The principles of life insurance form the foundation of the life insurance industry. These principles ensure that life insurance provides fair and reliable protection for the policyholder and at the same time ensures that insurance companies operate sustainably. A life insurance policy is essentially a contract between the policyholder and the insurer in which the insurer offers a payout to the policyholder after their death or when certain events have occurred. This information is, therefore, critical to any person looking to acquire life insurance as they would know how the system works to safeguard their loved ones.

What is Insurance?

Insurance is a financial product designed to provide protection against the financial impact of unexpected events or risks. It involves a contract between the insured (policyholder) and the insurer (insurance company), where the policyholder pays regular premiums. In return, the insurer promises to provide a sum of money or other benefits in the event of certain risks, such as death, illness, or accidents.

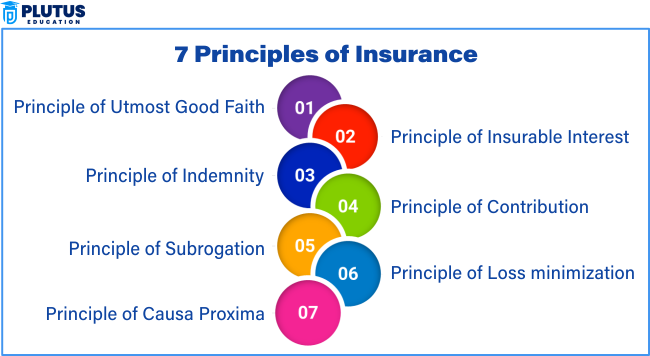

Principles of Life Insurance

The principles of life insurance are fundamental rules that govern how life insurance operates. These principles ensure that life insurance policies are fair, reliable, and sustainable for both the policyholder and the insurer. Several key principles guide the life insurance process:

Principle of Utmost Good Faith (Uberrimae Fidei)

The principle of utmost good faith is the foundation of all insurance contracts, including life insurance. This principle requires both the policyholder and the insurer to act honestly and disclose all relevant information. The policyholder must provide truthful information regarding their health, lifestyle, and other factors that may impact the life insurance policy. Similarly, the insurer must clearly explain the terms, conditions, and exclusions in the policy.

- Example: If a person has a pre-existing medical condition and fails to disclose it while purchasing life insurance, the insurer may refuse to pay the claim upon the policyholder’s death.

Principle of Insurable Interest

The principle of insurable interest states that the policyholder must have a financial interest in the life or property they are insuring. In the case of life insurance, the policyholder must have a legitimate relationship with the person they are insuring, such as a spouse, child, or business partner. This principle prevents people from taking out life insurance on individuals with whom they have no financial relationship.

- Example: A person cannot buy a life insurance policy on a stranger unless they can prove some form of financial dependency or relationship.

Principle of Indemnity

The principle of indemnity means that the insurance policy is designed to compensate the policyholder for their loss but not to allow them to profit from it. In life insurance, this principle is implemented through the sum assured, which is the amount paid out in the event of the policyholder’s death. The amount received should only compensate for the loss experienced by the beneficiaries, not provide a financial gain.

- Example: If the insured person passes away, the beneficiary will receive the death benefit, but it should be reasonable and proportional to the financial loss caused by the policyholder’s death, not more.

Principle of Contribution

The principle of contribution applies when the policyholder has multiple life insurance policies from different insurers for the same risk. If the risk occurs and the claim is made, each insurer contributes to the payout based on the sum insured. This principle prevents the policyholder from receiving more than the actual loss.

- Example: If a person has two life insurance policies and passes away, both insurance companies will pay a portion of the death benefit based on the coverage amounts.

Principle of Subrogation

The principle of subrogation applies in cases where an insurance company steps into the shoes of the policyholder to recover costs from a third party that caused the loss. Although this principle is more common in property and health insurance, it can also apply in certain situations in life insurance when there is a third party involved, such as in accidental deaths.

- Example: If a life insurance claim is paid due to an accident caused by a third party, the insurer may attempt to recover some or all of the costs from the party responsible for the accident.

Principle of Risk Pooling

Risk pooling is a fundamental concept of insurance, where the insurer pools the premiums of all policyholders to create a fund that can be used to pay claims. This system spreads the financial risk among all policyholders, reducing the financial burden on any single individual. By pooling the risks, insurance companies can offer coverage to more people at a lower cost.

- Example: In a large group insurance plan, the premiums collected from thousands of individuals allow the insurer to pay out claims when needed, without causing financial strain on the insurer.

Table on Principles of Life Insurance

| Principle | Description |

| Utmost Good Faith | Both insurer and insured must disclose all relevant and material facts honestly. |

| Insurable Interest | The policyholder must have a financial or emotional interest in the life insured. |

| Law of Indemnity | Not strictly applicable to life insurance, as it pays a fixed amount, not compensation for loss. |

| Principle of Subrogation | Not applicable to life insurance, as there is no transfer of rights after claim settlement. |

| Principle of Contribution | Doesn’t apply, as multiple policies can be claimed in full for life insurance. |

| Proximate Cause | Used mainly in general insurance; less relevant in life insurance unless linked with cause of death. |

Importance of Life Insurance

Life insurance plays a critical role in financial planning by providing financial security to your loved ones in case of an untimely death. Below are some reasons why life insurance is important:

- Financial Protection for Family Members: Life insurance provides financial support to your family after your death. If you are the main earner, the death benefit helps cover living expenses, debts, and future needs like education.

- Peace of Mind: Knowing your family is financially protected in your absence brings peace of mind. Life insurance reduces the worry about their financial future.

- Debt Repayment and Funeral Costs: Life insurance helps settle debts like mortgages, loans, and credit card bills. It can also cover funeral expenses, preventing your family from using their savings.

- Tax Benefits: Many life insurance policies offer tax benefits. In many cases, death benefits are tax-free, and the cash value of the policy grows without being taxed until withdrawal.

- Wealth Creation: Some life insurance policies, like Whole Life or Universal Life, accumulate cash value over time. This can be used for emergencies or retirement.

Principles of Life Insurance FAQs

1. What are the main principles of life insurance?

They include utmost good faith, insurable interest, indemnity, proximate cause, and contribution.

2. What does ‘utmost good faith’ mean in life insurance?

It means both the insurer and the insured must disclose all material facts honestly at the time of contract.

3. What is insurable interest in life insurance?

It refers to the legal right of the policyholder to insure someone whose life or well-being impacts them financially.

4. Does the principle of indemnity apply to life insurance?

No, because life insurance provides a fixed sum on death or maturity, not compensation for actual loss.

5. Why are these principles important?

They ensure fairness, transparency, and legal validity in life insurance contracts, protecting both parties.