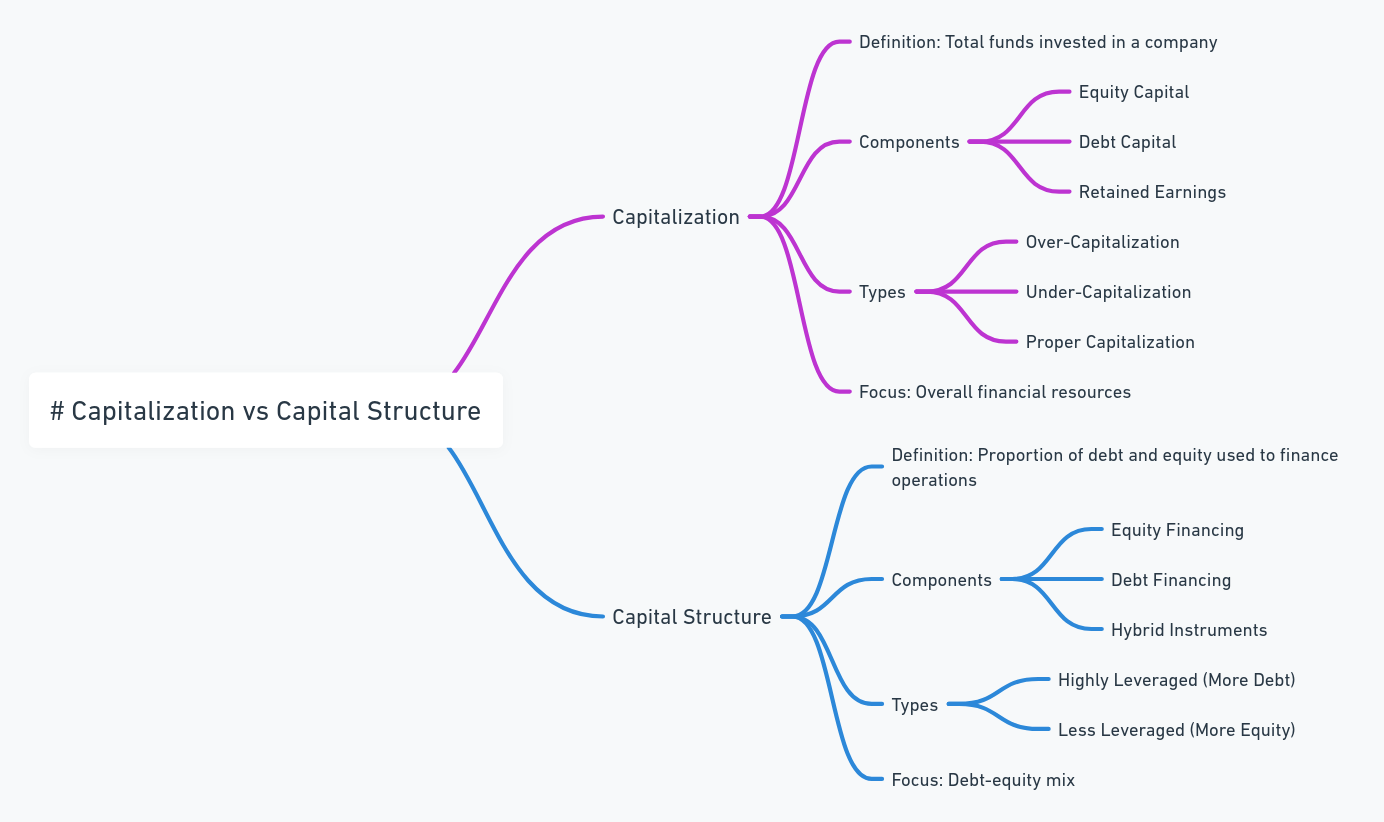

Capitalisation and capital structure are two essential concepts in financial management. While the terms are often used interchangeably, there is a clear difference between capitalisation and capital structure. Capitalisation refers to the total amount of funds a company raises through equity, debt, and retained earnings to finance its operations and growth. On the other hand, capital structure focuses on the composition or proportion of these funds, highlighting the balance between debt and equity in a company’s financing. Both concepts play crucial roles in shaping a firm’s financial stability and strategic decisions, but they address different aspects of financial planning and resource allocation.

What is Capitalisation?

Capitalisation is the total amount of funds raised by a business company to maintain its business and also to expand further. It includes equity, which is the owner’s funds, debt or borrowed funds, and retained earnings. Capitalization methods directly impact a firm’s financial condition, investment strategy, and also future growth prospects.

Important Attributes of Capitalization

- Aggregate Funds: The term capitalisation refers to aggregate funds raised.

- Components: It consists of shareholder equity, long-term debt, and retained earnings.

- Focus on Scale: It focuses on the scale of financial resources rather than their composition.

- Calculation: Companies use book value, market value, or earnings capitalization to calculate capitalization.

Example: A business raising $1 million in equity and $500,000 in debt has a total capitalization of $1.5 million.

What is Capital Structure?

Capital structure means the total percentage of funds used by a firm for its current and long-term plans that have two constituting components, that is, equity and debt. This gives the ownership rights as well as the fixed obligations in the form of interest payments which helps in minimizing the costs along with the risk management. The over-reliance on debt creates instability in finance and over-reliance on equity dilutes the ownership. The optimal structure would result in higher stability, investor confidence, and long-term growth. The factors affecting capital structure react to market conditions, industry trends, and potential growth in a company. It is important for corporate financial flexibility and sustainability.

Difference Between Capitalisation And Capital Structure

The difference between capitalisation and capital structure lies in their scope, focus, and purpose in financial management. Capitalisation refers to the total funds a company raises to finance its operations, including equity, debt, and retained earnings. It measures the overall size of financial resources. Capital structure, on the other hand, focuses on how these funds are proportioned between debt and equity, emphasizing the balance required for risk management and financial stability. Both are critical for assessing a company’s financial health, but they serve distinct roles in financial planning.

| Aspect | Capitalisation | Capital Structure |

| Definition | Total amount of funds raised by a company to finance its operations and growth. | Proportion or composition of equity, debt, and retained earnings in a company’s financing. |

| Scope | Capitalisation covers the overall size of financial resources available to the company. | Capital structure focuses on the specific mix or ratio of debt and equity used for financing. |

| Focus | Emphasizes the scale of funds available for business operations. | Emphasizes the balance between different types of financing (equity and debt). |

| Objective | Determines how much financial resources the company has to sustain its business and growth. | Aims to balance risk and return by optimizing the mix of debt and equity. |

| Components | Includes equity capital, debt capital, and retained earnings. | Includes equity shares, debentures, long-term loans, and retained earnings. |

| Measurement Methods | Calculated using methods like book value, market value, or earnings value. | Measured using ratios such as debt-to-equity ratio, interest coverage ratio, and other similar financial metrics. |

| Importance | Indicates whether a company has sufficient funds to finance its operations and future projects. | Helps assess whether the company’s financing mix minimizes costs, manages risks, and supports financial stability. |

| Examples | A company with $5M in equity and $2M in debt has a total capitalisation of $7M. | A company with $5M equity and $2M debt has a capital structure of 71% equity and 29% debt. |

| Impact | Impacts the overall financial scale and ability to raise funds for future investments. | Impacts financial risk, ownership dilution, and investor confidence based on the proportion of debt and equity. |

| Relevance | Capitalisation is relevant when determining the total funding needs of a company. | Capital structure is relevant for assessing how the company manages leverage and ownership. |

Types of Capitalisation

Types of Capitalisation refer to the financial conditions of a company based on the adequacy or inadequacy of its funds. It is classified into over capitalisation and under capitalisation, each with unique causes and impacts on a business’s financial stability and operations.

Over Capitalization

Over-capitalization refers to the practice where a business firm raises capital more than it can apply effectively. Financial inefficiency results, and so do lower returns.

Causes of Over-Capitalisation

- Wrong Investment Choices: Expenditure on non-earning projects leads to surplus cash.

- High Costs of Capital: Debt with higher interest or overcapitalization of shares can contribute to capitalization.

- Recession: During a recession, falling profits result in surplus capital from existing funds.

Effects of Over-Capitalisation

- Low Returns: Excess liquidity generates low profit per share and decreases investor’s mind

- High Fixed Costs: Excessive borrowing creates a high-interest burden.

- Less Competition: Over-employment of capital reduces business share in the market

Under Capitalization

Under-capitalization arises when an enterprise fails to properly raise sufficient funds to meet its business ventures. Poor use of capital brings bottlenecks to operations and forgone growth chances

Reasons for Under-Capitalisation

- Conservative Financing: The firms fail to raise adequate capital primarily due to the fear of debt.

- Turbulent Growth: Growth far exceeds the project’s financial capabilities

- High Efficiency: At times a high return on capital gives the impression of being under-capitalized

Impacts of Under-Capitalisation

- Business Failure: Poor operational performance is a direct result of poor capitalization.

- Delayed Payments: Further, they have delayed payments and operations

- Over Valuation: Earnings appear high relative to available capital boosting the stock valuation.

- Employees’ Grievances: They restrain wage rise and employee welfare investment.

Components Of Capital Structure

Components of Capital Structure The various sources of long-term financing that a firm employs to finance its operations and growth include: equity capital, consisting of common and preferred shares; debt capital, such as debentures, bonds, and long-term loans; and retained earnings, also known as reinvested profits, serve as an important part of capital structure since they reduce reliance on external sources. Every part plays a significant role in the balance of risk and return for a company. Equity ensures ownership and long-term stability, but debt provides leverage benefits with financial risk. All these components together determine the financial health and strategic flexibility of a company.

Capital Structure Characteristics

- Percentage of Funds: This shows the equity-debt proportion.

- Risk and Return: There is minimum risk and maximum returns in an efficient capital structure.

- Flexibility: A firm can alter the proportion based on the prevailing market conditions.

Illustration: For instance, when a firm maintains 60 percent of equity and 40 percent of debt, the capital structure portrays the risk profile and return the company expects to achieve.

Why does Capital Structure Matter?

Capital structure is significant for keeping finances stable and bringing long-term growth. A proper design ensures optimal utilization of resources and investor confidence.

Why Is Capital Structure Important?

The balance between debt and equity significantly impacts the cost of capital. A proper balance minimizes costs, ensures risk management, and maintains investor confidence. Excessive debt increases risk, while too much equity dilutes ownership. Companies with stable capital structures are better equipped to face economic shocks and remain competitive.

In terms of capitalisation vs capital structure, capitalisation refers to the total funds raised by a company (equity, debt, retained earnings). Capital structure, however, focuses on the proportion of these funds, emphasizing the balance between debt and equity. Both are essential but serve different roles in financial planning.

Capitalisation Vs Capital Structure FAQs

What does capital structure encompass?

Capital structure includes equity shares, preference shares, retained earnings, debentures, and long-term loans. It represents the mix of funds a company uses to finance its operations.

What is the difference between capitalisation and capital structure?

Capitalization would be the general funds raised and capital structure concerned with the proportional composition of financing between equity and debt.

What are capitalization techniques?

Capitalization techniques include net book value and market value technique and earnings-capitalization technique by which the capital of concern is computed from total funds sources.

What are some of the causes of over capitalisation?

Over-capitalization occurs because of bad investment decisions, a high capital cost, or a fall in profit during a recession.

Why is the capital structure importance important?

The importance of Capital Structure reduces costs, risk management, attraction towards investors, and also financial stability.