Business finance refers to the science of money management in terms of profits, innovation, and sustained value. An excellent financial management plan allocates limited resources among the many departments and projects of the organisation. Business finance also refers to sources of capital and budgeting, risk monitoring, and investment decision making. Every financial decision must match corporate objectives while managing the associated risks. The wrong accounting systems could ruin even a high-revenue company through inefficient operations and a slow recovery.

Meaning of Business Finance

Business finance refers to the management of inflows and outflows in an organisation. It encompasses budgeting, accounting, investment planning, and strategic forecasting. Effective business finance management allows a company to meet its obligations while planning for further outgoings. The finance teams aid in setting revenue targets and discovering where to save costs. The core aim of any such effort is to add value to the company with as little risk as possible.

Role of Finance in Business Operations

Finance is key to meeting the daily needs of a business. It pays suppliers, salaries, and the purchase of inputs for production. Cash flow should be carefully regulated so as not to disturb operations. Strong financial management keeps the company liquid and the operations running smoothly. An adequately capitalised operation remains agile and competitive in the marketplace.

Financial Planning and Forecasting

Financing describes calculating future anticipated revenues, costs, or capital needs to put a business back on its path. Forecasting uses data and trends to capture the organisation’s future financial performance. The company thus prepares itself for any market variations, economic environment changes, or unforeseen costs. Accurate forecasting induces strategic decisions regarding recruitment, marketing campaigns, or launching new products. It also assists in setting clear, firm, and measurable financial targets.

Capital Structure and Its Role in Decision-making

An appropriate balance between equity and debt to finance the operations or expansion of the company is defined as the capital structure. An optimum blend of the two minimises the cost of capital while giving maximum flexibility and control to those in charge. Whatever way this is viewed, interest rates, repayment schedules, or dilution of ownership would also be considerations for any decision concerning capital structure. This kind of structure should serve the needs of growth without compromising stability. On the other hand, the finance teams would have focused on such parameters as ROI and WACC to feed into the decision process.

Risk-Proactive Management for Business by Financiers

Every business faces the risk of inflation, interest rate increments, or default in credit. Finance helps identify and manage such risks through insurance schemes, hedging, and diversification. An emergency reserve and buffer in credit will contribute to resilience. Companies tend to study their financial exposure to avert unexpected losses. Any proactive approach in risk management protects the reputation and revenue generation.

Internal Sources of Finance

Internal financing refers to money generated from inside the company and not obtained from lending or investors. Because this method involves few legal hurdles and respects complete control over business decisions, it is often the priority. Companies use internal funds for short-term needs or as feed for reinvestment in equipment upgrades or marketing campaigns. Such funds are cheap, readily available, and pose less financial risk; however, they also have limitations in scale and scope.

Retained Earnings

Retained earnings refer to the profits kept within the company instead of being shared with shareholders through dividends. This is the money reinvested in the business to finance expansions, product development, or technology upgrades. This is a debt-free source; it incurs no repayments and does not dilute ownership. Retained earnings show fiscal discipline for the company’s long-term aims. However, reliance on it may slow down dividend returns, deterring some shareholders.

Working Capital

Working capital is the difference between a company’s assets and liabilities. Whenever there is excess working capital arising from sanctioned operational activities without recourse to external cash, it can be so deployed. Working capital ensures cash flow during the payment of short-term obligations, such as payments to suppliers or salaries, and assists weaker-performing businesses during their offseason. The other side of working capital management is that it can become an enemy to cash flow and disrupt the company’s operations if it is not done correctly.

Sale of Fixed Assets

Corporations frequently sell underutilized or obsolete assets, such as machinery, land, or vehicles, to generate funds quickly. Rarely does this short-term source of finance compromise corporate standing on credit. Nevertheless, it must be urgently invoked to settle business expenditures or fill funding gaps. With that said, persistent liquidation of assets may amount to an indication of poor planning or financial distress. The enterprise must evaluate the advantage of prompt cash inflow against the cost of an equivalent long-term utility

Owner’s Contribution or Personal Savings

Owner capital is the primary funding source for many startups and small businesses. Using your savings shows even more commitment, as it avoids all the complicated processes involved should one resort to borrowing or seeking funds through equity. It is also interest-free and allows the owner to control all financial decisions. However, this puts personal wealth at risk if the business does not start giving returns fast. Therefore, the owners must examine their economic safety net before making significant personal investments.

Cost Reduction and Internal Optimisation

Internal channels can be freed with a well-structured operational streamlining. Cutting unnecessary overhead, renegotiating supplier contracts, or automating repetitive tasks within the company are modifications aimed at reducing costs, leading to funds that may be reinvested into growth activities. Unlike loans or investments, internal optimization doesn’t call for external approvals or interest payments. Care must be taken, however, so that the quality is not undermined or the workforce is overstrained. Lasting efficiency benefits are suitable for both the financial health and operational resilience.

Pros and Cons of Internal Sources of Finance

Internal finance is quick, flexible, and cost-effective. However, it also has the disadvantages of limited availability and bookkeeping inefficiencies with day-to-day operations. Understanding the pros and cons will help businesses utilize internal resources properly without jeopardizing their growth.

No Interest or Repayment Obligations

Internal funding is not obtained from lenders or investors; therefore, there is no interest payment or strict repayment timelines. This makes internal funding very cost-effective and frees up cash for reinvestment. The absence of financial pressure improves decision-making quality. Businesses can focus on long-term returns instead of short-term loan obligations. It also preserves profitability and cash flow.

Maintains Complete Control and Ownership

Internal funding will not require relinquishing any equity or sacrificing control by the owners to outside stakeholders. Owners can thus dictate all business decisions, branding, and strategy. This is especially important when speed is critical at the beginning of a business; it also means that ideas can be implemented faster without interference from boards or investors, as there would be with a larger organization.

Fast and Flexible

Internal financing does not require approval formalities, documentation, or third-party approval to access the funds. This provides convenient availability without delays. These points make it ideal for emergencies and opportunities on the market that need a quick response. Through this, internal funding supports the smooth running of an entity and faster scaling for small initiatives. The organization changes according to the situation without waiting for banks to approve any requirements or waiting for meetings with investors.

Limited Funding Capacity

Even with internal finance, the funds might not be huge enough to cover larger investments in buying properties, new branches, and the acquisition of competitor companies. Not expanding with nearly the sole internal finance often ties the growth of businesses. It affects innovation and most capitals that require money for technological upgrades. In case of rapid expansion envisaged for the company, funds outside the internal domain will surely be needed. Internal supplements must be used alongside them for long-term projects.

Risking Operational Efficiency

Too much working capital or retained earnings would leave the company underfunded for operational, daily needs. In payroll issues or delays in supply chain costs, morale and trust with vendors are negatively affected. Financial pressure forces borrowing at emergency rates, which often stands unfavorably. Careful financial planning must be exercised to avoid these hazards. A business will have to balance liquidity and investment at all times.

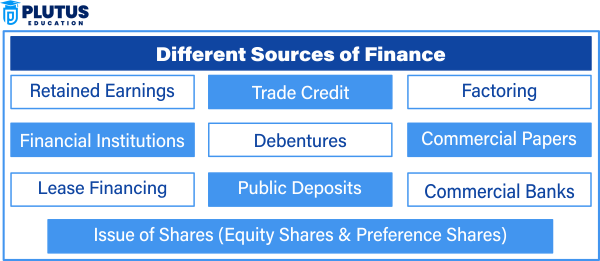

External Sources of Finance

When internal funds are not enough to expand a business, upgrade the equipment, or guarantee long-term growth, external sources of finance are most often sought after. These come in many forms, from getting capital access or loans through the bank to being considered by investors, leasing companies, and government entities. However, accessing larger sums of money from such sources comes with caveats, such as making interest payments, diluting ownership, or fulfilling legal obligations. Knowing these various external options will help you determine the fit for your business’s financial and operational needs.

Equity Financing: Raising Funds through Shares

Equity financing is how a business accumulates capital by selling ownership shares to investors. It is the most common alternative for startups and companies with high growth rates, needing lots of funds at different stages of their business cycles without being debt-reliant. Shareholders become co-owners with profit-sharing functions and paired decision-making rights. However, founders can lose some of their control over their companies. This form of financing is most appropriate for scalable ideas in businesses generating significant returns.

Bank Loans and Credit Lines

Borrowing from banks is one of the oldest outside financing forms. An application can be made for loans or lines of credit for short-term or long-term capital needs. The terms include interest rates and repayment conditions, which may require collateral. Loans must be repaid on terms; notwithstanding the financial obligation, loans are structured, predictable, and often become tax-deductible. This type of financing is suitable for a business with strong credit scores and a solid repayment plan.

Venture Capital and Angel Investors

Venture capitalists and angel investors are individuals or firms investing in startups in exchange for equity. They also offer mentorship assistance, networking, and industry development help. They generally invest in high-risk, high-reward ideas that guarantee significant returns. One goes through gruelling pitches and checks before getting on board. And while there may be substantial sums of money from them, they are not the kind of beings conventionally inclined to see owners retain partial ownership and board-level involvement.

Government Grants and Subsidies

The government provides grants, subsidies, and loans at low interest rates to encourage entrepreneurship. These funds are most favoured in areas such as agriculture and renewable energy, or where innovation is essential. While grants are non-refundable, they also face heavy competition and strict requirements. However, the loans provided by government institutions come in handy at some of the easiest and most favourable terms, albeit taking longer to process. Despite these challenges, government-backed finance remains a safe, low-risk option for deserving businesses.

Advantages and Disadvantages of External Sources of Finance

More funding options mean growth opportunities and shared risk. However, that shared risk comes at a price: the price of losing some control or, in other words, growing complexity. Thus, to see more clearly, this section will describe the advantages of an organisation and its drawbacks.

Advantage: Access to Larger Capital Pools

External financing usually opens up much larger funding than is generally available within the company. This augurs well for undertaking lofty assignments, such as entering new markets, buying up rivals, or extending infrastructure, and having the necessary firepower will allow an organisation to invest in long-term research and development and marketing initiatives. Such investment opportunities are seldom available purely from the internal source. This is one of the main reasons why most large corporations use external finance.

Advantage: Risk Sharing

Risk-sharing extends to all equity shareholders; when such an undertaking collapses or performs poorly, there will be no requirement for debt repayment. This makes equity an attractive proposition, especially for businesses undergoing high-risk ventures. Similarly, loan recipients share the risk financially over time, through the repayment of instalments, instead of paying the entire sum or principal all at once. Distributing financial pressures might allow a business to remain viable through hardships brought about by uncertain economic environments.

Advantage: Tax Incentives to Debt Financing

For business finances, the deduction of interest payable on loans reduces the tax liability on the gross amount. Effectively, the resultant cost of borrowing becomes less than what it appears. The proceeds of tax savings could be redirected toward other business expenditure activities to improve its cash flow. Debt financing of firms becoming established with predictable sources of income would have been manageable under the say-to-do-less-and-fire-more policy of taxation planning.

Disadvantage: Dilution of Ownership and Loss of Control

Equity financing is the most diluted form of ownership; therefore, in case of conflict in decision-making, the new investors will have an additional power source through the conflicted decision. This is primarily problematic when the investors measure their return on investment against the founder’s vision. Most importantly, the investors may require voting rights or board representation. It becomes harder to have control, especially when going through more than one funding round. Founders should prepare to work with stakeholders for a long time.

Disadvantage: Legal Complexity and Compliance

A gateway to external funding mainly opens with a series of legal contracts and a requirement of financial audits regarding plausibility with regulatory compliance. Required legal compliance may take the most diligent best practices away from the core processes of the business. Nonfulfillment of any aspect has a predetermined penalty and withdrawal of funding. The burden imposed by such inconvenience forces entities to use legal expertise; it gets further exaggerated because of startups’ restrained and limited administrative resources.

Selecting Ideal Finances for Your Business

With innumerable avenues for funding, one may understand the right source of finance as per business demand, urgency, cost, and the future impact. An organized funding template balancing risk and control will ensure enough capital at hand for growth. The section is concerned with the main factors considered in finance source selection.

Define the Purpose and Time Horizon of Funds

Are you financing a one-time purpose or a multi-year business expansion? Short-term needs typically supplement internal funds or short-term loans. On the other hand, generally speaking, longer-term projects could justify equity investment instead of long-term debt. That way, the applicability of the source is the same for the period, which will save the organisation a lot of financial time and efficiency without considering risk.

Understand Capital Cost

One has to consider the actual cost of finance and not only the interest cost but also ownership dilution, legal fees, and opportunity costs. Debt may be seen as cheaper because it is tax-deductible, but the fixed obligation to repay is with it, whereas with equity, which is less expensive, the future income is sacrificed. Therefore, a comprehensive analysis of all these costs can provide important insight for identifying the least-cost options.

Risk Tolerance and Business Stability

Paying debts is more feasible for stable revenue-generating companies than for erratic, risky start-up firms. The high-risk business is good for equity or grant funding. Understanding the company’s finances and the outlook for the market ties risk to an appropriate funding strategy.

Availability and Processing Time

External financing usually involves a lot of paperwork on credit assessments or negotiations with potential investors. Therefore, internal funds are considered for immediate availability. Emergencies can be solved quickly with options like overdraft or working capital loans. When it comes to decision-making, time is gold.

Sources of Finance in Business FAQs

Q1. What are the main sources of finance for a business?

The primary sources include internal finance (retained earnings, working capital, and asset sales) and external finance (bank loans, equity, leasing, and government grants).

Q2. How do internal and external finance differ?

Internal finance comes from within the business, requiring no repayment or ownership changes. External finance is sourced from outsiders and may involve interest or equity dilution.

Q3. Why is equity financing popular with startups?

Equity financing provides large amounts of funds without immediate repayment, which is ideal for growth-oriented startups that build products and markets.

Q4. What are the risks of using too much debt?

Large debt increases the financial obligations and interest costs of the entity. When not managed well, it may stress cash flow and further affect the company’s credit rating.

Q5. How do I decide the best source of finance for my company?

Consider your business needs, cost of capital, risk profile, and control requirements. Use a mix of internal and external sources to maintain flexibility and financial health.