The intermediaries offer the flow of goods, services, and finance products between parties and allow them convenience in between the parties to each other. Agents, brokers, wholesalers, retailers, and financial institutions are among them, and every intermediate plays a diversified role in efficiently carrying out business operations. Thus, due to their impact on markets’ efficiency and organisational effectiveness, they play an essential role in the trade, finance, e-commerce, and insurance industries.

Types of Intermediaries

The intermediaries are persons or groups that serve as intermediaries between two parties in a particular transaction. They help buy, sell, distribute, and manage goods, services, and financial products. There are three primary categories under which intermediaries fall broadly.

- Merchants: These are the intermediaries who purchase and sell merchandise for profit.

- Agents and Brokers: These intermediaries act as linkers between buyers and sellers and sometimes earn a fraction of the commission.

- Wholesalers and Retailers: These finally make products reach the consumer’s pocket

- Financial Intermediaries: They connect a borrower with a lender, through which money can flow between them

- Insurance Intermediaries: The organisation connects an applicant with an insurance company.

- E-commerce Intermediaries: It is beneficial for online firms selling a product

One from each class shows a function different from the previous ones, thus bringing ease in performance and an expeditious process in the transaction flow, with benefits arising as a gain for the entities engaged.

Financial Intermediaries

Financial intermediaries act as the glue between the savers and those requiring funds. They save, invest, borrow, and lend. There are three primary financial intermediaries which comprise:

Banks

They act as financial intermediaries. A bank accepts a deposit from one of its clients and advances some cash to those who use it. Money and other lending are separated, and the money banks keep or offer is available for credit cards and savings accounts.

Role of Banks:

- Receive deposits and issue interest

- Credit facilities to consumers and business institutions

- Assists in the transfer or exchange of a transaction and/or money.

Banks are risk-free outlets backed by the government in case money problems arise.

Credit Unions

Credit unions are banks owned by the people. They provide nearly the same facilities as savings accounts, loans, and credit facilities. Credit unions tend to offer more competitive interest rates since they care more about their members than their profit.

Investment Firms

Investment firms allow the public and institutions to invest their money in equities, bonds, and mutual funds. They advise on how to invest and maximise returns on investment.

Insurance Companies

Insurance companies collect premiums from individuals and organisations against risk or other loss. In collecting funds from several people, they become intermediaries when putting it to claim payments upon arising.

Pension Funds

Pension funds collect and invest money for yields upon a customer’s retirement. The amount aggregated can be so huge that these institutions will make massive investments in other financial instruments whose return values will eventually pay them when clients retire.

Financial intermediaries also play a significant role for individual and corporate organisations, providing an easy way to manage their finances and reducing the risk involved in their money management and future investment.

Types of Non-Banking Financial Intermediaries

Non-banking financial institutions provide various financial services, though they are not licensed as banks. They cannot accept conventional deposits since the banks are licensed but do much more to handle money and investments. Here is the list of some types of non-banking financial institutions:

Microfinance Institutions

Microfinance institutions provide small loans to people who cannot afford traditional banking facilities. They help in the growth of small businesses and economically weaker sections.

Finance Companies

Finance companies advance money to individuals and organisations with which to buy cars, houses or equipment. They earn interest on the loan and tend to prefer riskier borrowers.

Leasing Companies

Leasing firms lease equipment, cars, or property to organisations and individuals for years. The lessee does not own the asset; he pays a rental to utilise it.

Investment Banks

Investment banks advise massive companies on raising capital through equities or debt instruments. It also advises the firm on mergers and acquisitions and other financial transactions.

Hedge Funds and Private Equity Firms

The companies raise money from investors and invest it in various financial instruments. They are specialised high-risk, high-gain investment houses that handle large sums of money.

Non-banking financial intermediaries are essential because they provide credit services to those who do not qualify for credit from banks.

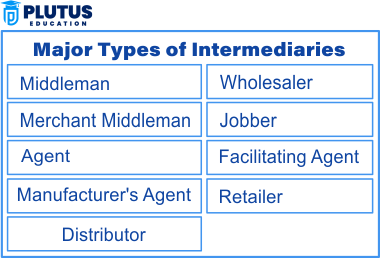

Types of Marketing Intermediaries

Form a bridge between producers and consumers. They allow the flow of products and services by making it easy for the business to reach the target market. There are various forms of marketing intermediaries, including wholesalers, retailers, agents, and distributors. All these play specific roles within the supply chain to ensure that supply is easily accessible at the right place, quantity, and time.

Wholesalers

Wholesalers are middlemen who buy large quantities from manufacturers and sell smaller quantities to retailers or other businesses. They usually do not sell to the end-users. Wholesalers assist the manufacturers by buying in bulk, reducing their need to store huge inventories and dealing directly with many small buyers.

Role of Wholesalers

- Buy goods in bulk from the manufacturers.

- Sell the products in small quantities to the retailers.

- Assist in the relief of inventory management to the manufacturers

- Provide storage and warehousing

Wholesalers are required to make the supply chain efficient, where the product is moved in bulk and made available for purchase to the retailer, ensuring the constant flow of goods to the market.

Retailers

They are the middlemen who sell the commodity directly to the final consumers. They get the inventory from wholesalers or manufacturers and sell it to consumers in smaller quantities. Retailers could be physical stores, electronic stores, or, at times, both. They build the demand and take products to the masses.

Functions of Retailers

- Buy the products from wholesalers or manufacturers

- Demote and sell to the final consumers.

- Customer services, product advice and return policies

- Offers: Ads and promotional offers, discounts

Retailers are essential in establishing brand awareness, but their importance lies in quickly offering these products to consumers in easily accessible locations or through an online portal. Their relations with the customer build demand for the products they sell.

Agents and Brokers

Agents and brokers act as middlemen. They facilitate sellers to buyers and take commissions or charges from them for services rendered. Unlike wholesalers and retailers, agents and brokers do not take title in the goods they trade. The agent or the broker acts like a matchmaker; suppliers and consumers, for one time at least, will profit in their interchange with each other.

Role of Agents and Brokers

- Agents and brokers act as matchmakers for buyers and sellers.

- Agents and brokers negotiate and close deals.

- Earn commissions on the sale value or service offered—Specialised in specific industries like real estate, insurance, or goods.

Agents and brokers are required for businesses that require sophisticated negotiations or expertise, such as real estate, insurance, or high-value products, where they help customers identify the correct product or service.

Distributors

Distributors are midstream wholesalers. Usually, the manufacturers give these distributors exclusive rights. These distributors form the channel to supply the products to retailers or sometimes to the consumers. They generally assume a higher level of supply chain responsibility compared to wholesalers. In addition to their role, the distributors could warehouse, haul goods, and market the product.

Roles of Distributors

- Purchasing from the manufacturer.

- Distribution of goods to retailers or businesses in a predetermined territory.

- After-sales servicing as well as technical assistance.

- Coordinate marketing and promotional programs for the brands they are undertaking.

Distributors help smoothen out supply chains through streamlining as they provide local-level markets to the producers. Distributors also support other related activities like promotional aid and stock maintenance. For that reason, they are necessary to ensure the successful delivery of the product into the market.

Direct Sellers

Direct selling describes third-party intermediaries responsible for selling products directly to consumers without any other intermediary. Such marketing intermediaries fundamentally opt for direct selling methods like door-to-door sales, home parties, and even electronic marketing in e-commerce. Examples of direct sales companies are Avon, Tupperware, and Herbalife.

Role of Direct Sellers

- To promote and sell products directly to end consumers

- Use personal selling techniques, including demonstrations and meetings.

- Build strong relationships and customised contact with customers.

- Usually, he makes contact with customers through independent intermediaries or agents.

The meeting of the fulfilment of direct selling in giving consumer access occurs directly through involvement with trust building, including loyalty and personalised relations between a direct seller and a customer.

Virtual or Internet Intermediaries

Over time, the increased internet use has been associated with expanded roles of online intermediaries in marketing. Online-based e-commerce, digital marketplaces, and affiliate marketers are digital platform operators’ activities that enable buyers and sellers to find one another and ensure the transfer of ownership through which products or services are delivered.

An international marketplace where businesses can market their product or services.

Payment instruments, customer reviews, and shipping logistics.

- Help customers find a business and promote a business through advertising.

- Help businesses reach more customers without having to build physical stores.

- Virtual intermediaries change the face of business-to-consumer relations through the power of the Internet. They offer convenience, wider product choice, and sometimes lower prices to reduce physical store requirements.

Types of Intermediaries FAQs

1. What are intermediaries?

Intermediaries include merchants, agents, brokers, wholesalers, retailers, financial intermediaries, insurance intermediaries, and e-commerce platforms. It connects the buyers to the sellers, manages transactions, and offers support services.

2. State the Types of financial intermediaries

The types of financial intermediaries include banks, credit unions, insurance companies, investment firms, and pension funds. They manage money flows in the direction of savers and borrowers.

3. Who does the stock market employ as an intermediary?

Types of Intermediaries The Stock market contains the following intermediaries that facilitate investors in buying, selling, and holding stocks: the stockbroker, dealer, market maker, clearinghouse, and custodian.

4. What are non-banking financial intermediaries?

Non-banking financial intermediaries are microfinance institutions, finance companies, leasing firms, investment banks, and hedge funds. They offer financial services but do not have a license from the bank.

5. What are intermediary roles in e-commerce?

Online marketplaces, payment gateways, logistics providers, and affiliate marketers are examples of intermediaries in e-commerce.