Professional ethics are the standards and moral principles that govern the conduct and decision-making of members of a profession. In ACCA (Association of Chartered Certified Accountants), professional ethics guarantee that accountants. Financial professionals meet the highest level of conduct. Ethical conduct ensures trust, integrity, and transparency in the financial sector. This piece examines the definition of professional ethics in ACCA. Its driving principles, and why ethics is crucial in the profession.

What is Professional Ethics?

Professional ethics in ACCA are the standards and principles for ACCA associates to follow professionally. These ethics are implemented to create a culture of professionalism, accountability and integrity among the members. ACCA Code of Ethics and Conduct is a guiding document that delineates the expected behaviour of members. It provides a framework for ethical decision-making. It preserves the integrity of the accounting profession.

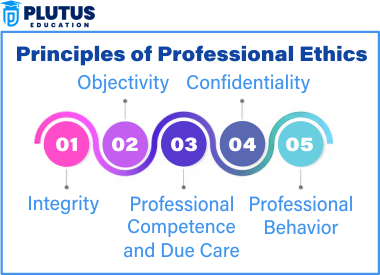

Principles of Professional Ethics

The ACCA Foundations of Professional Ethics are the ethos of the profession’s ethics. These principles guide members’ behaviours in several situations to help with ethical decision-making and subsequent action.

Integrity

Integrity is the quality of being honest and having strong moral principles. For an ACCA member, this principle means being honest at all times, and the financial information reported must tell the whole truth, even when it is bad news. Integrity creates trust among clients, colleagues and the public for the very reason of maintaining professional credibility and upholding the accounting profession’s standards. Integrity promotes fairness and transparency in financial reporting.

Objectivity

Objectivity is judged with decisions and a clear head based on facts and logic without personal bias or outside influence. An ACCA member must remain free from any conflict of interest that would compromise their professional judgment. For instance, their personal beliefs and interests should not affect business-related decisions. This principle is also clearly applied to be fair by avoiding bias and preserving objectivity in decision-making to act in the best interests of clients and the general public. It upholds the integrity of the accounting profession.

Professional Competence and Due Care

Professional competence is continuous training and development needed to achieve professional standards in work. To apply the principles correctly, an ACCA member must keep in sync with the latest accounting standards, legislations and regulations. Further, due care requires that all tasks be handled with due diligence and consideration to produce correct , high-quality work. This principle ensures ACCA members deliver the highest standard of service in both legal and ethical obligations.

Confidentiality

To be confidential means to respect private and sensitive information and not to disclose it unless authorized to do so. When a client provides financial data, an ACCA member must save this information and not leak it to third parties. This principle helps to build trust between the clients and the accounting professionals. By protecting sensitive data, ACCA members demonstrate respect for their clients’ privacy and regulatory compliance for data protection.

Professional Behavior

Professional behavior is following laws, regulations, and ethical standards. ACCA members must ensure that their behaviour will always reflect positively on the profession. That includes refraining from actions that could damage the profession’s reputation or credibility. They must conduct themselves to build trust with clients, colleagues and the public and to promote the accountancy profession’s integrity and responsibility.

The Importance of Ethics in the ACCA Profession

Ethics is one of the most crucial components of the ACCA profession. In addition to protecting client and stakeholder interests, ethical standards maintain the reputation and integrity of the broader accounting profession.

- Maintaining Trust and Credibility: Maintaining Credibility Training and commitment to ethical behaviour make financial information accurate, transparent and dependable, creating confidence among customers and stakeholders. Integrity in dealings lays the groundwork for lasting professional relationships with clients and partners, which is why accountants uphold it in everything they do. It builds trust that clients need to become sure of the household services, thus ensuring a strong standing in the market.

- Legal Conformity: Ethics help its members comply with the relevant laws to avoid legal issues. Also, the profession receives goodwill in society. By following regulations and standards, accountants can stay out of trouble and remain credible. Obeying the laws creates protection for both clients. The profession’s credibility, providing that confidence, is preserved in every deal.

- Safeguarding the Public Interest: ACCA members help safeguard the public interest by ensuring that financial decisions are taken ethically and according to the law. This safeguard prevents financial resource abuse and guarantees that decisions are in the best interest of the whole. Accounting ethics thus act as a form of protection for society by ensuring continued economic stability and economic markets.

- Long-Term Client Relationships: Ethical practice promotes long-term relationships with clients, colleagues and stakeholders , enhancing career success and business opportunities. It forms the basis upon which all professional relationships are built on as trust and respect. Acting with integrity earns professionals a reputation of integrity that can lead to opportunities for growth and career advancement.

- Ensuring Career Advancement: Ethical behaviour lays the foundation for a positive reputation, leading to career advancement opportunities for professionals. An ethical pathway to career development distinguishes you from your colleagues, providing a firm basis for career progression and advancement. You will never run out of leadership opportunities at all levels, and careers will soar as you nurture strong ethics.

Challenges and Ethical Dilemmas

It is very important to stick to ethical standards, especially at work; however, ethical dilemmas sometimes arise. Members might experience instances where personal interests, client demands, or outside pressures will conflict with professional ethics.

- Pressure to Compromise Ethical Standards: In some instances, it may be necessary for accountants to bend or manipulate the ethical values of their managers or clients by manipulating financial statements or ignoring particular legal needs. However, such pressures are not uncommon, and ACCA members need to have the power to stand their ground and deny them the opportunity to yield to such influence if they are to maintain integrity.

- Conflicts of Interest: Any interests that contrast or relate to professional responsibilities. An example might be an ACCA member who is asked to provide financial advice to a family member or close friend, which could create a potential conflict.

- Legal Requirements vs. Confidentiality: There are instances when accountants might be legally bound to submit confidential information, which can become an ethical dilemma. ACCA members should ensure that their duty of confidentiality to clients and third parties is carefully balanced against their legal obligations.

- Dealing with Whistleblowing Issues: When an ACCA member notices unethical behaviour, he might be torn between reporting these issues, particularly if the victim is his colleague or a senior company member.

Professional Ethcis FAQs

What is ACCA professional ethics?

ACCA professional ethics means the professional ethical standards and rules that the members of ACCA must adhere to, such as integrity, objectivity, competence, and confidentiality.

What are the professional ethics principles of ACCA?

The professional ethics principles are integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

Why is ACCA professional ethics significant?

Professional ethics are important for upholding trust, guaranteeing compliance with the law, safeguarding the public interest, and promoting professional development in the ACCA profession.

What are the challenges for ACCA members in terms of ethics?

Challenges involve pressure to breach ethics, conflict of interest, balancing confidentiality and the law, and dealing with whistleblowing issues.

How does the ACCA Code of Ethics assist professionals?

The ACCA Code of Ethics gives clear guidance on ethical decision-making, assisting professionals in dealing with difficult situations and maintaining high standards of behaviour.