The reserves form an integral part of financial planning undertaken by an enterprise. The reserves, which may be defined as part of profits retained from distribution as dividends, can be made for any future uncertainties, projects undertaken, or the corporation’s stability. Therefore, we have two central reserves dealt with in accounting- the capital reserve and the revenue reserve, which perform functions and roles of their own. It must be made clear because both the reserves look the same initially, but develop from differing sources and serve different purposes. Therefore, one should know these differences to ensure smooth usage in business and finance.

A Background on Capital Reserve

A capital reserve is that portion of profits not realised in the normal course of business but by exceptional or non-recurring transactions. There are capital reserves to safeguard against any investments and liabilities related to capital. Hence, the companies maintain such reserves for long-term capital needs, finance infrastructure, cover capital losses, or strengthen their equity position. Thus, these funds are withheld not for dividends or any operational use but solely for strategic purposes, which can be demanded by law or some accounting standard.

Definition of Capital Reserve

Capital reserves are generated from transactions and are not part of routine operating activities. These include profits from the sale of fixed assets, share premiums, or asset revaluation gains. Since these irregular transactions, capital reserves are considered non-recurring and set aside to support long-term financial strength.

Sources of Capital Reserve

The most common sources of capital reserves include gains from selling land or property, proceeds from issuing shares at a premium, government subsidies for specific capital projects, and profit on forfeiture. These gains are not considered operational income and thus form part of capital reserves.

Usage of Capital Reserve

Capital reserves are mainly used for capital investments such as the purchase of press-guild machinery, the expansion of factory capacity, or writing off long-term capital expenses, thereby also strengthening the company’s balance sheet. However, dividends cannot be legally paid from these reserves.’

Revenue reserves are those profits earned from the company’s regular business operations, usually intended to support the operational and financial stability of the company. They are retained earnings available for management to use at their discretion. These reserves serve as a source of liquidity and stabilise earnings for the company, enabling it to meet its obligations during tough times or seize some new business opportunities without going for a fresh capital raise.

What is Revenue Reserve?

Revenue reserves are a type of reserve created out of recurrent earnings accruing from the company’s core or principal business activities. After paying taxes and dividends, the earnings balance usually makes up these reserves. The reserves are regular in income, meaning that they reflect the active operations of the company.

Source of Revenue Reserves

Revenue reserves arise from profits prepared through sales of goods or services, fees, commissions, and all income related to everyday business undertakings. These represent income channels, allowing companies to form revenue reserves annually.

Purpose of Revenue Reserves

The various purposes for which companies put revenue reserves include paying future dividends, expanding their business activities, introducing new products, or they can use such reserves during periods of economic slowdown. These reserves give businesses the financial freedom to respond to the needs that are either planned or unanticipated.

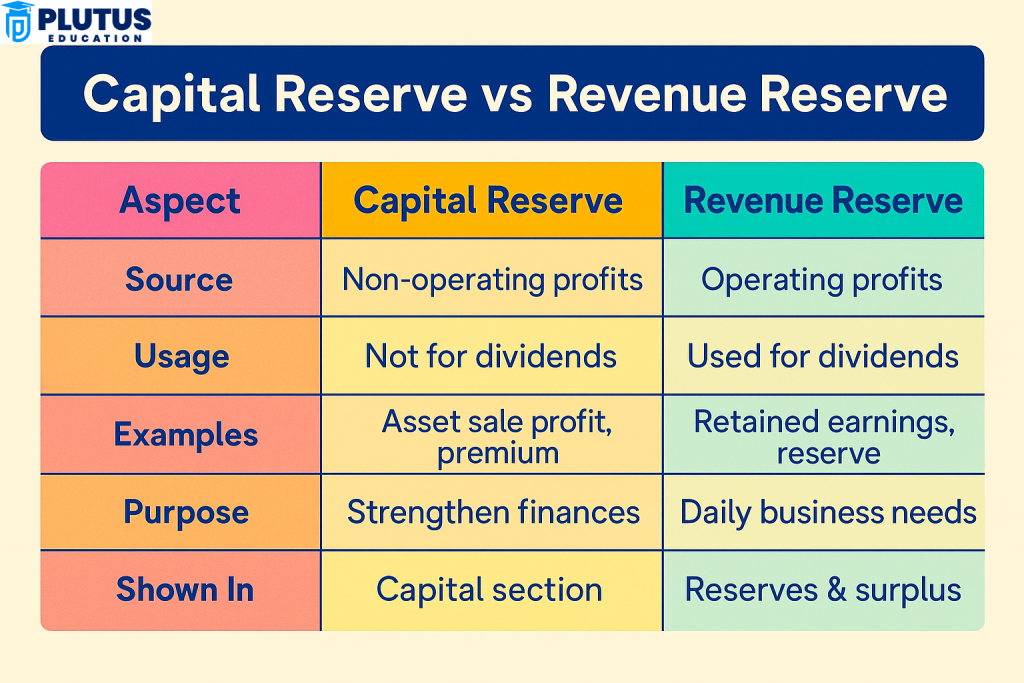

Differences Between Capital Reserve and Revenue Reserve

Foundations on which capital and revenue reserves differ in their mode of creation, purposes of utilisation, and legal status towards them. This means that even though both reserves contribute towards the financial strength of a business, they allow managers and investors to view the situation differently regarding profitability, investment assessment, and sustainability. These differences influence how companies approach risk, reward shareholders, and strategise for growth.

Basis of Creation

Capital reserves arise from one-off and non-operational gains. Revenue reserves come from the routine profits of a concerned business. This difference suggests, among other things, how often they are created and what weight they carry in the financial framework of a company.

Frequency of Formation

Revenue reserves are created regularly and are usually implemented whenever possible at the end of each profitable financial year. In contrast, capital reserves depend on infrequent or extraordinary transactions and may not be regarded as an annual installment.

Uses and Flexibility

Capital reserves are reserved strictly for long-term or capital-related purposes and cannot be used for dividend payments. Revenue reserves would, however, be more flexible and could be used to fund operations, distribute dividends, or support marketing and R&D.

Legal and Accounting Restrictions

Capital reserves are created by strict legal and accounting standards prohibiting their misuse. On the other hand, revenue reserves are distributable profits in the open and typically will not come under such limitations.

Effects on Financial Statements

While capital reserves show under the shareholders’ equity, they do not affect retained earnings. Revenue reserves appear under retained earnings and strongly influence the company’s capacity for dividend payout.

Capital Reserve Vs Revenue Reserve Comparison Table

| Aspect | Capital Reserve | Revenue Reserve |

| Source of Creation | Created from non-operational profits, such as the sale of fixed assets or share premiums | Created from operational profits generated from core business activities |

| Nature of Profit | Non-recurring or exceptional gains | Recurring and consistent profits |

| Frequency of Creation | Created occasionally, only when capital gains occur | Created regularly at the end of every profitable financial year |

| Usage Flexibility | Restricted to specific capital purposes like asset purchase or writing off losses | Can be used freely for dividends, reinvestments, contingencies, or expansions |

| Dividend Eligibility | Cannot be used to pay dividends | Can be used to pay dividends |

| Legal Restrictions | Legally restricted in use under company law and accounting principles | Generally not restricted unless company policy says otherwise |

| Effect on Financial Health | Enhances long-term capital strength and financial security | Improves liquidity, operational flexibility, and dividend consistency |

| Shown Under | Shareholders’ Equity (usually under Capital Reserves on Balance Sheet) | Retained Earnings or Reserves & Surplus in Equity section |

| Examples of Sources | Sale of land/building, share premium, asset revaluation gain | Net operating profit, business income, service revenue |

| Role in Financial Planning | Supports strategic and capital investment goals | Supports routine operations, growth funding, and shareholder value creation |

Importance of Capital and Revenue Reserves

Reserves are considered signs of financial prudence. Capital and revenue reserves help continue business and strengthen the company’s economic base and market reputation. While capital reserves help in the long-term planning and purchasing capital, revenue reserves support day-to-day operations and growth and the return on owners’ investment. In essence, both the reserves shield the business from inadequacies and provide flexibility for the direction of strategic objectives and operational needs.

Importance of Capital Reserves

These are reserves to handle large financial washouts. They are used more for investments in long-term assets, losses of windfall capital, or their usefulness in maintaining creditworthiness. A sound capital reserve instils confidence in the investor and creditor that the business will have a sound footing.

Importance of Revenue Reserves

Revenue reserves are essential for the business’s free and smooth operations. They help the business resist economic cycles, pay regular dividends, and invest in new opportunities. A healthy revenue reserve is an implicit testament to profitability and consistency in financial maturity.

Examples From Real Life

When examining real-life examples, it becomes easier to understand how capital and revenue reserves work. Companies use different methods across sectors depending on their financial objectives, industry requirements, and lifecycle stage. These examples show that both reserves are contributors to sound financial planning.

Capital Reserve Example

A manufacturing company sells a factory building and earns ₹3 crore in profit. This profit is not part of the company’s everyday operations and is transferred to the capital reserve. The amount is later used to purchase land for a new production unit.

Revenue Reserve Example

In an annual operating profit of ₹50 lakh, after meeting tax and dividend obligations, the company transfers ₹15 lakh to the revenue reserve. The following year, that reserve will be used to launch a new e-commerce platform and continue to pay dividends in a quarter of low sales.

Dividend Policy and Reserves

The ability to pay dividends is closely related to the level of revenue reserves. While capital reserves may bolster the balance sheet, they do not directly pay dividends till the time some legal restrictions apply. Revenue reserves are a cushion to keep the dividend stable or predictable, which is critical for retaining investor confidence.

Impact of Capital Reserve on Dividends

Capital reserves are prohibited from being distributed as dividends. Such a use would violate company law, ruin transparency, and create a principle of accounting that undermines the veracity of managers and the credibility of reports. Capital reserves are considered the sacred cow for funding only capital matters.

Impact of Revenue Reserve on Dividends

Revenue reserves allow dividends to be paid in bad times of low profit. They ensure a stable return for shareholders and help build a good reputation in capital markets. Well-managed revenue reserves can appeal to investors and earn better profits.

Difference Between Capital Reserve and Revenue Reserve FAQs

What is the main difference between capital reserve and revenue reserve?

The main difference is their source: capital reserves come from non-operational gains like asset sales, while revenue reserves are created from profits earned through regular business activities.

Can capital reserve be used to pay dividends?

No, capital reserve cannot be used for dividend distribution. It is legally restricted and meant for capital expenditures or absorbing capital losses.

How is revenue reserve used in a company?

Revenue reserve is flexible and can pay dividends, expand operations, cover future contingencies, or fund new projects.

Are both reserves created every year?

Revenue reserves are typically created annually from surplus profits. Capital reserves are only made when there are capital gains from non-operating activities.

Why are capital and revenue reserves significant in accounting?

They help a company manage its finances efficiently—capital reserves support long-term capital needs, while revenue reserves provide operational stability and funding flexibility.