Insurance is an instrument of finance and risk management. It is said to be a contract in which one party, the insurer, guarantees compensation to the other, the insured, for specific losses in return for premium payments. In essence, insurance provides financial coverage, facilitates risk pooling, and gives stability to persons, entities, and sometimes even the government. Insurance can be preventive against uncertain realities in life for families, and indeed, valuable to enterprises trying to recover from losses that could not have been foreseen. Insurance plays an integral part in ensuring economic activity continues and educating citizens to plan for the long term. This article will discuss its key features, types, governing principles, and role in society.

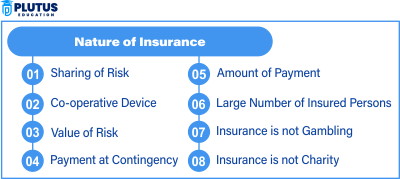

Key Features Defining the Nature of Insurance

The fundamental qualities of insurance define it as a financial risk mitigation and safeguarding mechanism. Some of these features emphasize the structured way through which insurance operates- the legal agreements, risk analysis, and equitable compensation. Recognition of these qualities is helpful in understanding how insurance operates in practice or theoretical situations.

Risk Management as a Core Importance

One of the main features of insurance is that it is part of risk management: financial risks are moved away from the individual or business and shifted onto the shoulders of the insurance company. Thus, it protects the insured from unpleasant happenings, such as diseases, accidents, and property losses. Protection for even calamitous losses by paying a relatively small premium.

Pooling of Risks Across Policyholders

Insurance functions on risk pooling; it collects premiums from numerous policyholders into a common fund. Then, this fund is used to compensate those who suffer losses. It spreads the financial loss impact on a broader group, making heavy losses manageable for any individual.

Legal Contract that Creates a Binding Obligation

An insurance policy, in its nature, is an enforceable legal contract under which both parties set out the terms, conditions, and obligations. The agreement specifies the covered risks, responsibilities for the payment of premiums, claims procedure, exclusions, etc. It aims at transparency and accountability.

Claims Settlement: The Indemnity Principle

Any loss is said to be indemnified if the insured is put back in the position he would have been but for that loss. This takes care to prevent the insured from making profits out of claims and emphasises the premise that insurance is more in the nature of protection than it is in that of speculation.

Financial Security and Peace of Mind

Insurance protects against uncertainties of the future and gives peace of mind. Whether through life insurance, it could create opportunities for a child’s education, or medical care with health plans, it allows people to lead their lives and run their businesses with the hope that all will be well.

Categories of Insurance Depending on Its Nature

Insurance is not a panacea because of its very constitution; it can tailor its products to operate on a number of varied needs. The kinds of insurance reflect what amounts to a highly flexible instrument for covering life, health, property, and liability risks when it comes to application. Each serves a distinctive end that type was designed to provide financial protection.

Life Insurance for Long-Term Financial Assurance

Life insurance provides a lump sum payment to the beneficiaries of the insured at the moment of the insured’s death. It ensures the family’s economic stability and covers costs for things like mortgages, education, and everyday life. The different variants are term life, whole life, and endowment policies.

General Insurance for Common Coverage

General insurance describes non-life insurance products covering assets and liabilities, as vehicle insurance, travel insurance, health insurance, and property insurance. It offers indemnification for losses suffered by the insured as a result of theft or damage, or medical costs associated with such event.

Marine Insurance for Transit Risks

Marine insurance covers goods and vessels transporting their mode of transport from sea to sea. Risks include shipwreck, piracy, or even damage during transit. For businesses that deal with international trade, marine insurance is very critical.

Liability Insurance for Legal Protection

Liability insurance shields individuals and organizations against legal liabilities subject to such claims arising due to accidents, negligence, or malpractice. This includes professional indemnity, public liability, and employer liability insurance, all of which are very necessary for professionals and companies.

Reinsurance to Mitigate Risk Exposure of an Insurer

Reinsurance is when insurance is given to insurance companies. Through this process, one company can transfer part of the risk portfolio for which it is liable to another company. In this way, it also protects the insurer from being overstretched by large-scale claims.

Tenets Dictating the Nature of Insurance

Insurance operates on principles that create fairness, trust, and responsibility between the insured and insurer. These principles of insurance form the basis of transparent operation and are ethical contracts that endorse the credibility of the insurance system in the financial system

Utmost Good Faith Principle

The principle demands that the insurer and insured behave honestly by revealing all relevant facts, for instance, any pre-existing health conditions and whether the insured is obtaining health insurance. Otherwise, such omission may render the contract void.

Insurable Interest Principle

An insurable interest is the financial or emotional interest that the insured has in the very subject matter of insurance. You can insure your own house or car, but not that of a stranger. This makes the contract lawful and means.

Principle of Indemnity

This principle ensures that the insured suffers a real loss and is therefore such that they should be compensated only for the actual loss, so that overcompensation would not be exercised. For example, a home will be either repaired or rebuilt to its original value after being set ablaze and not improved in such a way as to gain profits.

Principle of Subrogation

In this case, when his compensation is paid, the insurer receives the right to sue a third party who is responsible for the loss. For instance, if your car has been damaged by another vehicle, your insurance company may recover this amount from the wrongdoer.

Principle of Contribution

In case more than one policy covers the same risk, then all insurers share the claim amount proportionately as per the terms of the policies. Thus, ensuring that the insured does not benefit more than the actual loss by claiming from multiple sources.

Critical Concerns of Insurance in Modern Society

Insurance is more than a financial product; it’s a pillar of economic and social development. The present importance of insurance in society is to allow individuals, businesses, and governments a free environment within which to transact business, invest in the future, and recover losses using effective methods.

Financial Security Against Uncertainty

One of the compensatory mechanisms brought to bear by insurance is the paying out of some compensation in the event of the occurrence of unforeseen events; it can be clear, e.g., a store that might be flooded or a medical emergency that would draw savings down. Down-the compulsion of insurance brings about stability.

Promoting Saving and Investment in the Long Term

A sizeable portion of life insurance policies includes investment, together with protection. For instance, life insurance involves disciplined savings combined with investment-linked returns, all of which can help policyholders plan for critical future events in life, such as retirement or schooling for significant life events.

Promoting Economic Stability and Growth

Collected premiums are injected into the building of an economy in the infrastructure, housing, and national development projects. All of these are capital mobilisations that contribute to growth within an economy and job creation.

Creates Risk Awareness and Encourages Preventive Steps

Because insurance is bought, people are likely more aware of risks and perform more preventive measures. For example, businesses might set up fire alarms or a security system so they could save on their premiums; the less they risk, the less they are likely to pay.

Reinforce Public Trust in Financial Systems

Insurance builds public trust by offering an organised means by which to respond to risk. Such security encourages people to start businesses, raise loans, and invest in a buoyant economy.

Nature of Insurance FAQs

What is the nature of insurance ?

It is by nature that insurance improves financial protection through the transfer of risk by individuals or businesses to an insurer under a contract.

Insurance categories: What are they?

Types include those providing life insurance, general insurance, marine insurance, liability insurance, and reinsurance, each kind safeguarding specific types of needs.

What principles govern the nature of insurance?

Insurance operates under some key principles that operate in utmost good faith, indemnity, subrogation, insurable interest, and contribution towards fairness and trust.

Why is Insurance important in these modern societies?

Insurance is about giving the individual and the economy financial security, providing stability in times of economic uncertainty, helping people save, and promoting a risk-aware culture that makes it so crucial in the present time.

How does the nature of insurance promote fairness?

This way ensures fairness in operation by being based on long-standing principles, compensating according to actual losses, and therefore not allowing inequitable enrichment/theft.