Venture Capital (VC) and Private Equity (PE) are similar in that they fall under private forms of financing; but they are very different in terms of where they direct their investments. VC invests into projects in the early stages of their development, while PE tends to invest in relatively established but underperforming businesses. VC funds tend to be smaller and carry a much higher risk for potentially large returns, while PE funds are larger and pose lower risks with relatively moderate but nonetheless sizable returns. In the investment-related conversation, the Foundational Difference Between Venture Capital and Private Equity because, although both approaches involve investing in companies for growth and returns, the targets, risk levels, and structures of each strategy vary significantly. Venture capital generally seeks to finance startups that have high growth potential and are often based in technology or innovation-driven industries, while private equity targets more mature businesses to improve their operations and profitability and market values. Understanding these differences can help businesses and investors make informed choices based on risk tolerance, investment horizons, and financial goals.This article breaks down the essentials of venture capital vs private equity with examples to help you choose the best funding route

What is Private Equity?

Private equity consists of investment funds that acquire ownership thresholds in established companies solely to improve the operational performance of the business, increase market share, and sell for a profit. Classic examples of private equity would see a PE firm acquire a retail chain to optimize operations and increase valuation. “Private equity firms raise capital by attracting money from institutional investors, pension funds, insurance companies, or wealthy individuals. This capital is then used to acquire significant stakes in mature businesses, typically with a view to effecting strategic changes such as restructuring operations or improving management practices. Private equity is ideal for investors seeking stable returns from well-established companies with room for operational improvement and growth.

What is Venture Capital?

Venture Capital is a form of financing provided to early-stage or startup companies that have high growth potential but lack access to traditional funding sources like bank loans. A common venture capital example is early-stage funding provided to startups like Uber or Airbnb before they became global giants. Venture capital firms invest in startups across sectors like technology, biotechnology, and clean energy, often in exchange for an equity stake. Since investing in companies with unproven business models poses enormous risk, venture capital has the potential for enormous rewards upon success and scaling of such enterprises. Venture capital plays a key role in enabling innovation and entrepreneurship by providing these new companies with funding to grow, scale, and disrupt industries.

What are the Main Differences between Venture Capital and Private Equity?

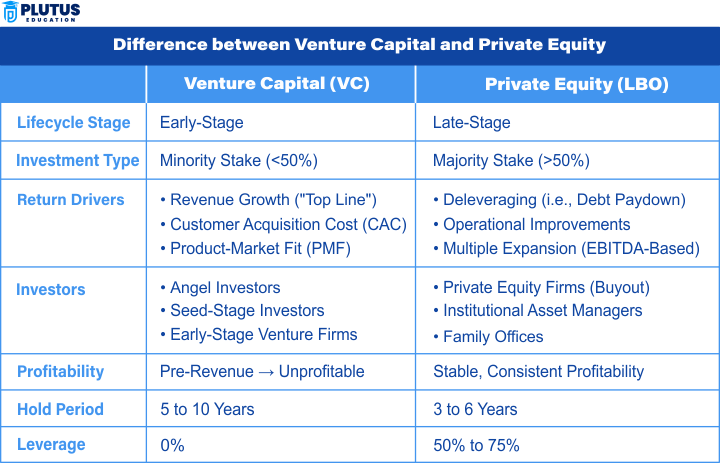

The Difference between Venture Capital and Private Equity lies in their target investments, risk levels, ownership structures, and exit strategies. While both involve investing in companies, venture capital focuses on high-potential startups, and private equity targets mature, established companies. The difference between VC and PE primarily comes down to target companies, investment stage, risk, and ownership control.

Investment Stage

Investment Stage One of the main differences is in the stage at which each type of investor comes into their business. Venture capitalists invest in emerging or early-stage start-up companies that have high-growth potential and are usually unprofitable. Such companies seek investment when they are still in the seed or Series A/B funding stage to scale rapidly. Private equity, on the other hand, targets mature and established businesses that can generate revenue and profit but may include financing to expand or restructure the business or have other use cases involving a current buyout.A real-world venture capital example includes a seed-stage tech startup receiving Series A funding from a VC firm to scale operations

Ownership and Control

Venture capital firms usually take minority stakes, which can be in the range of 10 to 30 percent depending on the funding round and valuation. They strategic this investment by mentorship and guiding users without real control. However, it is a private equity firm that tries to get either a majority or total ownership by buying out entire companies or significant shares that secure their decision-making authority. This enables them to apply requisite changes to increase efficiency, profitability, or just prepare for a future sale. A well-known private equity example is when a firm buys 80% of a manufacturing company to restructure its management and scale profitably.

Risk and Return

The difference in kinds of risk-reward profiles between VC and PE investments is very sharp. Venture capital is a high-risk, high-return proposition, where investors tend to bet on a startup that might fail but also has great potential for really big payoffs when successful. Most startups fail, but the few that become successful often yield exorbitant gains. The opposite of this is true of private equity, whose investments usually involve proven, stable companies, and returns are made from operational improvements, financial restructuring, or eventual resale. Although fairly predictable, PE returns are slower and demand much from performance optimization.

Size and Structure of Investment

Investments done through VC usually average up to a few million dollars as they are distributed over several startups to diversify the risk: seed, Series A, B, and whatnot. On the other hand, a PE deal is usually large; it typically has transactions that involve a hundred million even billion dollars. These investments usually bake into leveraged buyout (LBO) or management buyout (MBO) structures, where consideration involves both equity and borrowed capital to gain control.

Exit Strategy and Time Horizon

The investment horizon for venture capitalists is usually about 5-10 years within which they would invest with an exit plan or strategy, usually via an IPO or selling them to another investor. They mostly consider high-growth potential and scaling the start-up to a level where it can attract acquisition or public listing. However, most private equity firms hold their investments at a much shorter interval of between 3 and 7 years and exit through sales to another PE firm, a strategic buyer, or listing on a public exchange. They aim at improving value in order to exit profitably through strategic enhancement.

| Aspect | Private Equity | Venture Capital |

| Investment Targets | Mature, established companies with stable revenue | Startups and early-stage companies with high growth potential |

| Ownership Stake | Majority stake, often full control | Minority stake, founders retain significant control |

| Risk Level | Lower risk due to established business models | Higher risk due to unproven business models |

| Investment Size | Large investments, often in millions or billions | Smaller investments, with multiple rounds as startups grow |

| Objective | Operational improvements, scaling, and profitability | Funding innovation, scaling startups |

| Exit Strategy | M&A or IPO after restructuring and growth | IPO, acquisition, or exit upon scaling |

| Timeline | Long-term, generally 5-10 years | Medium-term, generally 5-7 years |

| Typical Sectors | Established sectors like manufacturing, retail | Technology, biotechnology, e-commerce, renewable energy |

Private equity provides more stable returns by improving mature companies, while venture capital offers high returns by betting on the success of innovative startups.

How Investors Approach Venture Capital and Private Equity Differently

The Difference between Venture Capital and Private Equity also extends to the investor approach and philosophy. Venture capitalists and private equity firms have distinct strategies based on their target investment types, return expectations, and risk management preferences.

Venture Capital Investor Approach

- Risk Tolerance and Return Expectation: The really lofty return expectations make venture capitalists accept higher risks because they fund ideas and startups that could disrupt the industry by achieving very high returns on investments.

- Championing Innovation and Growth: Generally, venture capitalists will mentor the fledgling entrepreneur and offer introduction or strategic advice to support the startup’s growth journey.

- Staggered Investment Rounds: Venture capital typically involves multiple funding rounds, from seed capital to later stages (Series A, B, C), as the startup matures and scales.

- Focus on IPOs and Acquisitions: Venture capitalists target rapid growth and scale, often planning an exit through IPOs or by selling the company to larger firms.

Private Equity Investor Approach

- Focus on Stability and Profitability: Private equity investors prioritize financial stability, targeting established companies with stable cash flows and growth potential.

- Operational Involvement: Private equity firms often work closely with management to improve efficiency, reduce costs, and optimize operations for better profitability. A relevant private equity example includes improving supply chain efficiency in an established industrial firm post-acquisition.”

- Single Large Investment: Unlike venture capital, private equity typically involves one large investment, often involving full or majority ownership for strategic control.

- Long-Term Growth Focus: Private equity is oriented towards enhancing a company’s market value over time, preparing it for resale at a higher valuation through M&A or IPO.

Venture Capital Vs Private Equity FAQs

1. What is the main difference between venture capital and private equity?

Venture capital pertains to investing in early-stage startups, whereas private equity funds mostly invest in already mature firms, which are either under restructuring or expansion mode.

2. Which is riskier,-venture capital or private equity?

Generally, venture capital is far riskier, as it invests in unproven startups, while private equity is risk-mitigated by investing in large amounts in established firms.

3. Who generally uses venture capital and private equity?

Venture capital is sought after by start-ups and rapidly growing companies, while private equity caters to already established companies or seeks those investors who wish to acquire and fine-tune companies.

4. What difference is there between the returns on venture capital and private equity?

Venture capital can offer larger returns, although it carries a heavier risk, while private equity almost always assures coconscious, stable, and long-term returns, mainly by operational improvements.

5. Do venture capitalists and private equity firms take ownership?

Yes, equity stakes are taken by both, although PE often buys majority or full control, while VCs tend to buy minority stakes.