It is all Money and Banking – There are very few other pillars an economy relies on, and money and banking on very few form the springboard for any financial sustenance. Money enables trade, savings, and investments. Banks act as intermediaries that would fulfill this function by linking savers to borrowers. Understanding how cash interfaces with banks brings sound decisions for individuals, businesses, and governments, leading to sustainable economic growth.

Definition of Money and Banking

Both money and banking shape economic behavior in a certain way and also manage financial activities. Both share distinct but interconnected and related roles in a financial ecosystem.

Definition of Money

This means any good the people have in common, or which they have accepted over a wide area, to be a medium for exchange in a given economy. Money serves four important purposes: a medium of exchange, a unit of account, a store of value, and a standard of deferred payment. This way, trade has been standardized, pricing is simplified, and wealth can be stored and transferred efficiently. Without it, the complexity of barter systems would make large-scale economic activity difficult.

Definition of Banking

This is where you take deposits from the general public and give loans and other financial services to the public, or offer deposits and then grant other loans and other financial services besides giving deposits to customers. Banks are not just deposit collectors; they actively create credit, provide liquidity, and, most importantly, manage risk. Through lending and investing, banks contribute to economic development, support entrepreneurship, and maintain the flow of capital in financial markets.

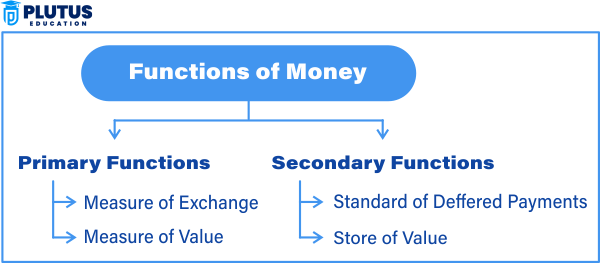

Key Functions of Money

Money serves as a medium of exchange, removing inefficiencies that would be allowed through barter. Money as a unit of account is a standard measure for valuing goods and services. Money acts as a store of value, enabling individuals to save purchasing power over time. Finally, as a standard of deferred payment, money aids an economy in borrowing and lending, whereby money supplies the way for economic expansion and long-term planning.

Function of Banking in the Economy

An account maintains savings with a bank, and a bank has the potential to transform savings into investments. Therefore, other types of businesses are also invested in. Such forms of banks are then applied to investment in technology and infrastructure. Banks also provoke demand and develop production and job creation by offering credit. Banks are also committed to keeping the broader financial system functioning by facilitating transactions, protecting deposits, and providing financial advice and services.

Types of Money and Banking Systems

Over time, money and banking systems changed to suit different forms of society and technology. Today, we recognise many forms of money and several banking institutions.

Types of Money

Money has taken many forms throughout history, from tangible goods to electronic tokens.

Commodity Money

Commodity money is, by definition, something that which has had an intrinsic value: gold or silver, cattle, etc., as forms used. These commodities were worth not only as currency but also for their usefulness. Although it is outdated, commodity money formed patterns around which modern monetary systems were built.

Fiat Money

Fiat money is the largest share of its kind in circulation today. It has been said to possess no intrinsic value and is not backed by any commodity reserves, deriving its value from government order. Examples include the U.S. dollar, Indian rupee, euro, etc. Its acceptance depends on faith in the authority of the issuer.

Digital Money

Digital money exists electronically and comprises money sent via online banking, digital wallets, etc. It facilitates speedy, contactless, and efficient transactions and has become global commerce’s mainstay. Paytm, PayPal, and Bitcoin are some examples.

Types of Banking

Various types of banking institutions depend on their primary function and clientele.

Commercial Banking

These banks handle everyday financial services like savings, checking, loans, and credit facilities for individuals and businesses. They generate profit through interest and service fees. Significant examples include ICICI Bank, JPMorgan Chase, and SBI.

Investment Banking

Investment banks specialize in large-scale financial transactions such as mergers, acquisitions, underwriting securities, and wealth management. Their services are targeted at corporations, governments, and wealthy individuals. Goldman Sachs and Morgan Stanley are prominent names.

Central Banking

Central banks are responsible for a country’s monetary policy, the issue of a currency, and the conduct of commercial banking. They also became the lenders of last resort. The Federal Reserve and the Reserve Bank of India are the two foremost examples.

Functions and Role of the Central Bank

The anchoring of a country’s financial system rests on the central bank’s monetary policy. It secures the economic state and supervises the total banking infrastructure.

Control of Monetary Policy in Money Supply

The central authority controls the money supply through interest rate adjustments, open-market transactions, and reserve requirement regulations. These are the few measures to restrain inflationary pressures and promote viable interest and economic growth. These actions ultimately lead to setting interest rate levels and consumer borrowing preferences.

Inflation and Price Stability

Contrary to monetary instability, central banks cannot sustain a runaway inflation-fallacy argument. It preserves the consumer’s purchasing power and investor confidence. This is a precondition for an economy’s sustained health.

Banker to the Government

The central bank maintains accounts on behalf of the government, finances public borrowing, and assists in national debt management. It is designed as a fiscal agent that guarantees that the government’s financial conduct runs with the least friction and the most reliability.

Lender of Last Resort to Banks

During financial emergencies, the central bank will reactively lend money to commercial banks so that systemic failure does not occur. This function will also maintain trust in the banking system and protect depositors from bank failures.

Regulatory Oversight and Supervision

The banking regulations are issued by the central bank to ensure that financial institutions’ operations are ultimately safe and transparent to the public. These regulations will cover audit compliance checks and specific enforcement actions to ensure the integrity of the economic system.

Specifics of the Money and Banking System

Some parameters determine the reliability and efficiency of money and banking in the economy. These determine the seriousness of things like financial instruments‘ stability, security, and usability.

Durability and Portability of Money

Money’s durability must be physical to keep it from breaking down, and it should be easy to carry or transfer money without breaking down. Paper currency, coins, and digitalised forms must withstand most of these normal usage and movement conditions.

Divisible and Homogeneous

Money should be broken down into smaller units for various transactions, while each unit needs to be an exact match in appearance and value to make the public trust its use.

Liquidity and Accessibility in Banking

Nowadays, banking has been liberalised; thus, deposits made in the bank are continuously at clients’ disposal to their needs and are available in a timely and sure manner. Availability is facilitated through ATMs, digital platforms, and real-time transfers to ensure this accessibility while at the same time boosting consumer confidence and healthy economic activity.

Safety and Risk Management

Banking institutions enforce stringent rules and technologies that protect citizens’ capital and data. Regulative frameworks, indications like deposit insurance, and, to some extent, cyber safety are used against fraud and crimes against finances.

Creation of Credit and Allocation of Capital

Banks create credit by lending part of their deposits. This increases the money supply and promotes investment and economic growth. The proper allocation of credit ensures that resources are directed toward productive uses.

Money and Banking FAQs

What is the role of money in the economy?

Money simplifies trade, measures value, and enables savings and investment. It is essential for pricing, debt settlement, and economic planning.

What are the differences between commercial and investment banking?

Commercial banks serve the public with deposit and loan services, while investment banks focus on large financial deals like mergers and IPOs.

What is a central bank, and what does it do?

A central bank controls a country’s monetary policy, issues currency, supervises banks and maintains financial stability in the economy.

What is fiat money?

Fiat money has no intrinsic value and is backed solely by government regulation. It includes currencies like the dollar, rupee, and euro.

How do banks support capital markets?

Banks help raise capital by underwriting securities and providing advisory services. They enable liquidity and investment flow into the economy.