Almost every business entity – a small one-person retail store, a multinational corporation, or a startup – has working capital that helps run the business as desired on a daily operational basis. It signifies the ability of the company government to handle short-term obligations such as payroll, utility bills, procurement of raw materials, and servicing current liabilities. Managing working capital does not merely go with having some cash in hand; it’s knowing where that cash will come from, and when. It can be said that there are several sources of working capital, which businesses wake up to face the hard decision of picking the one best suited for balancing cost, risk, and availability. So effective working capital management has a hullabaloo to do with liquidity, profitability, and customer satisfaction. That makes it a fundamental pillar of financial success.

What is Working Capital?

This defines the working capital in terms of the company’s short-term financial health and operational efficiency. It also helps the stakeholders determine whether a business can continue its operations without encountering liquidity problems.

The Working Capital Formula and Example Calculation

Working Capital = Current Assets – Current Liabilities

- Current Assets include cash, accounts receivable, inventory, and short-term investments.

- Current liabilities include accounts payable, accrued expenses, and other short-term obligations.

For example: If a company has ₹75,000 in current assets and ₹50,000 in current liabilities, its working capital is ₹25,000. This surplus means the business has good liquidity to meet its day-to-day requirements without external financing.

Why is Positive Working Capital Necessary?

Positive working capital supports successful businesses in routinely settling short-term payables and truly running their business. Therefore, it means stability, enhanced cash flow, and the ability to cater to unforeseen market repairs and downtimes. Banks and suppliers accord companies with such working capital positions better credit terms.

Negative Working Capital Consequences

Negative working capital is defined as when current liabilities exceed current assets. This would mean delayed payments, low inventory turnover, and a slowdown of operations. With time, such a scenario could spoil relationships with vendors and customer satisfaction, and possibly even declare bankruptcy for the company itself.

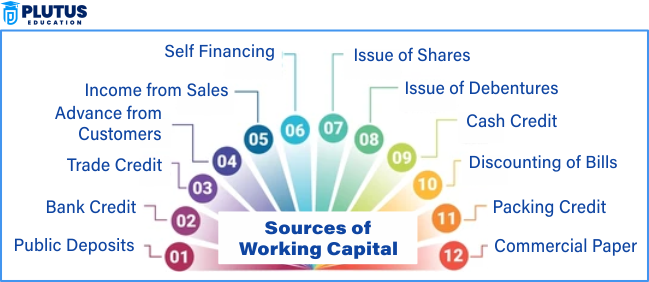

Spontaneous Sources of Working Capital

Spontaneous sources are natural, informal, and costless financing methods that arise during routine business operations. They do not require any negotiation or documentation. Hence, they are automatically incorporated into business cash flows.

Trade Credit

Suppliers often allow businesses to buy goods on credit—usually payable in 30, 60, or 90 days. This deferred payment option lets companies sell the goods first and use that revenue to pay the supplier later. Ian t improves cash flow and allows inventory movement without upfront cash outlay.

Real-life Example: A bookstore receives textbooks worth ₹1 lakh from a publisher on 60-day credit. During those 60 days, the bookstore sells most books and generates enough cash to pay off the dues without touching reserves.

Accrued Expenses

Accrued expenses like salaries, electricity bills, and taxes are recorded as liabilities until paid. During this deferral period, the company can utilize that money elsewhere if revenue collection is delayed. For instance, a business may buy short-term inventory if revenue collection is delayed.

Accounts Payable Management

Strategic temporary delay of non-essential payments (deferring). It can help a business retain more cash temporarily. Practical accounting is a notable strategy; suppliers are paid on time, but not prematurely, maximizing available cash.

So, in this case, due to the absence of interest payments and credit check requirements, we can consider any expenditure on the borrowing available as very cheap indeed, wonderfully cheap for small firms that find it hard to source funds from formal financial setups. Thus, when you have immediate demands for cash at little expense but without financial strain, you have something concrete.

Short-Term Sources of Working Capital

Short-term sources offer financing for less than one year to cover temporary cash gaps or unexpected costs or to take advantage of short-term opportunities.

Bank Overdrafts

Under bank overdrafts, a business can withdraw more than what is available in the bank account. Interest is levied only on the amount overdrawn and the number of days used. Banks usually approve their overdraft facilities beforehand based on a company’s transaction histories or security provided.

Example: The wholesaler has ₹10,000 in its account and needs ₹15,000 to pay for a flash sale to move its inventory. The overdraft facility enables them to access the additional ₹5,000 immediately to grab this opportunity.

Short-Term Business Loans

The loan is sanctioned by banks and nonbanking financial institutions for repayment within 12 months to assist with the working capital requirements of businesses. These may be secured (against an asset) or unsecured (against a credit score). These loans help finance inventory purchases for the business, payment of salaries in seasons with lower activity, or settlement of payments urgently due.

Invoice Discounting and Factoring

Delays in payment by customers are a common problem for businesses. Receivables are lent against invoice discounting, while factoring refers to the sale of invoices to a third party for immediate cash, usually at a discount. This method frees the capital stuck there and eases cash flows without involving any borrowing.

Commercial Paper and Trade Credit Lines

Commercial papers are short-term, unsecured promissory notes issued to institutional investors by large firms. Generally, trade credit lines or merchant cash advances are options suitable for financing retail businesses by SMEs.

Long-Term Sources of Working Capital

Long-term sources of working capital become necessary for enterprises to have funding that can run beyond a year. This will assist them to finance expansion projects, additional projects, bulk inventory, or stabilize under fluctuating commercial conditions.

Equity Financing

The most common method of obtaining long-term funds is selling shares, putting the company into an equity position. Equity investors become owners to some extent and share in the fruits of the company’s success. This source of funding is best suited for entrepreneurs and fast-growing companies. However, it dilutes ownership and hampers making executive decisions.

Example:A tech startup gives away 20% of its equity to the venture capital firm for ₹50 lakhs to sustain cash flow while scaling.

Long-term Bank Loans

Bank loans are for 3-10 years, with specified interest rates, used to purchase assets, expand business, or increase working capital reserves. These loans are predictable and safe; however, procured through extensive documentation and against collateral.

Retained Earnings: Profits from Within

Retained earnings refer to profits made during earlier periods which are reinserted in the business instead of being given out as dividends. It becomes a cost-free, internal, and non-dilutive long-term source of working capital. It is a test of financial discipline and boosts the equity base of the business.

Debentures, Bonds, Preference Shares

Debentures and bonds are long-term securities provided by companies. These are fixed-income securities offered to investors seeking stability while funding the company. Preference shares pay a fixed dividend rate and may or may not carry voting rights.

Sources of Working Capital FAQs

Q1. What are the three main categories of working capital sources?

The three are Spontaneous sources (e.g., trade credit, accrued expenses), Short-term sources (e.g., bank overdrafts, invoice factoring) and Long-term sources (e.g., equity, retained earnings, long-term loans)

Q2. Which source is most cost-effective for SMEs?

Retained earnings are the most cost-effective because they don’t involve interest or repayment. However, not all businesses generate sufficient profits to rely solely on this.

Q3. Why is working capital financing important for seasonal businesses?

Seasonal businesses like tourism or retail experience fluctuations in revenue. Short-term working capital financing helps them manage cash flow during low-demand periods and prepare inventory for peak seasons.

Q4. What is the risk of relying only on short-term financing?

Over-dependence can strain cash flow due to high interest and frequent repayments. It also increases the risk of missed deadlines and poor credit ratings if the business underperforms.

Q5. How can a company choose the right mix of sources?

A good mix depends on:Business lifecycle stage, Cash flow predictability, Risk tolerance, Ownership goals and Available internal reserves.