Responsibility accounting is a managerial accounting system aimed at measuring the performance of various sections or departments within an organization. It is meant to provide specific financial responsibilities for individual managers or departments and thus allow easy tracking and assessment of their financial performance. The expectations set are then linked to outcomes as a way of improving accountability in any organization.

It ensures the manager’s concentration in those areas they directly influence to create efficiency and encourage effective decisions. It motivates the manager to operate his resources efficiently while working towards making the most informed decisions to help in reaching the objectives of the organization. Generally speaking, responsibility accounting involves transparency, accountability, and a resultant enhancement of performance in line with an ascription of particular financial consequences.

How Does Responsibility Accounting Work?

Responsibility accounting operates on breaking an organization into smaller units or centers of responsibility, where the responsibility center is held responsible for a certain set of activities, and performance evaluation is made on the basis of the financial results produced. Managers of such responsibility centers are answerable for their decisions, and performance measurement is made possible by reports in terms of profit and loss statements, balance sheets, and variance analysis.

The system works by clearly defining the responsibilities of each department or unit. Responsibilities may be operational, financial, or a combination of both, depending on the organization’s structure. After defining the responsibilities, managers are provided with the necessary tools to achieve their objectives, such as budgets and performance targets. The beauty of responsibility accounting is that managers are only accountable for what they can control. Thus, there is fairness in evaluating performance.

A responsible accounting system also provides for the establishment of performance standards or budgets. The financial results of each responsibility center are compared with these standards. The variances, or differences between actual and expected performance, are analyzed. When the variances are significant, corrective action is taken to improve performance. This allows organizations to keep track of how well each department is doing and whether it’s meeting its financial objectives.

Objectives of Responsibility Accounting

The main objective of responsibility accounting is the measurement and evaluation of the financial performance of different organizational departments or managers. The system, by clearly assigning financial responsibility to managers, allows organizations to identify areas of improvement and those that are doing well. Some key objectives include:

- Improving Accountability: Responsibility accounting holds managers accountable for the financial outcomes of their departments. Each manager clearly understands what they are responsible for, reducing ambiguity and ensuring that everyone is focused on their specific tasks.

- Motivating Managers: When managers are given control over their department’s budget, they are more likely to make decisions that benefit the organization. Responsibility accounting empowers managers to take ownership of their performance, which often leads to improved efficiency and profitability.

- Enhancing Decision-Making: Responsibility accounting provides managers with relevant financial data, allowing them to make informed decisions. Managers can assess the financial impact of their actions, making it easier to plan for the future and allocate resources effectively.

- Performance Evaluation: By comparing the actual results of responsibility centers with the set targets or standards, responsibility accounting makes it easier to assess the performance of individual managers and departments. This evaluation can be used to reward high performers and guide underperforming departments to improve.

- Identifying Areas for Improvement: Responsibility accounting highlights areas where performance does not meet expectations. Managers can analyze these discrepancies to find out the root causes and take corrective actions to improve their operations.

Features of Responsibility Accounting

Some key features characterize responsibility accounting to become the proper effective mechanism for managing an organization’s performance. The prominent features characterize the system that works, making it possible for the managers to be responsible regarding their departments. Here are some of the significant features:

- Decentralization: Responsibility accounting is based on the idea of decentralizing decision-making. Managers are responsible for budgeting, cost control, and performance evaluation. Decentralization encourages managers to take ownership and responsibility for the financial performance of their respective areas.

- Clear Definition of Responsibilities: One of the core principles of responsibility accounting is that each department or unit has clearly defined responsibilities. These responsibilities typically include setting budgets, controlling costs, and achieving financial goals.

- Budgeting and Financial Planning: Responsibility accounting heavily relies on budgeting. Managers are assigned financial targets that are typically based on past performance or industry standards. Managers can determine if they are meeting expectations by comparing actual performance to budgeted performance.

- Performance Measurement: Responsibility accounting enables the measurement of a manager’s performance through financial reports. This performance evaluation helps determine the effectiveness of each department’s or manager’s decisions.

- Control over Costs and Revenues: Responsibility accounting ensures that managers have control over the costs and revenues in their areas of responsibility. Managers can control direct costs, which include expenses like raw materials, labor, and other operational costs.

- Variance Analysis: Variance analysis is a critical feature of responsibility accounting. It involves comparing actual performance with budgeted or expected performance to identify variances. Positive variances indicate favorable performance, while negative variances suggest that corrective action is necessary.

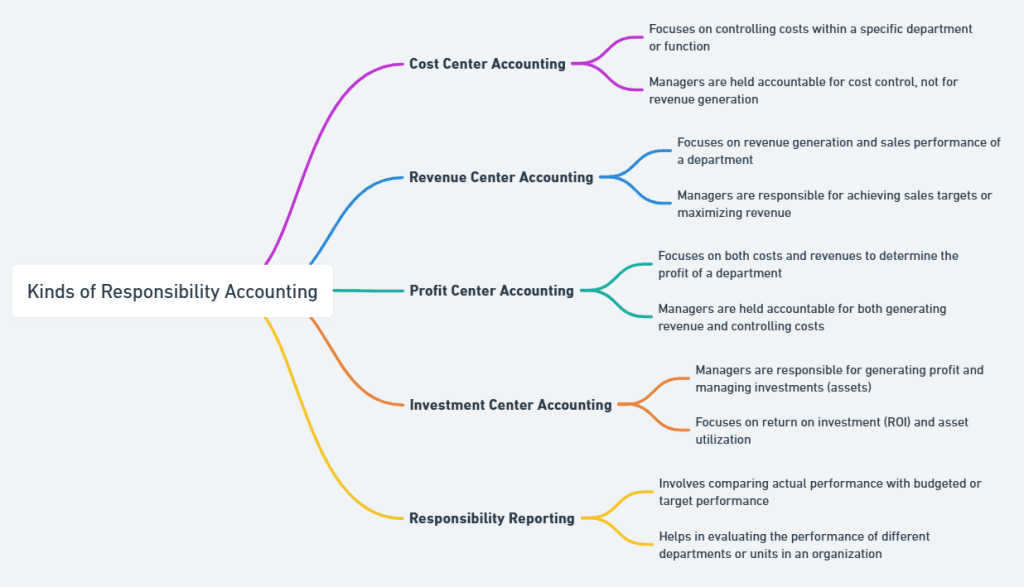

Different Types of Responsibility Centers

There are normally several types of responsibility centers in an organization operating on responsibility accounting. Different responsibility centers have varying degrees of control and responsibility. Here are the major kinds of responsibility centers:

1. Cost Centers

A cost center is a section of an organization in which the manager has responsibility for cost control but has no responsibility for revenues or profits. The departments are focused on the reduction of expenses with a constant quality of their work being maintained or improved. The most common examples are production departments, maintenance units, and administrative departments. Managers are not accountable for sales or profitability but play a very vital role in the cost management of the organization.

2. Revenue Centers

Revenue centers generate revenue primarily for the organization. A revenue center’s manager focuses on making money to the bottom line through more sales, better acquisition of customers, and ensuring revenue attainment of a unit. A sales department or any other marketing unit can be such a center. Revenue comparison versus budgeted revenues is usually the basis of the performance of any revenue center. It generates and produces, but also ensures that it is cost-controllable.

3. Profit Centers

A profit center is a cost or revenue center in the organization. The managers in the profit center are expected to generate income and contain expenses. Profit centers evaluate performance based on profit made. One calculates profit by taking the difference between revenues and costs.

Examples of profit centers include product lines, regional sales offices, or retail outlets. Profit centers encourage managers to maximize both revenue and profitability.

4. Investment Centers

An investment center is more than a profit center because it also holds managers accountable for investments made in assets. Managers are responsible not only for generating profits and controlling costs but also for decisions related to investments and capital expenditures. Investment centers allow managers more control over long-term financial decisions.

Steps in the Responsibility Accounting Process

The process of responsibility accounting, therefore, consists of several key steps to ensure that managers are held accountable for their financial performance. Following a systematic approach, organizations can track, evaluate, and enhance performance as follows:

1. Setting Objectives and Responsibilities

The first step in the responsibility accounting process is defining clear objectives and assigning responsibilities to managers. Managers should be aware of what their expectations are and what they will be held accountable for. Objectives may be financial goals such as revenue targets, cost reductions, or profit margins.

2. Budget Preparation

The following step is to budget each responsibility center. These serve as budgets of available resources and expectations of the unit’s performance. Its formulation must reflect expected revenues alongside allowable costs, hence painting a complete picture of managers’ actions.

3. Performance Measurement

After setting the budget, we track and measure actual performance. The managers will compare their actual performance to the budgeted targets and note the differences between them. The comparison allows the managers to assess how they are doing regarding the accomplishment of set targets.

4. Variance Analysis

Variance analysis is one of the major elements of responsibility accounting. Managers compare actual performance with budgeted targets and conduct variance analysis to identify areas of differences. Positive variances are an indication of good performance while negative variances indicate areas of improvement.

5. Taking Corrective Actions

Based on the outcome of variance analysis, corrective action is taken to address the problem in performance. This might be in terms of readjusting operations, cutting costs, or reallocation of resources. The objective is to get actual performance to conform to established objectives.

Responsibility Accounting Example

To illustrate responsibility accounting in action, let’s consider an example in a manufacturing company.

Suppose a company has several departments: production, sales, and administration. Each department measures its performance using responsibility accounting and has specific responsibilities.

Scenario:

- The sales department receives a target of $500,000 in revenue for the year.

- The production department is tasked with keeping production costs below $200,000 while maintaining a high level of product quality.

- The administration department has a budget of $50,000 for administrative costs.

At the end of the year, we compare actual performance to the budgeted targets:

- The sales department generates $480,000 in revenue, falling short by $20,000.

- The production department spends $180,000, staying under budget.

- The administration department spends $55,000, exceeding its budget by $5,000.

In this example, the responsibility accounting system helps the company assess each department’s performance and determine areas that need corrective action. The sales department may need to revise its strategies to meet future targets, while the administration department may need to control costs better.

Responsibility Accounting FAQs

What is the main purpose of responsibility accounting?

Responsibility accounting aims to measure and improve the performance of departments or managers by assigning specific financial responsibilities to each. It helps organizations track performance, ensure accountability, and make better financial decisions.

What are the different types of responsibility centers?

Cost centers, revenue centers, profit centers, and investment centers are the four main types of responsibility centers. Each center focuses on different financial objectives, from cost control to revenue generation and profit maximization.

How do variance analysis and performance measurement work in responsibility accounting?

Variance analysis involves comparing actual performance with budgeted targets to identify discrepancies. It helps managers pinpoint areas needing improvement, whether it’s due to overspending or underperformance in revenue generation.

Can responsibility accounting apply to all businesses?

Yes, responsibility accounting is flexible and can be applied to businesses of all sizes and industries. It is most effective in organizations with a decentralized structure, where different departments or units can be held accountable for their financial outcomes.

Why is decentralization important in responsibility accounting?

Decentralization gives managers more control over their departments or units, making them accountable for financial outcomes. It encourages ownership of decisions and allows for quicker, more localized decision-making.