The average profit method of calculating goodwill is one of the most widely used methods, especially in partnership firms, small businesses, and in cases of mergers and acquisitions. This method is considered because of its simplicity and dependability on actual performance. It is based on a premise whereby the average profits earned over a specific period are multiplied by the number of years of purchase to arrive at a fair estimate for goodwill, the foremost intangible asset of a business. Past profits are considered reliable indicators of future earnings, and this is why the method works very well where there is proven and sustainable profitability. Whether for the admission of a new partner, retirement of an existing partner, or selling the business, many professionals keep the average profit method close to their hearts due to its simplicity and transparency.

What is Average Profit Method?

Once the average profit method determines goodwill, it averages the past profits of the company for several years (called years’ purchase). Therefore, it assumes that any future profitability of the business may be assessed based on its past earning capacity. It is essential to determine goodwill when there is stability and consistency. Thus, goodwill is commonly thought to be a business’s ability to earn advantages above its rivals because of a good name, well-disposed customers, or location. This average profit method helps owners and investors weigh the intangible property rights attached to the firm beyond its concrete assets.

Simple and Logical Framework

Average profits demonstrate a simple enough procedure to be fully comprehended even by nonfinancial users. They do not require complicated calculations or biased assumptions like future growth rates or discounting. Thus, the method is assumed to be especially suitable for small and medium enterprises, family-run businesses, or single professionals wishing to value their practice on a past income basis.

Time-Weighted Profit Consideration

This method works on the principle that past profits indicate future performance. It best applies to firms whose earnings have been more or less steady for several years. Corrections may become necessary when there is a sharp, sudden change in profits owing to external or temporary considerations. In contrast, the weighted average or super profit method would be more appropriate.

Basis for Valuation of Goodwill

Since goodwill is intangible, it provides an approach for assessing its worth. The years’ purchase figure indicates how long the business is expected to earn that profit in the future. Consequently, goodwill is determined based on the past profit record, which helps firms better manage partner retirements, business sales, or mergers.

Reflective of Operational Performance

Using historical profits makes this method a good reflection of how the business has performed operationally. It relies on actual numbers rather than speculative forecasting. This historical grounding gives confidence to stakeholders, partners, investors, or buyers, because it depends on evidence instead of assumptions.

Commonly Accepted in Audits and Legal Disputes

For its transparency, the method finds acceptance in audit reports, tax assessments, and even in court cases concerning partnership disputes or business sales. It provides a neutral and objective framework, which is defensible and easy to verify, making it a dependable tool in financial assessments.

How to Calculate Average Profit?

Calculating average profit is relatively straightforward and involves a few essential steps. Average net earnings for the last few years are determined and multiplied by a specific multiplier, years’ purchase, to arrive at goodwill. In so doing, the valuation process is based on the actual earning capacity of the company rather than that overlooked in traditional balance sheet evaluation.

Step 1: Collect Historical Profit Data

Collect profit figures for at least 3-5 previous years and ensure a consistent accounting practice is used throughout. More years likely mean a better average, but ensure all data is free from abnormal transactions, especially the one-off gains/losses.

Step 2: Add Up All Profits

Add all the profit figures together. If there were losses in a few years, those must be added to the accurate average. This total portrays the overall earning capacity of the business upon which your valuation is based.

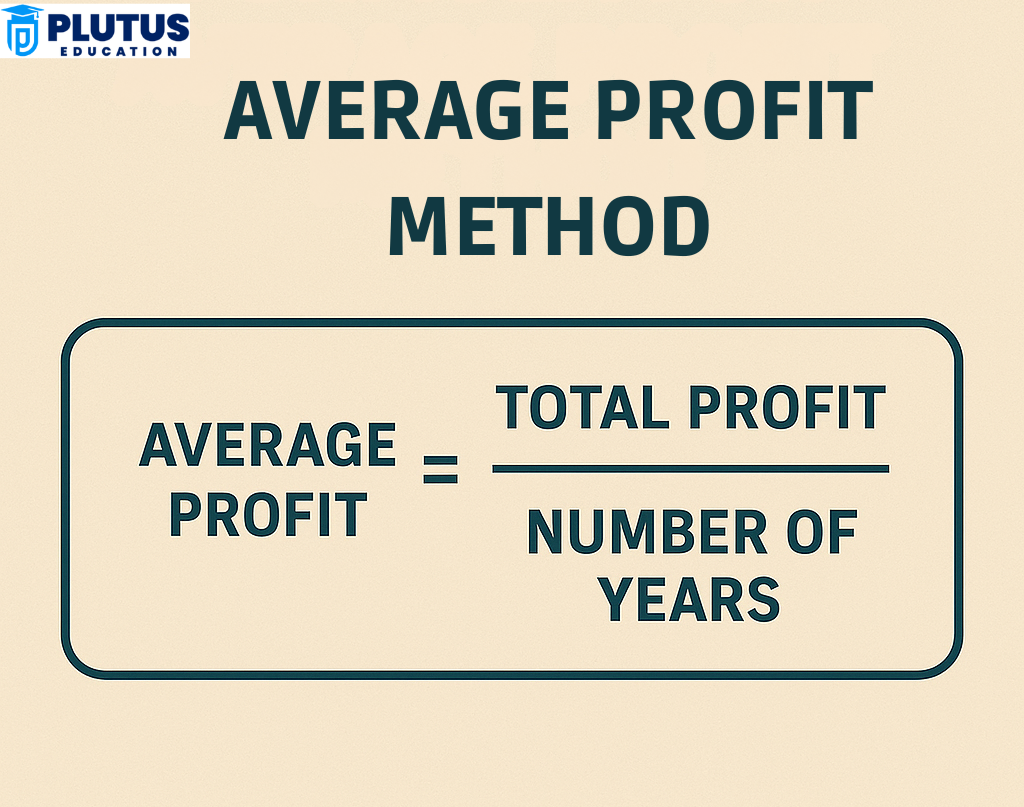

Step 3: Calculation of Average Profit

Divide the total profits by the number of years taken into account. The average annual profit reflects the company’s core earning potential. Ensure you round off appropriately and document adjustments made for abnormal income or expenses.

Step 4: Multiply by Years’ Purchase

Years’ purchase is the duration considered, in terms of years, during which future profits are presumed to remain stable. Average profit is thus multiplied by this figure. The outcome is called goodwill for the business. This step converts a form of earning capacity given over time into a form of lump sum value.

Formula Summary

Goodwill = (Total Profit of X Years ÷ Number of Years) × Years’ Purchase.

It is very straightforward to understand and apply, and has found great acceptance in academic and practical work.

Example of Average Profit Method in Practice

Let’s understand how the method is applied through a real-life example. Suppose a business wants to value its goodwill using the average profits of the last five years. This example demonstrates how average profits translate into goodwill, showing why this method is commonly used in partnership adjustments and SME valuations.

Given Profits Over Five Years

Year 1: $50,000

Year 2: $55,000

Year 3: $60,000

Year 4: $52,000

Year 5: $58,000

Add all these profits:

Total Profit = $275,000

Calculate the Average Profit

Average Profit = $275,000 ÷ 5 = $55,000

This value represents the average annual earning power of the business, assuming steady performance continues.

Assume 3 Years Purchase

Goodwill = $55,000 × 3 = $165,000

This means the business’s goodwill is valued at $165,000 under the average profit method, which is a fair representation of its earning potential.

Business Use Case

Such a valuation might be used during the admission of a new partner, where the new entrant must compensate existing partners for their share in goodwill. This also helps determine exit values for a retiring partner or selling a stake to an investor.

What the Example Teaches

It shows how simple the method is while highlighting the importance of accurate financial records. Businesses with volatile or manipulated records may not get reliable results. The simplicity of this example reinforces why this method is popular among small businesses and accounting students.

Where and Why the Average Profit Method Is Used?

The average profit method is often the default choice when valuing goodwill in small to medium enterprises (SMEs) or during partnership restructuring. Its simplicity and reliance on historical data make it widely accepted across industries. It works best in stable earnings and where past performance is a reliable predictor of future results.

Merger and Acquisition Scenarios

When two businesses merge, the buyer may want to assess goodwill based on how profitable the acquired business has been historically. This gives a reliable valuation that can be used to negotiate a fair price for the acquisition, particularly in services or retail sectors.

Partner Admission or Retirement

Partnership firms often rely on this method to determine the share of goodwill to be paid to an outgoing partner or by an incoming one. The technique ensures fairness and reduces disputes, especially when the profits have been steady.

Small Business Valuation

SMEs often don’t have the data or resources to use complex valuation methods. The average profit method offers a clean, simple solution. It is also helpful when business ownership changes hands in family-run enterprises, sole proprietorships, or small partnerships.

Valuing Franchise Businesses

Franchise businesses that maintain consistent brand-based revenues often use average profit to determine buy/sell value or royalty base. This is due to the predictable revenue models and established operational consistency across units.

Usability in Legal and Tax Matters

Although transparent and formula-based, it is often valid regarding legal evaluations, inheritance disputes, or tax assessments. Courts and auditors ratify this method because the profits are verifiable and adjustments are open.

Limitations and Usage

Even simpler, the average profit method has certain limitations. It assumes that the previous trends will continue, which may or may not be true, particularly regarding volatile industries or startups. Knowing its limitations thus helps to determine when to use alternate valuation approaches like the Super Profit Method or DCF.

Not Appropriate for a Startup

Startups usually do not have any significant profit history. Using this method could end up creating inaccurate or undervalued goodwill. Those companies should instead resort to methods that consider future growth, such as DCF or risk-adjusted valuation techniques.

Ignores Market Changes

This approach does not recognise the current changes in market dynamics, competition, and changes in business models. So, if a company has recently undergone restructuring or changed its operations, past profits may not forecast future profits.

No Weightage to Recent Performance

Every year’s profit is equally important, even though newer years may reflect more relevant business conditions. A weighted average profit method may provide a more realistic valuation.

Doesn’t Consider Capital Employed

The method values goodwill based only on profits, without considering how much capital was used to generate those profits. This limits its use in industries where capital efficiency or return on investment is a crucial metric.

Sensitive to One-Off Events

If a year’s profits were abnormally high or low due to unique events (like COVID-19), it may skew the average and result in inaccurate goodwill estimation. Adjustments should always be made to account for such irregularities before applying the method.

Average Profit Method FAQs

What is the average profit method?

The average profit method values goodwill by averaging past profits over a specific period and multiplying them by a set number of years, called years’ purchase.

How do you calculate the average profit for goodwill?

Add up profits over a selected period (usually 3–5 years), divide by the number of years to get the average profit, and multiply that by the number of years’ purchase.

When should I use the average profit method?

Use this method when a business has stable, consistent profits and you value goodwill for mergers, acquisitions, or partnership changes.

What are the key assumptions in this method?

It assumes that past profits are a good indicator of future performance and that these earnings will continue at the same rate.

What are the disadvantages of using this method?

It may not work for startups, ignores market volatility, gives equal weight to all years, and doesn’t factor in capital employed or external disruptions.