Journal entries for issues of shares are vital for company accounting. When a company raises funds by selling shares, it must properly record these transactions in its books. These journal entries keep the business books tidy and accurate. You will find these entries in every corporate balance sheet. These entries indicate how much capital a company raised and how to issue, at par, premium or discount. Issue of shares journal entries lets the company account for the money it gets from shareholders while issuing new shares. Whether a company issues shares at face value, shares at more than face value (premium) or less than face value (discount), its journal entries are clear. This article will cover all kind of journal entries of issue of shares, such as issue of shares at par journal entries, issue of shares at premium journal entries, journal entry for issue of shares at discount with pdf format and issue of bonus shares journal entries. Equity shares and preference shares entries will also be touched.

What is Issue of Shares in Accounting?

Issue of shares refers to offering a company shares to the public or to private investors Companies do this to fund operations, to expand or to pay off loans. Proper journal entries are required for the accounting treatment of these types of share issues.

Why Do Journal Entries Matter?

In the beginning, when a company issues shares, the company gets cash. If issued at a higher price, this money becomes share premium; otherwise, it becomes share capital. In other words, the company needs to post lucid journal entries so that the correct amount appears under each head.

It is a key detail for companies accounts issue of shares journal entries, and readers will need clarity on how each case affects the accounts.

Now let us learn all the types of journal entries for share issues in a sequential manner.

Issue of Shares at Par Journal Entries

Issue of shares at par is when a company issues shares at the same value as the face value. To explain, if a share’s face value is ₹10 and the company offers the share at a price of ₹10, it would be par value.

For example, a company issues 1,000 equity shares of ₹10 each at par and collects the full money on application.

Step-by-step journal entries:

Bank A/c Dr. ₹10,000

To Share Capital A/c 10,000

Through this, the whole sum is credited to the Share Capital Account.

If the company collects money in installments such as Application, Allotment and Calls:

On Application Received:

Bank A/c Dr. ₹4,000

To Shares Application A/c ₹4,000

Earnest Money Transferred:

Share Application A/c Dr. ₹4,000

To Share Capital A/c ₹4,000

And parallel entries for Allotment and Calls.

This type of entry is very basic and often comes in exams as an issue of shares at par journal entries.

Issue of Shares Journal Entries at Premium

A company receives bonus money when it sells its shares at a price higher than their par value. The difference is known as Securities Premium. What to understand and learn from the issue of shares at premium journal entries depends on each case, different entries or instances are passed.

Example:

For example, if a company issues shares of ₹10 at ₹12 per share, then ₹2 is the premium.

On Received Application Money

Bank A/c Dr. ₹12,000

To Share Application Account Dr. ₹12,000

On Application Money Transferred:

Share Application A/c Dr. ₹12,000

To Securities Premium A/c ₹2,000

In this entry, we move ₹10,000 to share capital and ₹2,000 to premium.

Notes:

- In the balance sheet, Premium appears as Reserves and Surplus.

- This should be known by students under journal entries for issue of shares at premium.

Issue of Shares at Discount Journal Entries

In some countries, companies can issue shares at less than par value. That is known as discount issue. Although not a common practice now (Companies Act, 2013 in India allows issue of only sweat equity shares at discount), it holds significance with respect to academic knowledge. These items are examined under journal entry for issue of shares at discount and issue of shares at discount journal entries.

Example:

When a company issues its shares of ₹10 at ₹9 then ₹1 is loss that is discount.

On Money Received:

Bank A/c Dr. ₹9,000

Discount on Issue of Shares A/c Dr. ₹1,000

To Share Capital A/c ₹10,000

Here Discount on Issue of Shares A/c is a loss and there it is an asset (deferred expense).

Issue of Bonus Shares Journal Entries

Any company can issue bonus share to its existing shareholders. Basically, a company can issue shares free of charge for its remaining stockholders. This is called a bonus issue. It is paid out of profits or reserves and does not generate any cash.

Bonus Shares Journal Entry:

So, if a company splits its 1,000 ₹10 shares into 2,000 ₹5 shares:

General Reserve A/c Dr. ₹10,000

To Bonus to Shareholders A/c ₹10,000

Bonus to Shareholders A/c Dr. ₹10,000

To CapitalA/c ₹10,000

Bonus issue is not cash transaction That just shifts reserves to share capital. This is under the problems of issue of bonus shares journal entries pdf.

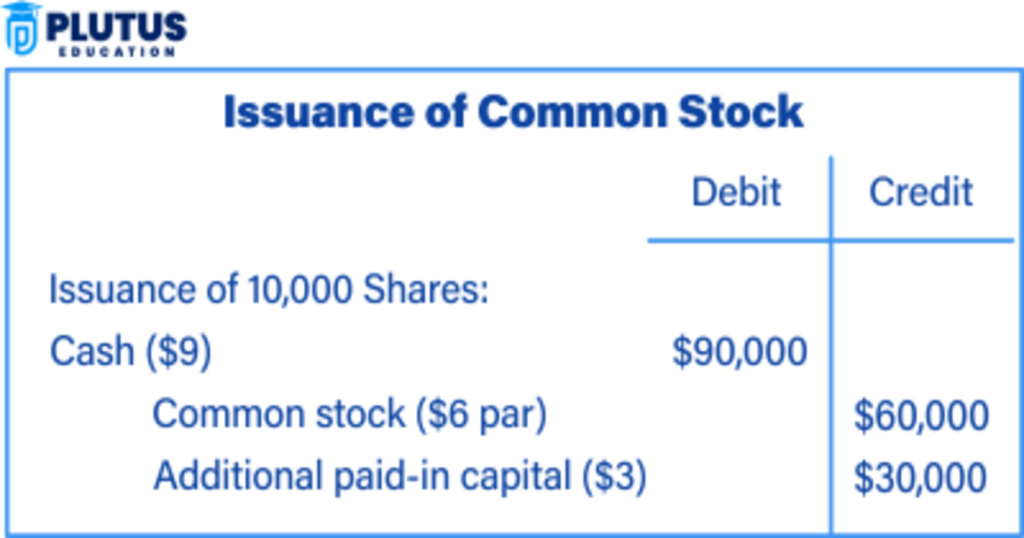

Journal Entries for Issue of Equity Shares

Equity shares are referred to as common shares or ordinary shares. Equity shares provide rights to their shareholders. Equity share provides control and participation in company’s management. The same format applies when a company raises funds using equity shares (at par, premium or discount).

Journal Entries Summary for Equity Shares Issuance:

| Type of Issue | Bank A/c Dr | Share Capital A/c | Securities Premium A/c | Discount A/c Dr |

| At Par | Full Amount | Full Amount | ||

| At Premium | Full Amount | Face Value | Extra Money | |

| At Discount | Amount Paid | Face Value | Discount Value |

These problems usually fall under journals for issue of equity shares in school and college exams.

Company Accounts Issue of Shares Journal Entries

This article is in the larger company accounts section. Each company raising money in the shape of share capital is required to pass on these journal entries in their books. These entries adhere to legal rules and accounting standards. Companies follow these rules when they issue shares to raise money.

Real-World Applications:

Thousands of pupils around the world learn this under company accounts issue of shares journal entries. It assists with the preparation of final accounts of companies.

- Used in IPO accounting

- Needed during audits

- Shown in annual reports

- Used in Tally and SAP

Common Mistakes to Avoid

Students need to be vigilant while solving these entries:

- Please do not equate premium with capital

- Debit the Bank in when cash is received

- Discount is a LOSS not an Income.

- Bonus shares are cashless and hence no money is involved.

Relevance to ACCA Syllabus

It applies to Financial accounting (FA) and Corporate and Business law in ACCA. This includes keeping track of company accounts including entries regarding share capital as a part of the financial statements. Journal Entry for Issue of Shares is an important accounting treatment to consider for dealing with company accounts as well as disclosures.

Issue of Shares Journal Entries ACCA Questions

Q1: When a company issues shares at par, the following accounts are credited.

A. Bank A/c

B. Share Capital A/c

C. Securities Premium A/c

D. Profit & Loss A/c

Answer: B

Q2: Which account is credited when shares are issued at a premium?

A. Share Capital A/c

B. Retained Earnings A/c

C. Securities Premium A/c

D. Bank A/c

Answer: C

Q3: What would the entry for issuing shares of ₹10 each at ₹12 look like?

A. Bank A/c Dr. ₹10, To Share Capital A/c ₹10

B. Share Capital A/c Dr. ₹12, To Bank A/c ₹12

C. Bank A/c Dr. ₹12, To Share Capital A/c ₹10, To Securities Premium A/c ₹12

D. Bank A/c Dr. ₹10, To Share Capital A/c ₹10

Answer: C

Q4: Where is ‘Securities Premium’ shown in the balance sheet?

A. Current Liabilities

B. Current Assets

C. Shareholders’ Equity in Reserves

D. Fixed Assets

Answer: C

Q5: In case of issue of shares at a discount what is debited?

A. Profit & Loss A/c

B. Share Capital A/c

C. Discount on Issue of Shares A/c

D. Reserve A/c

Answer: C

Relevance to US CMA Syllabus

The syllabus for US CMA Financial Reporting & Decision Making includes share capital accounting, stock transactions and equity recognition. Hence, understanding share issue journal entries enables candidates to appropriately record and comprehend various changes in the equity in the company.

Issue of Shares Journal Entries US CMA Questions

Q1: What is the main effect when a company issues shares in exchange for cash?

A. Decrease in capital

B. Increase in equity and cash

C. Increase in liability

D. No impact

Answer: B

Q2: It means that when the shares are issued at a premium, what happens to this premium amount?

A. It is recognized as revenue

B That gets filed as a liability

C. From its profit; it is transferred to share Capital

D: Securities Premium is credited.

Answer: D

Q3: Now determine the use of Securities Premium which is not valid.

A. Issue bonus shares

B. Write off losses

C. Pay dividends

A write off of preliminary expenses

Answer: C

Q4: A company issues 1,000 shares at $15/share, face value $10. What is the journal entry?

A. Bank 15,000 Dr; Cr. Share Capital $15,000

B. Bank Dr. $15,000; Share Capital Cr. $10,000; Securities Premium Cr. $5,000

C. Share Capital Dr. $10,000; Premium Dr. $5,000; To Bank Cr. $15,000

D. No journal entry needed

Answer: B

Q5: Why is ‘Discount on Share Issue is a Loss?

A. It decreases equity

B. It reduces liabilities

C. It increases revenue

D. It decreases Profit and Loss Appropriation

Answer: A

Relevance to US CPA Syllabus

This idea is critical in CPA Financial Accounting and Reporting (FAR). Instead, candidates cover equity transactions, journal entries for the issuance of stock, and the shares issued at a premium or discount under US GAAP.

Issue of Shares Journal Entries US CPA Questions

Q1: How is share premium to be recognised under US GAAP?

A. As income

B. As deferred revenue

C. As contributed capital

D. As current liability

Answer: C

Q2: What is the journal entry when a company issues common shares for cash?

A. debit capital A/c for credit bank A/c

B. Debit Bank A/c & Credit Share Capital A/c

C. Debit Revenue A/c, Credit Bank A/c

D. No entry is needed

Answer: B

Q3: A company announces the issue of shares having the face value of $10 at $8. How is this recorded?

A. No entry

B. Dr Bank $8, Dr Discount $2, Cr Share Capital $10

C. Debit Bank and Credit Share Capital (both $10)

D. Bank $8 Bank credit $8

Answer: B

Q4: What is “Discount on Issue of Shares” on US GAAP?

A. Contra equity account

B. Liability account

C. Expense account

D. Revenue reserve

Answer: A

Q5: If shares are issued at premium and cash is received, what will be the correct entry?

A. Dr. Cash, Cr. Share Capital

B. Cash Dr., Share Capital Cr., Share Premium Cr.

C. Capital Share Dr., Cash Cr.

D. No entry needed

Answer: B

Relevance to CFA Syllabus

The concept of issues creates a link between CFA Level I – Financial Reporting and Analysis, where the financial transactions of equity affect the balance sheet components and financial ratios. Analysts need to understand share capital movements and assess their impact on shareholder equity.

Issue of Shares Journal Entries CFA Questions

Q1: When does a company issue shares at a premium?

A. Assets increase, equity increase

B. Decrease in assets, increase in liabilities

C. There is less owner equity, more liabilities

D. No change occurs

Answer: A

Q2: What is the effect of issuing new equity shares on Return on Equity (ROE)?

A. Always increases ROE

B. May dilute ROE

C. Has no effect on ROE

D. Always decreases ROE

Answer: B

Q3: Eyeballing financial statement showing the share capital raised during the year.

A. Income Statement

B. Cash Flow Statement

C. Balance Sheet

D. Changes in equity statement

Answer: D

Q4: Book value per share is affected when shares are issued at discount.

A. It increases

B. It remains unchanged

C. It decreases

D. It becomes zero

Answer: C

Q5: What is the impact of issuing bonus shares on total shareholders’ equity?

A. Increases total equity

B. Reduces total equity

C. No change in total equity

D. Increases liabilities

Answer: C