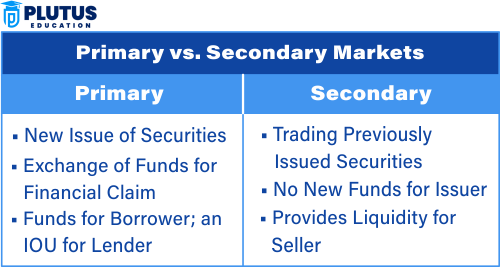

Understanding the primary and secondary market in India is crucial for investors. In this guide, we explain what is primary market and secondary market with examples, their features, and why they matter. These two types of markets are central to knowing how the financial world works. The primary market is where new securities, for instance, stocks or bonds, are sold to investors for the first time so that companies can raise funds. On the other hand, the secondary market is the marketplace in which the securities are bought and sold between investors after the first sale. Both markets are critical to the economy, and one should be aware of their differences before investing or researching financial markets.

What is Primary Market?

The primary market is the place where new securities are created and sold for the first time. When a company or government needs to raise money, they issue new stocks or bonds in this market. Investors buy these new securities directly from the issuer, which allows the company or government to raise funds for business activities or projects.One major advantage of the primary market is that it allows companies to raise fresh capital efficiently—one of the most important advantages of primary and secondary market structures

One common example of the primary market is an Initial Public Offering (IPO), where a company offers its shares to the public for the first time. The money raised from selling shares goes directly to the company. The primary market is important because it enables companies to raise capital for growth, product development, or to pay off debts.

Key Features of Primary Market

- First-Time Issuance: Securities are issued to the public for the first time.

- Capital Raising: The issuer (a company or government) raises funds directly from investors.

- Issuing Process: Investment banks usually help companies with the process of issuing securities and setting the price.

- Direct Investment: The money from the sale of securities goes directly to the issuer.

What is Secondary Market?

How does the secondary market work? In India, it operates through regulated stock exchanges like BSE and NSE, providing liquidity and fair pricing. The secondary market is where investors buy and sell securities after they have already been issued in the primary market. In other words, it is the market for trading existing stocks, bonds, and other securities. The company that issued the securities does not receive any money from these transactions. Instead, investors exchange securities with each other.

The secondary market provides liquidity, meaning it makes it easier for investors to buy and sell their investments. Stock exchanges like the NSE or BSE markets are examples of secondary markets. The prices of securities in the secondary market are determined by supply and demand.

Key Features of Secondary Market

- Trading of Existing Securities: Investors buy and sell securities that have already been issued.

- Liquidity: The secondary market makes it easier to buy and sell securities, providing liquidity.

- Price Determination: Prices are set by supply and demand, and can fluctuate throughout the day.

- No Capital Raised for Issuer: The money from transactions in the secondary market goes to investors, not the issuing company.

Difference Between Primary Market & Secondary Market

Though both the primary market and the secondary market are part of the financial system, they serve different functions. Below are five key differences:

Purpose

The primary market is where companies or governments issue new securities to raise capital. When a company needs funds for expansion or a government requires money for infrastructure, it issues stocks or bonds for the first time. Investors in the primary market buy these newly issued securities, directly contributing to the capital needed by the issuer.

The secondary market is where previously issued securities are traded among investors. In this market, the company or government that originally issued the securities does not receive any money. Instead, investors buy and sell securities among themselves, allowing for liquidity and the opportunity to trade based on changing market conditions.

Securities

In the primary market, securities are being issued for the first time. Investors in this market buy stocks, bonds, or other securities directly from the issuer, often through an initial public offering (IPO) or government bond issuance. This is the point where a company raises funds for its operations or projects.

In the secondary market, securities that have already been issued are traded. These can include stocks that were initially offered in an IPO or bonds that were sold earlier. Investors trade these securities with each other, and the issuer is not involved in these transactions. The role of the secondary market is to provide an avenue for investors to buy or sell securities and to help determine their market value.

Participants

In the primary market, the key participants are the issuer (which could be a company or government) and investors. The issuer offers securities to raise capital, while investors purchase them with the expectation of earning returns.

The secondary market is most active; this is where the investor at such a point generates most of his business activity. Individual investors have created a comparative multitude of functions in the selling and buying of securities among themselves directly investors of stock. It includes individual and institutional investors, market makers, and others. The trading that occurs within them provides liquidity and allows investors to manage their respective portfolios as per market trends and performance.

Money Flow

Primary market money generated through selling securities passes directly to the issuer. For example, issuance of stocks from a company or issue of bonds from the government generates money for an issuer and uses it for a specific purpose, i.e., expanding business operations or funding public projects.

Unlike the primary market, money in the secondary market flows from one investor to another.When one investor sells securities to another, the issuer does not receive any of this money. The secondary market simply facilitates the exchange of securities, helping investors buy and sell based on their investment needs and market conditions. The funds are exchanged between investors, not the company or government that initially issued the securities.

Price Determination

In the primary market, the price of securities is usually set by the issuer, with the aid of underwriters. The issuer and underwriters set the initial offering price depending on market conditions and demand from investors. In the secondary market, one price is determined by the forces of supply and demand. Unlike the primary market, where the price is fixed, prices in the secondary market fluctuate based on how many people want to buy or sell a security. If demand for a stock is high, its price goes up; if demand is low, the price falls. The secondary market allows investors to buy and sell securities at prices that reflect the current market sentiment.

Primary Market vs Secondary Market: Key Differences

| Aspect | Primary Market | Secondary Market |

| Definition | Market for issuing new securities directly to investors. | Market for trading already issued securities between investors. |

| Purpose | Helps companies/governments raise fresh capital. | Provides liquidity and trading opportunities for investors. |

| Participants | Issuer (company/govt) and initial investors (including retail). | Buyers and sellers (investors, institutions, traders). |

| Money Flow | Funds go directly to the issuer. | Funds are exchanged between investors. |

| Price Determination | Set by the issuer and underwriters. | Determined by market forces: supply and demand. |

| Liquidity | Less liquid; limited to offering period. | Highly liquid; allows continuous buying and selling. |

| SEBI’s Role | Regulates IPO processes and disclosures. | Regulates stock exchanges and ensures fair trading. |

| Retail Investor Access | Yes, through IPO allotment under SEBI guidelines. | Yes, through regular buying/selling on stock exchanges. |

| Trading Platform | No stock exchange; securities are issued via intermediaries like banks or brokers. | Stock exchanges such as NSE, BSE. |

| Examples | IPO of LIC, Government bond issuance. | Buying Reliance shares on NSE, selling SBI stocks on BSE. |

Primary Market vs Secondary Market FAQs

1. What are the features of primary market and secondary market?

There is the primary market when companies raise capital directly from investors by selling new issuances of securities. Trading occurs among securities already issued between investors on secondary markets where income is generated from expected future cash flows. Enclosed prices are typical in primary markets, with fluctuation instead being regulated by supply and demand within the secondary market.

2. What advantages do primary and secondary markets have?

The primary market enables firms to secure fresh capital for purposes such as expansions and developments and creates liquidity in the secondary market, where individuals buy and sell securities. Jointly, they sustain economic growth and complete the efficient distribution of funds.

3. What is the functioning mechanism for primary and secondary markets under SEBI, particularly in Indian territory?

The primary market is governed by SEBI, which controls issues such as IPO management, Leave Price Discovery, and disclosures-thus providing protection to the capital of investors. The roles that SEBI plays in the equity market are more of the guardian-kind of defining rules governing the exchanges i.e., NSE, BSE. Such involvement is not without culpability in assuring the overall transparent conduct, to save investors from harm or swindling, and to maintain a code of ethics and stability in the market.

4. Can retail investors participate in the primary market?

Yes, retail investors can apply for shares in the primary market through IPOs using platforms like ASBA. A portion of the IPO is reserved for them. This offers them access to early-stage investment opportunities.

5. Which one is more liquid: primary or secondary market?

The secondary market is more liquid, which allows for the frequent and many trades in securities. Investors can enter or leave positions easily. The primary market only functions during the raise of a securities issuance.