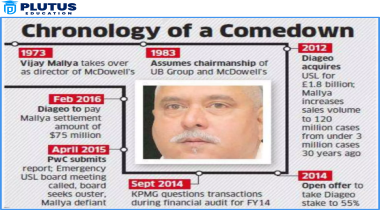

The Vijay Mallya scam is one of the most infamous financial scandals in India, involving a high-profile industrialist and an extensive web of debt, fraud, and legal battles. This case shook the financial and corporate sectors, exposing loopholes in regulatory oversight and raising serious concerns about governance and accountability in the business world. Vijay Mallya, once hailed as the “King of Good Times,” faced allegations of defaulting on loans worth over ₹9,000 crore borrowed by his now-defunct Kingfisher Airlines. His escape to the UK and prolonged legal battles further added layers of intrigue and controversy to the scandal.

The Origin of Kingfisher Airlines Loan Scandal

Kingfisher Airlines was incorporated in 2005 with Vijay Mallya as chairman. The company rapidly expanded during the period. It has now emerged that the expansion was through reckless borrowings. The IOB officers, between 2007 and 2012, when the UPA government was headed by Congress. They allegedly disbursed several loans to Kingfisher Airlines based on conditions heavily criticized for lack of due diligence and other impropriety.

Parties Involved

The primary figures in this case include:

- Vijay Mallya: The flamboyant businessman and then-owner of Kingfisher Airlines, who is currently in the UK, fighting extradition to India.

- Satya Mishra: The then General Manager at IOB’s Centralized Credit Processing Centre.

- Suhas Bhat: Former Managing Director of IOB.

- Anil Bansal: Executive Director of IOB when the loans were sanctioned.

- Narendra Mairpady: The competent authority at IOB is involved in the loan sanctioning process.

These individuals are accused of bending and breaking banking norms to facilitate substantial loans to Mallya’s airline, which ultimately defaulted, leading to significant financial losses.

Analysis of Mallya Loan Transactions

Kingfisher Airlines received a slew of loans approximately amounting to Rs 255 crores between 2007 and 2010. The transactions amount to a questionable way of decision- and risk analysis by the respective bank officials

Loan Timeline

- 2007-2010: Kingfisher got five individual loans worth Rs 255 crore. Among the five loans received, the entity repaid Rs 100 crore, but the other remained as a Non-Performing Asset (NPA).

- 2010: The Reserve Bank of India intervened to lead a consortium of 18 banks to restructure the remaining debt, which included restructuring loans worth Rs 127.68 crores and sanctioning an additional loan of Rs 89.38 crores.

- December 2010: Two more loans were disbursed—Rs 18.89 crore and Rs 10.56 crore, both of which also became NPAs.

- February 2012: One last loan worth Rs 20 crores was given that, once again, was unsuccessful.

Further investigations by the CBI showed that these funds were not utilized for the purpose they were allocated but were diverted for other expenses, including purchasing luxury items like helicopters, ostensibly for corporate use.

| Year | Loan Amount (in Rs crores) | Initial Purpose | Status |

| 2007 | 50 | Operations and Expansion | Restructured, then NPA |

| 2008 | 80 | Acquisition of Helicopters | Restructured, then NPA |

| 2010 | 127.68 (restructuring) | Restructuring existing loans | Turned into NPA |

| 2010 | 89.38 | Additional capital for operations | Turned into NPA |

| 2010 | 29.45 (two separate loans) | Fresh loans for operations | Turned into NPAs |

| 2012 | 20 | Further operational expenses | Turned into NPA |

The Legal Framework and Proceedings

According to Indian law, one cannot prosecute a public servant for any actions done in their official capacity except with the sanction of the concerned authority, here the Finance Ministry. These sanctions represent the first step the court has agreed to take legally to ensure the conviction of the persons involved.

In July, the Special CBI Court understood the seriousness of the charges and issued non-bailable warrants against Mallya. The charges are those of making false projections of financial flows to obtain loans, using them for unauthorized purposes, and failing to meet the obligations of repayment. This has resulted in significant financial loss not only to IOB but also to the entire banking fraternity, who are the victims of these bad debts.

Broader Implications and Reforms

The Kingfisher Airlines loan scandal is symptomatic of the deeper issues plaguing India’s banking sector, where corruption and undue political and corporate influence are at play in loan sanctioning processes. The gross NPA ratio of scheduled commercial banks before the change of government in 2014 had stood alarmingly at 4.9 percent, with bad loans amounting to ₹66.6 lakh crores as of March 2014. The BJP government has since approached these issues through tightened regulations and legal actions taken against those accused of financial management malpractices.

Current Government’s Approach

Prime Minister Narendra Modi has openly criticized the previous government’s practices, particularly the “Phone Banking Scam.” In these scams, loans were allegedly sanctioned under pressure from high-ranking officials without proper checks. Investigations have been a slow process, but recent developments seem to suggest a more assertive approach to solving these legacy issues.

Conclusion

The trial of the former officials of IOB in the Kingfisher Airlines loan case forms a critical hallmark in India’s continuing battle against corruption in the banking sector. The case not only throws light on the long-overdue regulatory regime but also restates the importance of accountability in public service. The unfolding legal saga would gradually throw light on the financial malpractice mechanisms and hopefully deter future occurrences. The good move by the CBI in coordination with the current government may eventually help the public regain their trust in Indian financial institutions so that such tragedies may not repeat themselves.

Vijay Mallya Scam FAQs

What is the Vijay Mallya scam about?

The Vijay Mallya scam refers to the financial fraud involving defaulted loans worth ₹9,000 crore taken by Vijay Mallya’s Kingfisher Airlines. He fled to the UK, leading to prolonged legal battles for his extradition.

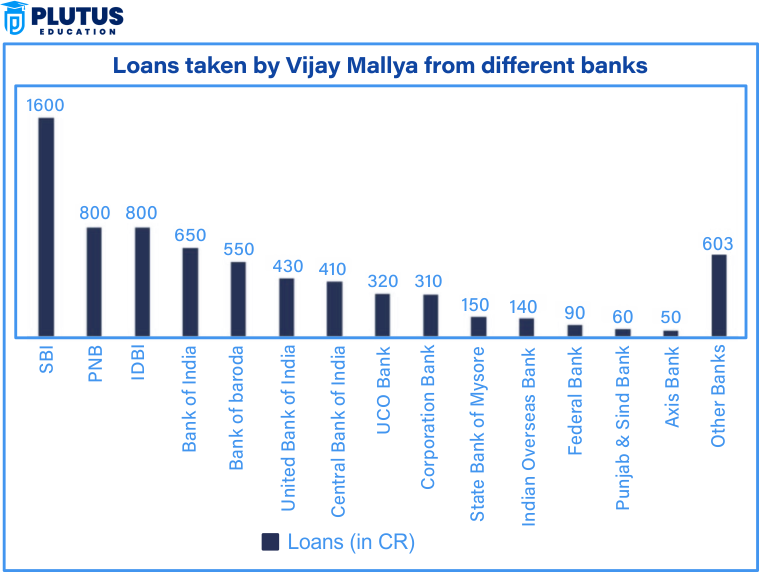

How much money did Vijay Mallya owe?

Vijay Mallya and Kingfisher Airlines defaulted on loans totaling over ₹9,000 crore from a consortium of Indian banks.

Why did Vijay Mallya leave India?

Vijay Mallya left India in March 2016, allegedly to evade arrest over loan default and money laundering charges.

What reforms came after the Vijay Mallya scam?

The scam prompted reforms like the Fugitive Economic Offenders Act, stricter NPA monitoring, and improved corporate governance norms.

What is Vijay Mallya’s current status?

Vijay Mallya is in the UK right now. He is fighting extradition to India as he was declared a fugitive economic offender in India.