Capital markets play the most crucial part in the worldwide economy because they mediate between funding and fund mobilizers. Their functions involve activities like stock trade, issuing bond, etc. Some of the Capital market examples in India are the New York Stock Exchange NYSE, the Bombay Stock Exchange, and also trading Government and corporate bonds. These examples show how capital markets provide diversity and how important they are in stimulating economic growth and innovation.

What are Capital Markets?

Capital markets are financial ecosystems where businesses and governments raise long-term capital through the issuance and trading of securities. These markets have raised the option for investors to make investments in bonds, stocks, and other items, on which returns are made while allowing entities to finance projects. They are useful in ensuring that resources flow efficiently from those who save to those who invest. The term capital market encompasses a wide range of financial activities aimed at supporting sustainable economic growth.

Features of Capital Markets

Capital markets are unique because they focus on long-term investments and have a diverse set of participants. Their markets are characterized as high liquidity, where securities can easily be bought and sold in them, regulated through comprehensive regulatory structures in an attempt to appear fair and transparent in the conduct of their activities. The markets are thus safe for both institutions and individual investors. They also enable the emergence of innovative finance due to products like derivatives and others used to meet different investor needs. The capital scale that these markets can raise becomes necessary for almost all economies around the world.

Capital Market Examples

Capital markets are generally global in extent and offer multiple platforms through which equity, debt, and hybrid instruments can be traded. There is a strong element of intermediating funds between providers and seekers thereof. The remainder of this note discusses seven types of capital markets in some depth.Some of the Capital market examples are as follows:-

Stock Exchanges

Stock exchanges are the mainstay of the capital market.It is one among the capital market examples. They represent an intermediary where ownership securities can be traded. The New York Stock Exchange is the biggest, where companies like Microsoft, Amazon, and Tesla trade billions of dollars daily. The existence of stock exchanges helps ensure liquidity; that is, investors can buy and sell shares without much difficulty. In India, the Bombay Stock Exchange is one of the main centers, where companies like Reliance Industries and TCS are listed. These websites offer the corporates an avenue to issue debt securities, which thus gives investors exposure to corporate equity and enables the corporates to finance growth and also play a significant role in the discovery of price as well as market equilibrium.

Bond Markets

The bond market provides the marketplace through which debt security issued by companies, governments, or municipal authorities, can be traded. For instance, the US Treasury Market allows government bonds to be traded which is useful in funding public infrastructures and maintaining the national debt. Indian Bond Market. The Government Securities or G-Sec market is responsible for the sovereign bonds issuance as well as the trading. Even bond markets trade with corporate bonds: they were a good example is those issued by giant firms Apple or Tata Steel. These bonds provide a safety net compared to equities but are essential elements of portfolio diversification. Therefore, bond markets help entities borrow money while keeping fixed-income flows to investors open.

Derivative Markets

Derivative markets are where financial contracts that have their value based on an underlying asset such as stocks, commodities, or indices are traded. Among the leading derivative trading platforms, is the Chicago Mercantile Exchange, which offers futures and options on commodities, currencies, and indices. In India, the National Stock Exchange leads the way in derivatives trading with Nifty futures and options. Such markets are necessary for risk management since investors can hedge against potential losses. Derivative markets encourage speculative trading that enables investors to earn money from the movement of prices without owning the underlying assets.

Commodity Markets

Commodity markets trade in physical commodities, which are gold, crude oil, and agricultural commodities. Some commodity exchanges where trade is conducted include the Multi Commodity Exchange of India (MCX) and the London Metal Exchange (LME). Such commodity markets ensure appropriate pricing on global supply and demand. Commodity markets are a hedge against price volatility for the producers and consumers. For example, the farmer can hedge future prices of crops using futures contracts, thereby reducing risks inherent in fluctuating market prices.

Global Capital Markets

Global capital markets integrate economies as they enable investments and trade between borders. Other international markets include the London Stock Exchange and the Shanghai Stock Exchange. Such markets attract global investors to invest in their commodities and also enable companies to source funding from across the globe. International markets further help in the trading of international bonds, equity, and derivatives. This boosts economic integration by portfolio diversification in terms of geographics through investment and provides additional funding to the issuer.

Corporate Debt Markets

Corporate debt markets are those markets where there is trading in bonds and other forms of debt papers issued by private enterprises. IBM, Amazon, and Tata Motors raise funds for their expansion, acquisitions, or operational requirements by issuing corporate bonds. These bonds carry a higher yield than government bonds to compensate for the additional risk. The US Corporate Bond Market and India’s corporate bond platforms facilitate these trades. Corporate debt markets are crucial in enabling companies to raise significant funding without diluting equity ownership.

Green Bond Markets

Green bond markets are dedicated to financing environmentally friendly projects. Governments, corporations, and financial institutions issue green bonds to finance renewable energy, clean transportation, and water conservation projects. The European Investment Bank (EIB) and entities in India like the Securities Exchange Board of India (SEBI) play pivotal roles in this segment. This opportunity for investors is to support sustainable development while still earning returns through green bonds. With climate change now becoming one of the major burning global issues, the markets for green bonds have expanded, and billions are channeled into eco-friendly initiatives.

How do Capital Markets Work?

The capital markets connect the buyers and sellers of securities. Therefore, it is a channel through which savings are transformed into investments. Consequently, there is economic growth. The companies raise capital by issuing stocks or bonds; the investors buy them for returns. This process forms an efficient allocation of resources leading to economic growth. The whole cap system forms a complete network of complex interrelations between the exchanges, brokers, clearinghouses, and investors.

Steps in the Capital Markets Working Process

- Issuance of Securities: Companies and governments issue securities to raise funds, providing an entry point for investors.

- Trading: The securities are sold and bought in the exchanges or over-the-counter platforms. Trading ensures continuous activity as well as provides liquidity.

- Price discovery: The actual values of the securities are ascertained by the flow of demand and supply forces that determine the prices in the capital market.

- Settlement and clearing: clear and settle over a clearinghouse to ensure safe, expedient exchanges among the participants involved.

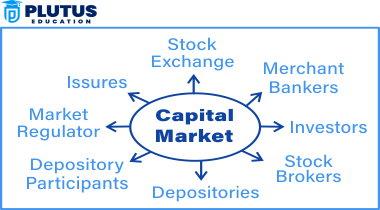

Participators of the Capital Markets

The key players in the capital market are issuers, investors, and intermediaries. These are issuers of securities, providers of capital, and facilitators of transactions through brokers. Market operations are monitored by regulators for the maintenance of integrity and investor protection. Thus, the different participants bring life and vibrancy to a marketplace that can sustain global economic activities.

Types of Capital Market

Capital markets can be broadly classified into two categories: primary and secondary markets. Both are part of the financial system but serve different purposes. New securities are traded in the primary market, whereas the secondary market deals with the trading of existing ones.

Primary Market

The primary market is the part through which organizations issue new securities directly to investors. It plays an extremely fundamental role in the process of raising fresh capital for companies and governments. Initial Public Offers are key parts through which IPOs offer investors a primary opportunity to buy shares within the company. Characteristics of the Primary Market are this market, companies issue equity shares and bonds to raise capital for projects or expansions. This is a direct transaction between the issuer and the investor. The major market allows business to raise innovational and development capital. Success in an initial public offering can be demonstrated as in the case of Reliance Industries; how effective the capital market is for mobilizing huge capital.

Secondary Market

The secondary market allows the trading of previously issued securities. It ensures liquidity, so investors can buy or sell their holdings according to the prevailing market conditions. This type of market will enable price discovery due to the continued trading activity. In the secondary market, trading is performed on stock exchanges or over-the-counter platforms. The supply and demand for these securities reflect their true value as determined by the market prices in the secondary market. The secondary market also represents an indicator of economic health; it affects investors’ decisions, companies’ policies, and other policymakers’ actions.

Capital Market Examples FAQs

What is a capital market?

The capital market is the system of financial transactions that deals in the trading of long-term securities like stocks and bonds. This also allows the allocation of funds raised by investors for developmental projects in the hands of either businesses or the government.

State some Capital Market Examples.

Examples of capital markets include stock exchanges such as NYSE and BSE, bond markets such as US Treasury, and derivative markets such as CME. These markets enable trading in equity, debt, and financial derivatives.

What is the role of the capital market?

The capital market helps in capital formation, wealth distribution, and economic growth. It acts as a source of raising funds for businesses and generating returns for investors.

Why do we need capital markets?

We need capital markets to channel savings into productive investments, drive economic development, and create opportunities for wealth generation. They also offer tools for risk management.

What are the types of capital markets?

The two types of capital markets are: Primary Market: For new securities issuance. Secondary Market: For trading existing securities.