A promissory note is a basic financial instrument that everyone knows and uses today in personal finance, business, and real estate finance. It allows putting a formal debt agreement into writing with a clearly stated amount, terms of repayment, interest (if any), and signatures of the involved parties. Promissory notes provide legal security and prevent any misunderstanding that might arise in borrowing transactions. Commonly used in occasions when those in need develop or institutions want to seek from the borrower a more organized, short-term financing option, the article teaches a bit about what a promissory note is, its types, its applications, key features, and uses in real life, which would help one understand its importance in this lending practice.

What is Promissory Note?

A promissory note is a legally binding document in which one party (the borrower) commits to paying a specific amount of money to another party (the lender) by a predetermined date. This instrument is critical for debt formalization in personal and professional settings. Unlike a cheque or a verbal promise, a promissory note legally enforces repayment and outlines specific loan terms. Interest-bearing and non-interest-bearing loans are both applicable with this document. Although it is less legally weighty than the other formalized loan instruments, it is still a formal, serious and enforceable instrument in law.

Legal Status of Promissory Note

A promissory note is governed under the Negotiable Instruments Act and is considered a valid legal document. Once the document is signed, a contractual obligation shall be created between both parties. It also means that the instrument will be enforced whenever needed. So it is the most preferred tool in repayment security, precisely in personal or informal transactions devoid of bank oversight, where the primary use type of document is cash.

Difference Between Promissory Note and Loan Agreement

Both documents are lending-related, but a promissory note is less formal, usually just the amount to be repaid, interest, and when repayment is due. Loan agreements are much longer, including penalties, warranties, and enforcement rights. It is comparatively easier and faster to compose promissory notes; thus, they are the most suitable for the simpler occurrences of lending.

Types of Promissory Notes

Different promissory notes are structured based on the conditions agreed upon by the lender and borrower. Knowing the various provisions of different kinds of promissory notes will help ensure that the right instrument is employed regarding a specific need for financing.

Secured Promissory Note

A secured promissory note refers to a specific pledge of collateral that could be a car, a house, or some valuable asset. If the borrower doesn’t repay the debt, the bank can take possession of that collateral to mitigate losses. Real estate financing and car loans often come with this type of note, such as a car loan with a promise to pay backed by a promissory note with the car as collateral.

Unsecured Promissory Note

An unsecured promissory note does not give room for collateralization and thereby depends on the borrower’s creditworthiness and promissory trust. Much riskier for lenders, and almost certainly higher interest rates will be attached. A common one is an unsecured promissory note, a personal loan between friends without backing from assets.

Demand Promissory Note

This type of note allows lenders to return and demand repayment whenever they deem it appropriate. The borrower must repay without a date by which payment must be made. Again, a very informal lending setting would do well with this instrument, but could generate a legal challenge if the demand for repayment has not been adequately documented.

Installment Promissory Note

This creates an obligation concerning regular payment over a fixed time in installments. It goes from ranges in that the EMI amount, interest rate, and payment frequency become the content parts. This is the instrument used throughout most consumer loans or business credit arrangements. For instance, a new venture might have a monthly repayment over 12 months with an investor; thus, an installment-based note would fit that model quite well.

Interest- and Non-Interest Bearing Notes

Interest-bearing promissory notes prescribe a specified interest rate, which could be fixed or variable, against the loan amount. Most professional and commercial loans will have these. Non-interest-bearing promissory notes will often be utilized by lending and borrowing transactions between family members or friends, where no profit scheme is being sought and only the principal amount is returned.

Uses of Promissory Note in Personal and Commercial Finance

They are the most versatile of promissory notes: they cater to any manner of borrowing and lending, personal, business, or commercial. More importantly, a promissory note gives structure, legality, and much-needed clarity in debt dealings so that the relationships are smoother and have less room for friction.

Loans from Friends or Family

One of the most common uses of a promissory note is as a formalized tool in informal loans. If one should borrow from an immediate relative or acquaintance, it can very well act as evidence of how much should be paid back and when, thus preventing misunderstandings or disputes in the future. Trust is extended further in personal lending relationships by setting expectations in writing.

Financing the Short Term for Business

It can present a promissory note that will give it the possibility of short-term credit from a partner, financial institution, or supplier, and this should serve to record cash in better flow for proper operation until receivables or the sale come. It also encourages better record-keeping and easy legal compliance.

Real Estate Transactions

Promissory notes are also used to establish a loan’s terms in mortgages. They form part of mortgage agreements, when a private lender finances or when seller financing is used to purchase a property, promissory notes itemize the terms of the loan. It’s then tied with the deed of trust to legally contain the borrower for repayment and protect the lender’s interests.

Debt Consolidation Agreements

They simplify all complex entanglements. A promissory note will consolidate some categories of debts into one loan with a better and easier repayment schedule. Borrowers will hence be able to streamline their payments, and even in most instances, interest costs will decrease and improve the individual’s credit position as time goes by.

Business-to-Business Lending

Companies lending to other companies—for expansion, inventory purchase, or as intercompany loans—use promissory notes to document repayment terms. This is common in joint ventures or strategic partnerships where cash assistance is offered temporarily.

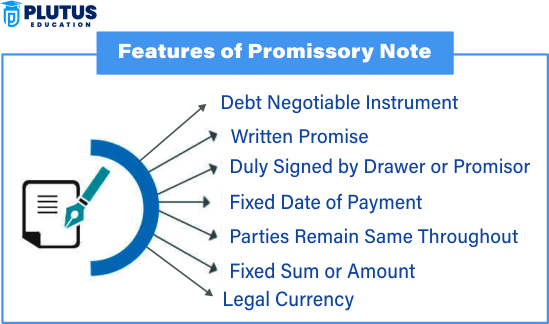

Key Features of a Promissory Note

Promissory notes must contain certain features to be valid and enforceable in a court of law. These features essentially protect both parties involved and define and determine the mode of repayment accepted by both parties.

Unconditional Promise to Pay

It should state an unambiguous, unconditional promise to pay the money mentioned in the note to the lender. An agreement is, at best, legally weak if it contains any condition or uncertainty. This feature ensures the finality of accountability against the clear intent of what the borrower must do.

Specific Amount and Currency

The document needs to mention the exact figures for the repayment and the currency it will use. This leaves no room for ambiguity and provides the total amount on which any repayment is to be based. Any dispute can thus be adjudicated according to what has been agreed upon.

Due Date or On-Demand Clause

The due date or on-demand clause must be stipulated. An uncertain time will imply that the parties’ agreement will be assumed to be unfulfilled. Hence, time is one factor that keeps both parties agreeing on payment.

Rate of Interest Terms (If Any)

If there is any interest charge on the promissory note, the rate must be mentioned explicitly as either the fixed rate of interest or a variable interest rate. This will prevent the claim from attaching to the local statutes on interest rates and will entail no further disputes regarding the amount payable concerning interest.

Signatures of Both Parties

The promissory note must carry the signature of both parties, the lender (payee) and the borrower (maker). The signatures signify acceptance and agreement of the parties to the terms specified in the note.

Repayment Schedule (For Installment Notes)

In cases of partial repayments, a detailed repayment schedule is laid out, stating the period of repayments, the respective amounts, and repayment dates. This keeps both parties’ cash flow intact and records payment history.

Real-Life Example of a Promissory Note

Suppose Ravi lends ₹1,00,000 to his friend Arjun to start a small business. To formalize it, they draw upon a promissory note specifying that Arjun shall pay back the amount within 12 months at 8% annual interest. It mentions the principal, due date, interest, and signatures, which states that, in case Arjun fails to pay back, Ravi can legally enforce the contract to recover the money. This example shows how promissory notes inject structure and security into informal loans.

Why Promissory Notes Are an Integral Part of Financial Transactions?

A promissory note is much more than an IOU; it is a legally binding mechanism for creating trust and financial clarity. Whether lending to a friend or funding a business venture, a written and structured agreement protects from future misunderstandings. Types and uses, features and examples, everybody interested in lending or borrowing money must know about promissory notes. Their flexibility, enforceability, and ease of creation make them one of the best tools to secure and formalize credit.

What is Promissory Notes FAQs

Q1. What is a promissory note in simple terms?

A promissory note is a written promise from one person to another to repay a specific amount of money by a certain date, usually with interest.

Q2. Is a promissory note legally binding?

A properly drafted and signed promissory note is a legally enforceable financial document recognized in courts.

Q3. What are examples of promissory notes in real life?

Examples include personal loans between friends, real estate financing agreements, and business-to-business lending arrangements.

Q4. What is the difference between a promissory note and a loan agreement

A promissory note is simpler, usually outlining just the repayment terms. A loan agreement includes broader terms like penalties, warranties, and borrower obligations.

Q5. Can a promissory note be used without interest?

Non-interest-bearing promissory notes are common in informal loans, where only the principal must be repaid.