The full disclosure principle is one of the pillars of modern financial reporting. It states that the company should disclose all material financial information that stakeholders, such as investors, creditors, and regulators, require. The information disclosed presents anything that may need transparency before making an economic decision, be it pending lawsuits, mergers in view, or operating risks that may surprise investors. It is the principle of fairness that deals primarily with no surprises concerning any operating risks. Full disclosure will create a level playing field, comfort with corporate accountability, and moral bases for ethical and trustworthy financial reporting.

Full Disclosure Principles An Essential Aspect Of Financial Employment

Full disclosure is more than a regulation; it is a factor of financial ethics and global trust. The modern financial ecosystem is interlinked, and the slightest distortion or omission may send widespread damaging effects. Since stakeholders today demand high transparency, it is not because they have a right to, but because transparency mitigates risks and fosters confidence. Full disclosure enhances a fair capital market, which promotes sustainable business practices and compliance with international financial standards. Without full disclosure, the financial reports would be incomplete, misleading, or manipulated.

Fairness in a World of Disclosures between Interested Parties

Transparency would affect all stakeholders, from the internal managers to external analysts, equally. That is what financial statements that follow the Full Disclosure Principle should ensure; no stakeholder is partial or privileged to receiving information. Each user gets the same package of complete facts, making decisions justly and leveling the playing field for information. This deters fraudulent reporting or biased internal reporting structures.

Fairness for Enabling Accurate Investment Decision-making

Investors heavily depend on financial data disclosed to them to decide whether to buy, hold, or sell their investments in equity or debt instruments. Lack of complete disclosure could result in investors unwittingly putting their money in a company whose very operations are bedeviled by hidden risks or legal liabilities. By transparently putting these threats and growth prospects on the table, companies allow investors to factor in the expected returns against a relatively more transparent background.

Legal and Regulatory Frameworks Compliance

There are strict rules for disclosure in almost all jurisdictions, and these have been monitored with the aid of agencies like the SEC (U.S.A.), SEBI (India), and several global accounting boards. Such companies avoid hefty punishment and maintain legal integrity with full disclosure. This happens because they can carry on their business without being hindered by restrictions from regulatory bodies.

Ethical Reinforcement of Financial Practices

Full disclosure satisfies not only the laws but internal ethics. Hence, complete transparency with a company internalizes the values of honesty and accountability in the organizational culture. This reduces the chances of internal fraud, misreporting, and misleading practices, giving long-term trust to clients and shareholders.

Judging Credit Risks

Lenders, banks, and financial institutions need to assess liquidity, solvency, and creditworthiness in any company. Complete clarity allows access to proper liabilities, assets, and cash flow statements. As such, the absence of sufficient information will mislead credit scoring models and make wrong predictions about funding decisions.

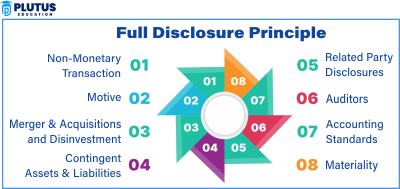

Key Practical Applications of Full Disclosure Principles

However, the principle is its form of practical power that makes companies put it into use through the myriad tools and formats that they apply in their financial statements to communicate sensitive, complex, and related data. The quality of these disclosures makes the financial reports robust, verifiable, and meaningful for interpretation by serious companies. Country variances occur in disclosure standards; however, all serious corporations employ several typical applications of the principle to meet both legal and ethical expectations.

Transparent Reporting through Footnoting

Footnotes make up the backbone of most corporate financial statements. They explain accounting policies, valuation methods, risk assumptions, and deviations from previous periods. For instance, a change in inventory valuation method from FIFO to LIFO would be represented in the footnotes. The core benefit is the guarantee that readers understand the “why” and the “what,” but not the numbers.

Management Discussion and Analysis (MD&A)

MD&A tells context. It is management’s take on financial performance, industry trends, market expectations, and plans. This section helps users link into the company’s strategy and direction, not just bare financial numbers. Poor results in performance can be justified in the section, or forward-looking optimism can be put forth contingent on operational changes.

Importance of Supplementary Schedules

These are supplementary schedules that contain data with greater granularity regarding cumulative elements, such as futures on debt maturity, revenue by segment, or capital expenditures. These fine tables allow analysts to understand key obligations or returns in finer detail. This one, in particular, is critical for larger corporations with several divisions.

Auditor’s Reports as a Verification Tool

The independent audit report certifies whether the financial statements are in accordance with the accepted accounting principles. Such reports will indeed also cite instances of non-compliance or deficiency in disclosures. For stakeholders, auditor assurance raises trust in the quality and integrity of the financial reports.

Risk Factor Disclosures and Business Environment

Operational risks, such as everything from supply chain instability to cyberattacks and threats from the industry (market volatility), will have to be included. Geopolitical risks, legal challenges, and regulatory uncertainties will be covered. Risks of this type certainly complete the picture to ensure that investors do not wake up one morning and find a value eroded suddenly by unanticipated risks.

Difficulties and Restrictions of the Full Disclosure Principle

However, challenges exist in full disclosure. This may be one of the most significant disadvantages of a full-disclosure policy: the dilemma between transparency and secrecy. Extracompany disclosure or erratic reporting standards may significantly limit the usefulness of financial reports. The following are the notable limitations that corporations face while trying to apply this principle.

Information Overload and Its Effects

Too much disclosure can confuse rather than clarify. When a lot of the report has pages full of technical details, stakeholders will be confused about what is materially significant. Causing fatigue in information and paralysis in decision-making would, at least, be prevalent among small investors.

Very High Cost of Complete Compliance

In this case, the smaller firms and start-up businesses suffer from compliance cost burdens. Full compliance necessitates hiring audit experts, legal consultants, and internal compliance officers, which entails a sufficiently sizable amount in the budget. Such an extra financial burden could either push one not to comply fully or postpone reporting.

Risk of Unnecessarily Revealing Sensitive Information

Over-disclosure may lead to revealing proprietary strategies or trade secrets to competitors; product pipeline plans or marketing tactics may be disclosed such that the firm absolutely loses its competitive edge. As such, the companies are left trying to balance on a razor’s edge between transparency and strategic confidentiality.

Subjective Interpretation of Materiality

Materiality is the measure of the importance of an item in users’ decision-making. However, something that one firm considers material would not be acceptable to another firm. Such subjectivity will lead to differences in disclosure practice between companies, even among those in the same industry, hence diminishing comparability.

Legal Liabilities for Unintentional Omissions

From both intent or carelessness, omitting material facts to a greater or lesser extent may lead to lawsuits or governmental action. Even minor transgressions can be construed as misrepresentation in compliance-minded markets. Such liabilities hurt the image and cause the loss of corporate sales.

Global Standards and Regulatory Requirements

Platforms for global financial systems depend on some standard codes related to disclosures for the interception of cross-border investments. Regulatory frameworks like GAAP and IFRS guide companies in their reporting obligations. Such standards ensure consistency, comparability, and global trust in financial data. Major frameworks and bodies enforcing the Full Disclosure Principle across regions include the following:

GAAP and the Full Disclosure Framework

The Generally Accepted Accounting Principles (GAAP) in the U.S. mandate full disclosure of all pertinent information, financial or operating, pending litigation, regulatory fines, and disruptions to operations. GAAP dictates the rules for severe compliance via specific formats and guidance.

The IFRS Way of Disclosure

Adopted in over 140 countries, the International Financial Reporting Standards (IFRS) prescribes a principles-based approach. The company shall exercise judgment on relevance and materiality about the facts disclosed to ensure their clarity. IFRS also encourages notes, schedules, and explanatory paragraphs.

Disclosures Rule of SEC Enforcement

The American Securities and Exchange Commission (SEC) requires that both quarterly (10-Q) and annual (10-K) reports contain extensive disclosures concerning risk factors, legal proceedings, executive compensation, and forward-looking statements, all of which are subject to stringent timelines.

Regulations of SEBI Regarding Indian Organizations

The above rule is applicable to Indian listed entities, with SEBI requiring compliance with the disclosure requirements contained under Listing Obligations and Disclosure Requirements (LODR). The rules provide guidelines on the timely disclosure of material events, earnings reports, resolutions of the board, or any events that affect shareholder value.

Role of External Auditors in Compliance

Auditors act as watchdogs. They verified whether disclosures met regulators’ expectations and would determine if omitted information would have otherwise misled stakeholders. A clean audit opinion boosts investor trust, whereas a qualified report may raise red flags and sully a reputation.

Full Disclosure Principle FAQs

What is the Full Disclosure Principle?

The Full Disclosure Principle in Accounting involves the requirement that all companies record in their financial statements all relevant financial information to audiences in order to provide transparency and valuable information for decision-making.

Why do investors require full disclosure?

Investors thus could accurately evaluate the risks, performance, and outlook of a company, improving their ability to make prudent investment decisions.

How can footnotes support full disclosure?

Footnotes provide more detail on accounting policy, risk exposures, and assumptions that underlie financial figures, thus enhancing transparency.

What risk do companies face if they do not disclose entirely?

They are risking regulatory penalties and lawsuits, unfair investor sentiments, and damaged reputations—none of which bode well for the financial position.

Do both IFRS and GAAP mandate full disclosure?

Both IFRS and GAAP require full disclosure to ensure that stakeholders receive complete and accurate financial information.