A trial balance is a report that summarizes with all the debit and credit balances from a company’s general ledger. It is one of the important steps in accounting as it checks the correctness of financial records before financial statements are drawn. To prepare a trial balance you need to place each account from the general ledger with its debit or credit balance and sum up the debit and credit columns to see that they agree. A balance trial helps check accuracy in record accounting before going to prepare financial statements like the balance sheet. The preparation of the trial balance requires accountants to list all general ledger accounts with either debit or credit balances, and this goes a long way toward ensuring that the books are well balanced and all accounting entries are correct. This article describes the steps to produce a trial balance, the main approaches, and its connection with the balance sheet and ledger entry.

What is a Trial Balance?

A trial balance is a report of the balances of all ledger accounts within an organization so that debits equal credits. It is a part of the double-entry bookkeeping system that gives a basis to financial statements’ accuracy.

The first objective for preparing a trial balance is to detect mathematical errors made when recording financial transactions. It will not guarantee the absence of any accounting errors but will, however, identify differences. Thus, if the trial balance is not balanced, one would suspect mistakes in posting, such as transpositions, wrong amounts, and misclassifications.

Key components of a trial balance include:

- Debit Balances: Accounts that typically carry a debit balance, such as assets and expenses.

- Credit Balances: Accounts that typically carry a credit balance, such as liabilities, equity, and income.

Preparing a trial balance ensures that the accounting equation holds:

Assets = Liabilities + Equity

which is crucial because one can be assured of getting correct accounting records before finalizing statements.

How to Prepare a Trial Balance?

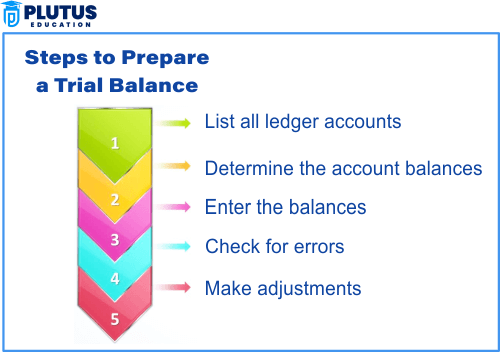

Before we discuss how to prepare a trial balance, it is important first to know how a trial balance is structured and what accounts go into and make up the balances. Preparing a trial balance requires exacting attention to detail to see that all ledger entries have been correctly posted and totaled. The steps that then comprise the process of preparing a trial balance are as follows:

Step 1: Calculate the Account Balances for Your Ledger Accounts

The first thing to do when preparing a trial balance is to calculate the balances of all the ledger accounts. All transactions of a company are recorded in a general ledger. For every account in the ledger, you should find out if the account has a debit or credit balance.

- Asset accounts (e.g., cash, accounts receivable) generally have debit balances.

- Liability accounts (e.g., accounts payable, loans payable) generally have credit balances.

- Equity accounts (e.g., capital, retained earnings) have credit balances.

- Expense accounts (e.g., wages, rent, utilities) usually carry debit balances.

- Revenue accounts (e.g., sales, service revenue) carry credit balances.

The balance of an account can be determined simply by summing up the debits and credits within that account for a given period. The amount resulting from this sum will indicate whether the account has a debit or credit balance.

Step 2: Record Credit and Debit Balances on Your Trial Balance

Before recording the account balances, it’s helpful to understand the standard trial balance format, which typically includes columns for account names, debit balances, and credit balances. Now that you’ve calculated the balance of every account, you need to record these in the trial balance. You need to prepare the accounts into two columns: debit balances and credit balances.

For example:

- In the debit column, you would record asset and expense accounts with their balances.

- In the credit column, you would record liabilities, equity, and revenue accounts with their balances.

The trial balance should have all the ledger accounts and their respective balances. This step helps organize the data before proceeding to the final calculation steps.

Step 3: Calculate the Total in Your Credit Column

To gather and then accumulate the credits column after all have been recorded in their respective columns. Credits are added up on the credit side and totaled because that is the next thing to do. But just to be safe, double-check the totals before continuing. The total in the credit column states all liabilities, equity, and revenue.

Step 4: Calculate the Total in Your Debit Column

Similarly, calculate the total in your debit column by adding up all the debit balances. The total should be all the assets and expenses. It would normally appear from a trial balance whether the totals of debits and credits are equal, thus making it possible to verify your accounting records as correct.

Step 5: Compare Your Debit and Credit Totals

The next thing in preparing a trial balance is to compare the total debits with the total credits. Ideally, these two totals should match. If this is the case, this would mean that your books are balanced, meaning no obvious mathematical errors in the accounting system.

However, if the debits and credits do not match, you need to perform further investigation to identify and correct any errors, such as:

- Transactions were recorded in the wrong account.

- Incorrect addition or subtraction of amounts.

- Errors in posting the transaction to the wrong side (debit instead of credit, or vice versa).

Step 6: Look for Errors

If the totals in the debit and credit columns do not match, you will need to investigate and correct the errors. Common mistakes include:

- Posting errors: This occurs when the wrong amounts are entered into accounts.

- Transposition errors: Occurs when digits are reversed (e.g., 540 vs. 450).

- Omissions: Sometimes, transactions are missed or forgotten.

Look carefully through the entries for what the problem might be. Run through all accounts and checks to see whether everything adds up. Then, if it does not, there may be nothing to do but look up the original ledger or journal entry.

Step 7: Close Your Trial Balance

After completing the last step, compare it to a basic trial balance example to ensure formatting and calculations are accurate. You’re done balancing your debits and credits. Now, let’s get ready to close the trial balance. To close your trial balance, you need to prepare it for future use in creating the balance sheet and other financial statements. If you’ve found no errors, then your trial balance is ready for further use in the accounting cycle.

What Are the Methods of Preparing Trial Balance?

Regardless of the method used—total or balance—the correct trial balance format should always be followed to ensure proper reporting. There are two main methods used to prepare a trial balance: the Total Method and the Balance Method. Let’s explore each one in detail.

1. Total Method

All ledger balances are posted directly in the total method into the trial balance. For instance, the sum of all debit entries and credit entries is calculated separately, and the trial balance is generated by just listing them.

- The total of the debit column is compared to the total of the credit column to verify the books are balanced.

- The total method is more straightforward but may not detect errors where the balances are mixed up or wrong.

2. Balance Method

The balance method, on the other hand, focuses on determining the individual balance of each account (rather than the total sum) and recording it in the trial balance.

- Each ledger account is checked to ensure that it is balanced.

- The balance method is more precise and ensures accuracy because the balances of individual accounts are checked and verified before being recorded.

How Do You Match a Trial Balance?

Matching the debit and credit totals is easier when using a clear and structured trial balance format. To balance a trial balance, you must ensure that the sums of debits equal the sum of credits. This becomes a critical step in how the financial data is maintained: when the two sides cannot match, you must start by checking for errors in any of the ledger entries entered and ensuring that every debit account has a corresponding credit one.

- Review individual account balances and verify their totals.

- Check for common mistakes, such as transposed numbers or omitted entries.

- Ensure every transaction is accounted for, and verify the trial balance is complete.

If everything checks out, the trial balance is considered “matched” and is ready for further use in preparing financial statements.

How to Prepare a Balance Sheet from Trial Balance?

A balance sheet is a statement of the finances summarizing the assets, liabilities, and equity of a business. Once prepared with a trial balance, it is the basis upon which to build the balance sheet.

- Assets: List all the assets from the trial balance, including current and non-current assets.

- Liabilities: List all the liabilities, separating current liabilities from long-term liabilities.

- Equity: Include owner’s equity or shareholders’ equity, which is the difference between assets and liabilities.

The balance sheet should balance, with assets equal to liabilities plus equity.

How to Prepare a Trial Balance from Ledger with Example

If you’re wondering how to prepare a trial balance using ledger accounts, follow these practical steps to ensure accuracy. Using the correct trial balance format helps ensure consistency and accuracy across financial periods. To prepare a trial balance from the ledger, follow these steps:

- Step 1: Review each ledger account and identify its balance (either debit or credit).

- Step 2: Record each balance in the appropriate column of the trial balance (debit or credit).

- Step 3: Calculate the total debits and credits.

- Step 4: Ensure the totals are equal; if not, investigate the errors.

Example: If the ledger has the following balances:

- Cash: $1,000 (debit)

- Accounts Payable: $500 (credit)

- Revenue: $800 (credit)

- Expenses: $400 (debit)

The trial balance would look like this:

| Account | Debit | Credit |

| Cash | 1,000 | |

| Accounts Payable | 500 | |

| Revenue | 800 | |

| Expenses | 400 | |

| Total | 1,400 | 1,300 |

Mastering how to prepare a trial balance is essential for ensuring that your books are accurate before finalizing your balance sheet and other financial statements.

How to Prepare a Trial Balance FAQs

1. What is trial balance in accounting?

Trial Balance: The trial balance is the statement that summarizes all the ledger accounts balance at a particular date and ensures that total debits equal total credits. It is used before preparing the financial statements to ensure that bookkeeping has been done in an accurate way.

2. Why is it important to prepare a trial balance?

It helps find mathematical errors in the double entry system and balance the accounting books. Trial balance is an essential step towards preparing accurate final accounts such as income statement and balance sheet.

3. What are the steps for preparing trial balance?

List down all ledger accounts along with debit or credit balance, total each column and check whether total debits equal total credits, if they do then the trial balance is arithmetically correct.

4. What all accounts are included in the trial balance?

All types of accounts are included in the trial balance-assets, liabilities, equity, income, and expenses, according to their respective debit or credit balances.

5. What if the trial balance does not match?

If the total debit and credit do not match, it indicates, there is an error in journal entries, posting, or computation. Hence the next step is to check all the entries and find out where there is a mistake to correct it.