for a single company.

Access to Innovation and Advanced Technology

Joint ventures create opportunities for state-of-the-art technologies and approaches that would otherwise have been prohibitively expensive. They mutually enhance their products and services and maintain their competitive advantages.

Improved Market Competitiveness

JVs pool their pools of expertise and capabilities for an excellent offering. Consequently, they may compete more ably with former players and begin to acquire a larger share of the market.

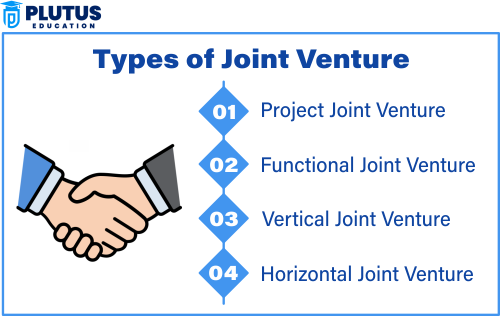

Types of Joint Ventures

Joint ventures can be designed in any way depending on their legal status, purpose, and duration. In that context, the correct form is the first principle that needs to be established, since any project would then be a success.

Equity-Based Joint Venture

In an equity-based JV, all parties invest capital and receive shares based on their ownership percentage. This type of JV is legally incorporated and operates as a new, separate business entity.

Contractual Joint Venture

This type is governed purely by a legal agreement. No new entity is created, but each party’s roles, contributions, and profit-sharing ratios are clearly defined in a contract.

Project-Based Joint Venture

These JVs are temporary and dissolve once the objective is met. Common in sectors like construction, engineering, or research, such ventures are tightly focused and deadline-driven.

International Joint Venture

When companies from different countries form a JV, it is classified as international. These are popular for global market entry, primarily where regulatory hurdles and cultural gaps exist.

Vertical vs. Horizontal Joint Ventures

Vertical JVs are formed between companies in different stages of production (e.g., supplier and manufacturer), while horizontal JVs involve competitors or companies in the same industry joining forces for mutual benefit.

Importance of Joint Ventures for Modern Businesses

Joint ventures are not just about collaboration—they are about strategic growth, innovation, and long-term sustainability. Here’s why they matter.

- Accelerated Business Growth: JVs enable companies to tap into new opportunities quickly without building operations from scratch. Whether launching a new product or entering a foreign market, JVs save time and resources.

- Innovation Through Shared Expertise: Joint ventures become innovation hubs by combining different technologies, perspectives, and approaches. They often lead to new ideas, innovative solutions, and game-changing products.

- Cost Reduction and Financial Viability: JVs lower capital expenditure through shared investment. This makes even large-scale or high-risk ventures more financially feasible, especially in R&D-heavy industries.

- Better Competitive Positioning: JVs allow businesses to scale, adapt, and outperform competitors by combining complementary strengths. It becomes easier to challenge market leaders and establish a strong foothold.

- Global Expansion with Local Knowledge: Local partners help navigate cultural, legal, and regulatory complexities, especially in international joint ventures. This smooths the path for multinational success and global reach.

Joint Venture FAQs

1. What is a joint venture in simple words?

A joint venture is a business partnership in which two or more companies collaborate on a project or business activity by sharing resources, risks, and profits while remaining legally separate entities.

2. How is a joint venture different from a merger?

In a merger, two companies combine into one. In a joint venture, they remain independent but cooperate on a specific project or purpose through a formal agreement.

3. What are the major types of joint ventures?

The main types include equity-based, contractual, project-based, and international joint ventures, each with unique legal and operational structures.

4. Why are joint ventures important in global business?

Joint ventures help businesses expand globally by offering access to local expertise, reducing entry barriers, sharing risks, and increasing cultural adaptability.

5. Can joint ventures fail? Why?

Yes, joint ventures can fail due to mismatched goals, poor communication, lack of trust, unclear roles, or changes in market conditions that affect profitability or cooperation.