Each individual, enterprise, or venture confronts issues. Some are insignificant and some are huge. These issues are known as dangers. Hazards can stall work or cause harm. To remain protected, we need to manage these dangers before they expand. That is the place the danger administration process assists us with doing as such. It gives a straightforward and clear arrangement to oversee issues before they happen.

Hence, what precisely is the risk management process?

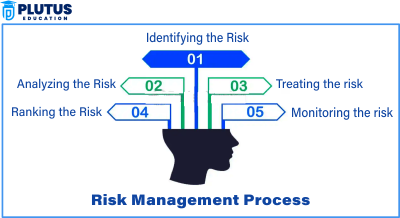

It is a stepwise way to recognize dangers, examine them, decide how terrible they are, plan to settle them, and after that check again if the arrangement is working. This procedure is not done only once. It is a cycle. We keep rehashing it to stay safe.

For instance, consider a shop proprietor who plans to offer products during a celebration. On the off chance that he doesn’t check for hazard, like climate issues, late conveyance of items, or fewer purchasers, he may look on misfortune. In any case, in the event that he utilizes the danger administration process, he can maintain a strategic distance from these issues. He can arrange early, keep extra stock, and even plan limits. This makes his business preferable.

The danger administration process is utilized by huge organizations, schools, clinics, and even government workplaces. Truth be told, in the present reality, it is additionally educated in schools and colleges. It assists understudies with arranging their objectives, examine all the more productively, and even pick preferable vocations.

What is Risk Management Process

The risk management process is a smart and simple way to prepare for future problems. It Risk management helps both individuals and organizations make better decisions and remain prepared for whatever may come. It begins with identifying potential risks and ends with verifying whether one’s actions addressed them effectively or if more work is still needed.

Risk can come in many forms—the possibility of financial loss, harm to one’s reputation, breaking regulations, or encountering an unexpected crisis. When risks go unmanaged, they have potential to intensify and negatively impact objectives. This is why the savvy consistently apply this process routinely.

The methodology also helps anticipate future events. In exploring risks, planning is strengthened. It cultivates caution without instilling fear. With a defined system, difficulties can be met with composure.

Prudent risk administration likewise applies outside commercial ventures. A student intending to take an essential test ought to consider potential hindrances, for example, illness, power blackouts or forgetting notes. By arranging appropriately, issues can be circumvented. Similarly, associations utilize this system to reinforce operations.

Identify the Risk

The first step in effective risk management is to comprehensively uncover anything and everything that could potentially go awry. If issues aren’t brought to light, one cannot possibly devise solutions to address problems at their root. Thus, risk identification is paramount.

When undertaking risk identification, we cast a wide net to catch all potential troublespots. For example, in an academic setting, power failures prior to exams pose problems. In a medical facility, shortages of vital medicines are cause for concern. Retailers must consider delays inhibiting product delivery. And for enterprises, new regulations or price alterations can disrupt operations.

Many organizations assemble cross-functional teams to cast a discerning eye over operations to surface risks. They delve into historical records, interface with subject matter experts, and solicit customer input to gain insight. Tools like interviews, surveys and checklists are employed to leave no stone unturned.

Another prudent approach is examining each element of the work. Within a delivery company, vehicles, drivers, fuel costs, traffic rules, weather patterns and client feedback all warrant scrutiny – as each sphere harbors its own set of risks just waiting to materialize.

Analyze the Risk

After you find the risk, the next step is to study it. This is called analyzing the risk. Here, you ask two simple but important questions:

- How big is the risk?

- How likely is it to happen?

Understanding how vulnerabilities affect operations is an important factor when considering risks. For instance, if operating a retail shop, one day without functioning computing systems can make the income earnings impossible. This, therefore, represents medium peril. If the retail shop is now burned by fire, then it will hurt so many financially. This is a high threat.

Many companies use a tool referred to as a hazard matrix-which looks like a grid of rows and columns-to evaluate risks. The likelihood of a peril recorded on one end along with its scope being aped opposite that. The position of risky things, therefore, identifies whether they are minor, moderate, or extreme.

Some companies even analyze the SWOT. In this analysis, strengths, weaknesses, opportunities, and threats are analyzed. It can further differentiate risks brought into actual business operations as to those factors extraneous to it.

Consequently, the objective of assessing risk is to scrutinize each vulnerability thoroughly. Upon accomplishing this, it is comprehended which dangers necessitate swift action and which can endure. It aids in preparing one’s time and finances solely for the most serious perils.

Evaluate or Rank the Risk

But the next step into the depths of the study of risks requires the priority setting. Ranking which hazards pose in some sense greater threat and which pose rather less is a fundamental condition of good risk management.

The categorization of the risks would facilitate a judicious allocation of limited resources. Fixing every single vulnerability simultaneously is an impossible feat, so highest priority must be afforded to most severe exposures to dodge future complications. Quantifying jeopardies through scoring likelihood and impact severity on a scale, often from one to five, then multiplying those figures generates high numbers for grave risks, mandating prompt remediation beforehand.

Meanwhile, lower-scoring threats can be addressed at a more leisurely pace once more pressing issues have been addressed, preventing stress and burnout from an all-at-once approach which resources could not sustain.

Let’s take an example. Suppose a business finds three risks. One risk has a score of 5 x 5 = 25. Another one is 2 x 3 = 6. The third one is 1 x 2 = 2. The business must fix the one with a score of 25 first.

Ranking enables you to better plan your day. It is also the means by which your team remains focused. Everyone works more smoothly and speedily when they are aware of the most important risk that they can face at the time. So, this step ensures that you explain your risk plan more simpler and straight to the point. They will promptly implement the risk by listing them and then prioritizing them.

Treat the Risk

Now that the hazards have been ranked, the focus shifts to their appropriate control. Handling the risk involves active attempts to repair, mitigate, or avoid the damage caused. This is where one of the important phases of risk management occurs.

There are many strategies to deal with risk. The first way is to avoid the risk. This means to stop those activities that can cause harm. For example, an organization may find that the risk of a project is too risky and decide not to undertake the project.

Next, you can reduce the risk. This means that risk will be reduced: precautions will be taken to decrease its intensity. For example, if a store fears fire, it will install smoke detectors and inform its staff about the necessary evacuation steps.

You can also transfer risk as a third party. In this example, insurance is involved. The firm pays premiums to the insurer and thus assumes liability for losses.

Lastly, one can accept the risk. This strategy is used in cases where risk is minimal. Just monitoring it is enough, but not taking heavy preventive measures.

To confront a risk effectively demands crafting a risk mitigation plan. The plan must outline what the hazard is, who will manage it, the approach, and the timeline. This guarantees teams act promptly without confusion. All involved comprehend their designated roles unambiguously.

Monitor and Review the Risk

Many people think that once a risk is managed, the job is done. But that isn’t true. Continuously monitoring and examining the risk is the final step in the risk management process. This means consistently checking if your plan is effective.

Hazards alter with time. A risk that was insignificant before can become substantial later. Additionally, new dangers can emerge. So, you must keep closely observing your system on a regular basis.

To systematically monitor the risk, businesses employ instruments like reports, meetings, and reviews. They additionally keep a risk register. This log retains all details about hazards, actions taken, and the current status. It helps individuals stay alert and prepared to respond.

Monitoring also helps you learn. If your plan was highly effective, you can replicate it next time. If it failed, you can implement changes. So, assessing the risk helps in improving your whole risk system over time.

A robust company does not stop examining its hazards. It stays vigilant always. That is the real strength of the risk management process.

Relevance to ACCA Syllabus

The process of risk management is the main issue for Strategic Business Leader (SBL) and also Audit and Assurance (AA) papers. The ACCA professionals should identify, assess, and respond to financial and operational risks of in the organizations they work for. This in turn will assist in the process of governance, internal control, and strategic planning. Risk management is also questioned on the tests such as F9 (FM) and P3 (SBL).

Risk Management Process ACCA Questions

Q1: What is the first step in the risk management process?

A) Analyze the risk

B) Monitor the risk

C) Identify the risk

D) Evaluate the risk

Ans: C) Identify the risk

Q2: In the risk management process, what does a risk matrix help to evaluate?

A) Budget allocation

B) Internal audit

C) Risk likelihood and impact

D) Profit margins

Ans: C) Risk likelihood and impact

Q3: Which of the following is an example of risk treatment?

A) Ignoring the risk

B) Transferring the risk to insurance

C) Waiting for the risk to occur

D) Only documenting the risk

Ans: B) Transferring the risk to insurance

Q4: In ACCA SBL, effective risk management mainly supports which of the following?

A) Tax savings

B) Strategic objectives and governance

C) Cash flow analysis

D) Dividend decisions

Ans: B) Strategic objectives and governance

Q5: What is the main reason to monitor and review risks regularly?

A) To improve employee morale

B) To reduce marketing spend

C) To ensure actions remain effective over time

D) To increase tax deductions

Ans: C) To ensure actions remain effective over time

Relevance to US CMA Syllabus

Part 2 of the CMA syllabus in the US, that is, Strategic Financial Management, covers concepts of risk management. Students are trained to not only know the financial risks but also measure and manage them to enable the company’s growth. Making risk understandable enables CMAs to involve strategic planning and protect organizational value.

Risk Management Process US CMA Questions

Q1: Why is risk identification important in financial planning?

A) To manage staff turnover

B) To avoid preparing budgets

C) To anticipate future threats and avoid losses

D) To increase overheads

Ans: C) To anticipate future threats and avoid losses

Q2: What tool is commonly used to analyze risk in CMA practice?

A) Dividend discount model

B) Balanced scorecard

C) Risk matrix

D) FIFO inventory method

Ans: C) Risk matrix

Q3: In the risk management process, when a company chooses to “accept” a risk, what does it mean?

A) The company ignores the risk

B) The company removes the risk completely

C) The company acknowledges the risk but takes no immediate action

D) The company takes legal action

Ans: C) The company acknowledges the risk but takes no immediate action

Q4: Which of the following best describes risk treatment?

A) Making a product launch plan

B) Transferring, reducing, avoiding, or accepting risk

C) Hiring new managers

D) Conducting financial audits

Ans: B) Transferring, reducing, avoiding, or accepting risk

Q5: How often should risk monitoring be done?

A) Only once a year

B) After product launch

C) Regularly and continuously

D) Only during audits

Ans: C) Regularly and continuously

Relevance to CFA Syllabus

At Level I and Level II, the Portfolio Management and Ethical & Professional Standards sections of the CFA Program cover risk management. The candidates are taught how to worry, tracking risk-adjusted returns, and coming up with ideas for investments by Risk Profiling, which is done in the 9th Module of this CFA program.

Risk Management Process CFA Questions

Q1: What is the main goal of the risk management process in investment firms?

A) To maximize taxes

B) To eliminate all risks

C) To balance risk and return

D) To increase trading volume

Ans: C) To balance risk and return

Q2: Which step comes right after identifying a risk in the risk management process?

A) Monitor the risk

B) Analyze the risk

C) Avoid the risk

D) Accept the risk

Ans: B) Analyze the risk

Q3: A risk with high impact but low probability is usually:

A) Ignored

B) Treated as urgent

C) Accepted without review

D) Considered in strategy with contingency planning

Ans: D) Considered in strategy with contingency planning

Q4: What does risk treatment involve in portfolio management?

A) Only selling all risky assets

B) Using diversification, hedging, or insurance

C) Ignoring small risks

D) Changing accounting methods

Ans: B) Using diversification, hedging, or insurance

Q5: What is the main reason to regularly review risk control measures in finance?

A) To keep risk scorecards colorful

B) To reduce audit frequency

C) To adapt to changes in the market

D) To remove all controls

Ans: C) To adapt to changes in the market

Relevance to US CPA Syllabus

A prime issue in the US CPA Exam, particular in the audits of risk management environment such as BEC and AUD, is the presence of risk. The CPAs [must] should examine such risks as audit risk, financial risk and operational risk, and finally the companies should be encouraged to solve these. Uncertainties in the reporting and compliance process are required in order to help companies build them up.

Risk Management Process US CPA Questions

Q1: Which of the following best describes audit risk?

A) Risk of late filing

B) Risk of an auditor giving a wrong opinion

C) Risk of customer complaints

D) Risk of losing vendors

Ans: B) Risk of an auditor giving a wrong opinion

Q2: What is a key part of internal control in the risk management process?

A) Budget increase

B) Regular reviews and testing

C) Buying more assets

D) Hiring more staff

Ans: B) Regular reviews and testing

Q3: In CPA exam topics, which step ensures that the risk response stays effective?

A) Identification

B) Evaluation

C) Monitoring and Review

D) Ranking

Ans: C) Monitoring and Review

Q4: What kind of risk is linked to changes in tax laws or accounting regulations?

A) Strategic risk

B) Operational risk

C) Legal and compliance risk

D) Market risk

Ans: C) Legal and compliance risk

Q5: When a company buys insurance to protect against damage, which risk treatment method is used?

A) Avoidance

B) Reduction

C) Transfer

D) Acceptance

Ans: C) Transfer